Kyle Burbank

Head Writer ~ Fioney

Kyle is the head writer for Fioney. He is a personal finance nerd, constantly looking for new apps and services to test and incorporate into his own financial game plan.

In addition to his role at Fioney, he's written for other publications including Born2Invest, Lifehack, and Laughing Place, as well as his own site Money@30. He also creates personal finance and travel-related videos for Fioney's YouTube channel, which has garnered more than 2 million views.

Currently, Kyle resides in Springfield, Missouri with his wife of 10 years. Together, they enjoy traveling (including visiting Disney Parks around the world), dining, and playing with their dog Rigby.

Credit Card Reviews

Money at 30: M1 Finance Owner's Rewards Credit Card Overview

by Kyle Burbank

For a time, it seemed as though every FinTech was rolling out its own debit card — including some that broke the mold with some interesting features. Since then, some neobanks have moved on to creating unique credit card products instead. Among them is M1 Finance, which originally launched its Owner's Rewards Card in 2021. Since then, the card has undergone some tweaks, but the idea remains largely the same:...

Money Management Product Reviews

Money at 30: Pluto TV Review — The Pros and Cons

by Kyle Burbank

These days, it feels as though everyone has at least a few streaming service subscriptions. While these memberships may only be a few dollars each, those costs can add up as more services join the fray and prices rise for many. However, there is at least one service you can enjoy without paying a dime: Pluto TV. Pluto TV may not exactly be new, but I've noticed that the service...

Credit Card Reviews

Cash App Cash Card Review (2023)

by Kyle Burbank

Have you ever owned something for years before one day you suddenly discovered a super useful function you never knew it had? That’s essentially what happened to me with Cash App. Despite downloading the app long ago, I apparently didn’t keep up with its growing power and ability to save me money — that was until a couple of years ago. So what is the Cash Card and what makes...

Money Management Product Reviews

Aldi Curbside Pickup Review — Is it Worth it?

by Kyle Burbank

Over the past few months, I've been a bit torn. While I love saving money and keeping costs down, the convenience of grocery delivery has proven too powerful for me to resist. Now one of my favorite discount grocery stores is rolling out a better option with the introduction of Aldi Curbside Pickup. Yet, the question still remains: is this option actually worth it?

Money Management Tips

Money at 30: My Top 3 Finance Apps and Tools to Watch in 2023

by Kyle Burbank

Over the past few years, I've offered up my list of the top FinTech apps and tools. This originally started as a way to highlight a few of my favorite tools but eventually evolved to also highlight offerings from startups I just found fascinating. Well, as it turns out, my track record has been a bit hit-or-miss on that front. So, this time around, I thought I'd keep the tradition...

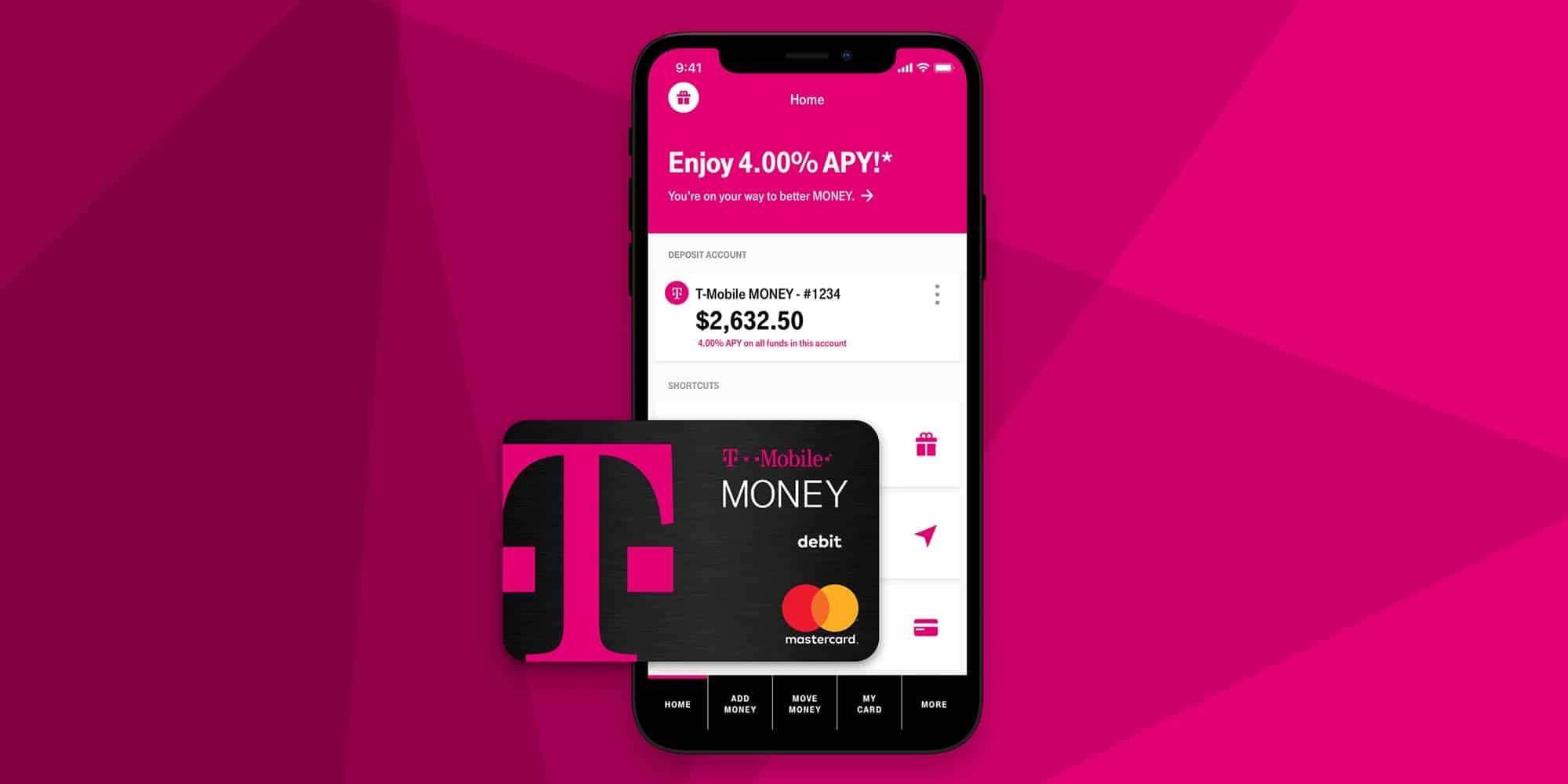

Checking Account Review

T-Mobile Money Review (2023)

by Kyle Burbank

More than two years ago now, I ended up switching my wireless service from AT&T to T-Mobile. In doing so, I was able to save money in a few different ways — but it turns out there was another savings opportunity I had overlooked until recently: T-Mobile Money. While this digital banking account is open to non-T-Mobile customers, those who do have T-Mobile or now Sprint postpaid plans (as opposed...

Money Management Product Reviews

Privacy.com Review (2023) — How it Could Help Keep Your Money Safe

by Kyle Burbank

First the bad news: considering all the major data breaches that have hit retailers, websites, and freaking credit bureaus alike, there’s a very strong chance your personal info has been compromised at some point. Luckily, in addition to steps you can take, such as freezing your credit reports to prevent criminals from using this data, there are a growing number of tools you can use to foil thieves in the...