Small Business News

BlueVine Business Banking Expands Roll Out Following Beta

Just as FinTech banking options have changed the personal finance landscape in recent years, FinTech startups have also had an impact on small business finance. This is perhaps most evident in the lending space where companies such as OnDeck and Kabbage have made it easier for entrepreneurs to obtain capital quickly. Now another online small business lender is expanding its reach by rolling out business checking features.

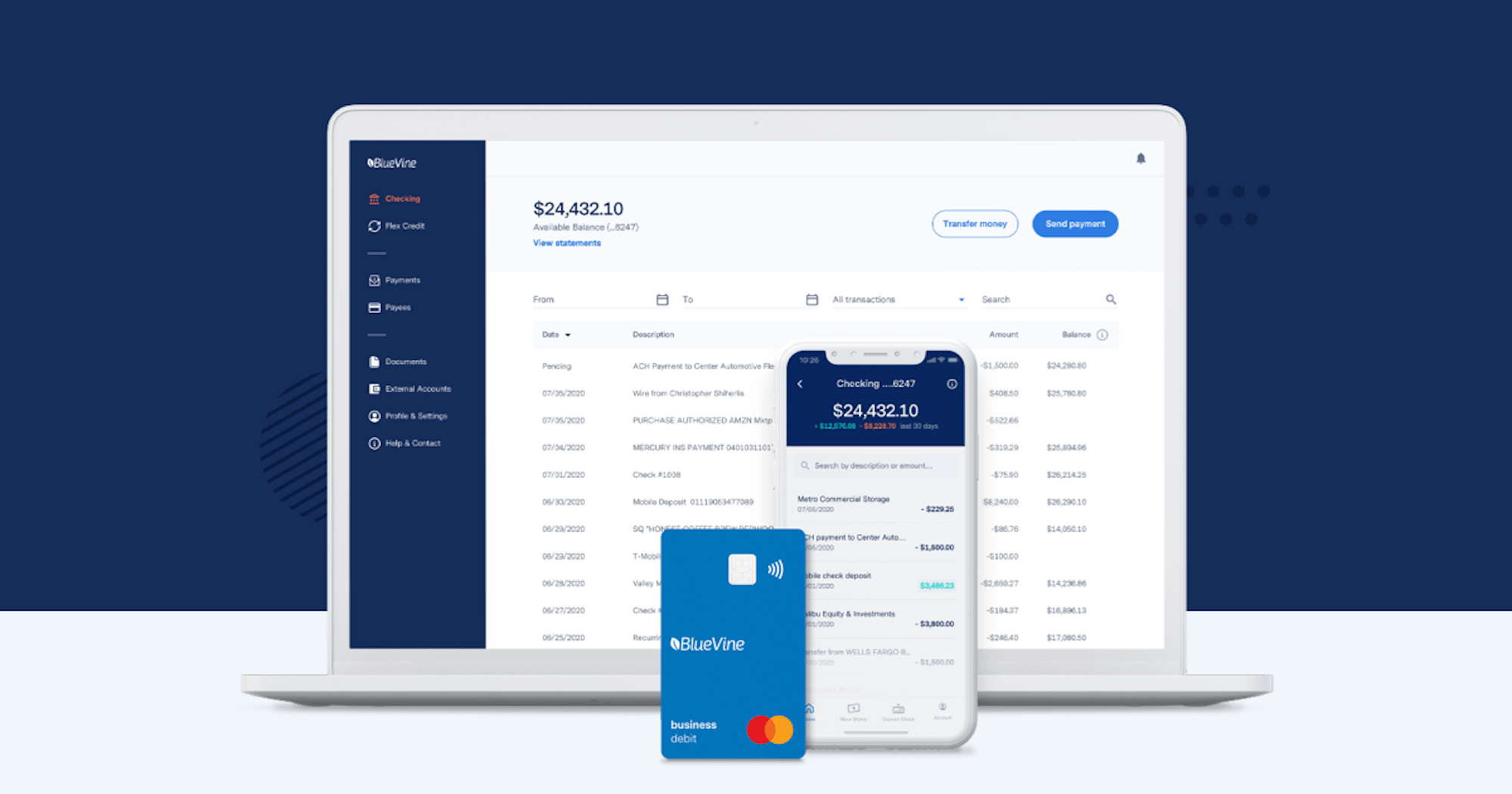

After launching in beta one year ago, BlueVine’s Business Banking — including Business Checking — will now be available more broadly. As a result, small business owners will be able to enjoy the various perks of the account, including unlimited transactions, accruing interesting, and more. Additionally, BlueVine says that business owners can open an account in “as little as 60 seconds” by entering information about themselves and their business.

One benefit of BlueVine’s Business Checking is that it had offered 1.0% APY on balances over $1,000. However, the company recently dropped that minimum balance requirement, allowing account holders to earn 1.0% APY on balances up to $100,000. Elsewhere, BlueVine’s Business Checking has no monthly service fees, no minimum balance requirements, and offers access to more than 38,000 fee-free ATMs as part of the MoneyPass network. Small business customers can also get two free books of checks upon opening their account.

Speaking to the timeliness of the account’s wider rollout, BlueVine CEO and co-founder Eyal Lifshitz said, “Now more than ever, small businesses need simple, easy-to-use financial solutions, services, and guidance that support – not nickel-and-dime – them on their path to recovery amid the pandemic.” Lifshitz added, “Over the last year, we have worked tirelessly behind the scenes to innovate and iterate on our BlueVine Business Checking product based on tremendous beta customer reception and feedback. We are thrilled to provide all small business owners with access to sign up for an account today, to help them achieve a better financial tomorrow.”

In addition to the expansion of Business Checking, BlueVine has also recently introduced Payments. With this feature, customers will be able to pay vendors using a bank account, debit card, or even credit card (although this option is in beta). Then, BlueVine will send a payment via ACH, wire, or check on the business’s behalf. Notably, while this option could allow business owners to use credit cards in circumstances where they otherwise wouldn’t be able to, the service does charge a 2.9% fee for credit card payments.

Overall, the rollout of BlueVine’s Business Checking highlights the fact that there are now more options than ever when it comes to managing your small business’s finances. Because of this, business owners can decide whether a streamlined or à la carte approach makes the most sense. With that in mind, if it’s been a while since you’ve assessed your business banking needs, now may be a good time to research your options and consider a switch.