Category: FinTech News

FinTech News

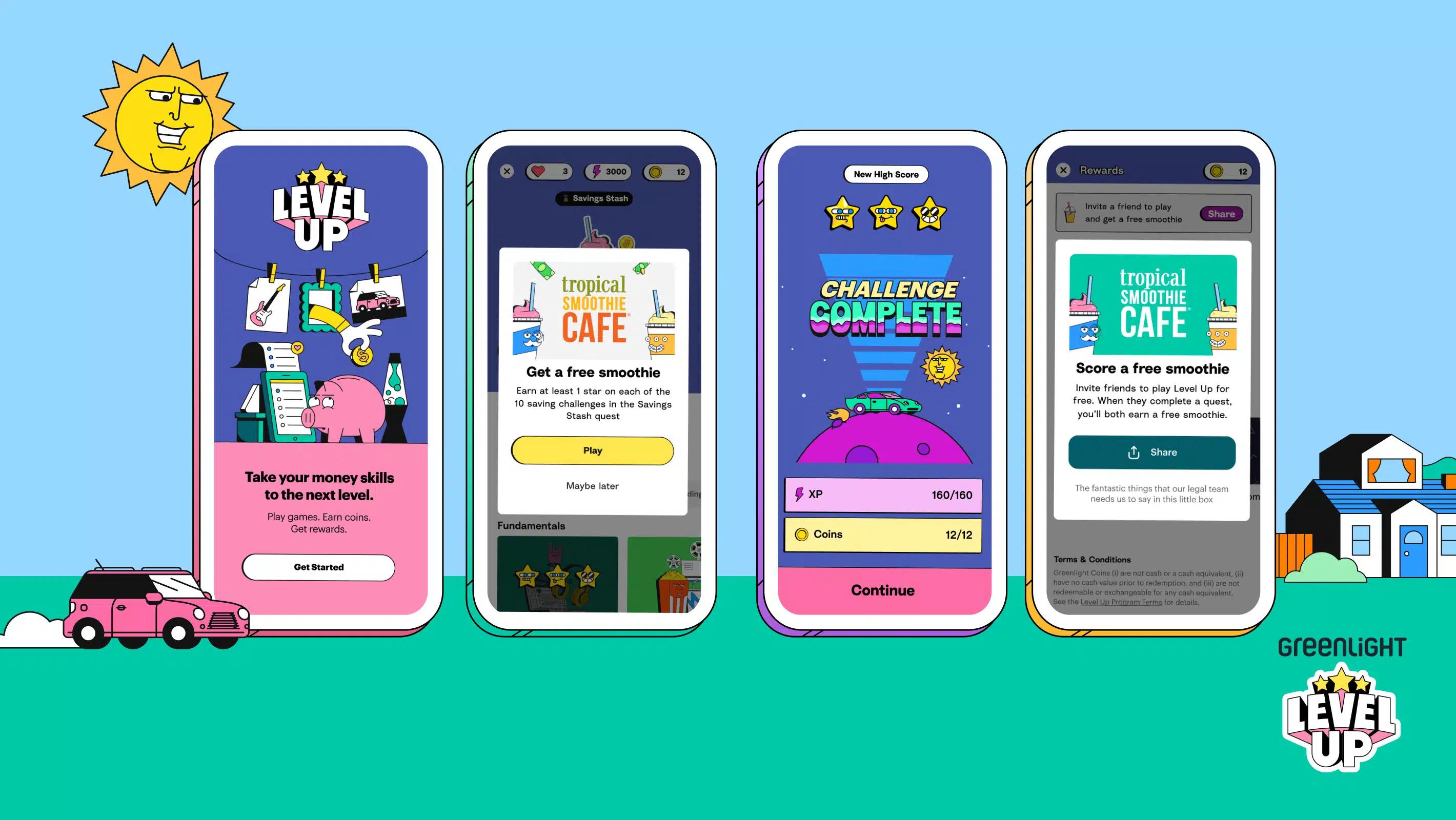

Greenlight Partners with Tropical Smoothie Cafe for App Rewards

by Kyle Burbank

The financial learning app Greenlight is introducing a new way to reward students, forming a partnership with Tropical Smoothie Cafe. About the partnership and program: Greenlight is adding a new rewards program to its Level Up financial literacy game. Now, users can earn a free smoothie from Tropical Smoothie Cafe by playing the game and completing levels. Specifically, when players finish 10 Level Up challenges in a learning quest, they'll...

FinTech News

"Copy-Trading" Platform Dub Raises $17 Million

by Kyle Burbank

A FinTech brokerage platform that makes it easy to share and follow portfolio strategies has closed a new round of funding. About the round: Dub has announced that it's raised $17 million — including $15 in equity deals and a $2 million debt facility. The seed round was led by Tusk Ventures with several other venture firms as well as individuals participating. This list includes Uber CEO Dara Khosrowshahi, Apex...

FinTech News

SoFi Named Official Banking Partner of the NBA

by Kyle Burbank

The FinTech-turned-bank SoFi has announced a new partnership with the National Basketball Association. About the partnership: SoFi is now the official banking partner of the NBA as well as the G League, NBA 2K League, and USA Basketball. Moreover, the company will be the title sponsor for what will now be the SoFi NBA Play-In Tournament (taking place April 16th to 19th). This includes a co-branded tournament logo featuring SoFi....

FinTech News

Fraud Prevention FinTech Closinglock Raises $12 Million

by Kyle Burbank

A FinTech that looks to reduce fraud in real estate transactions has raised a new funding round. About the round: This week, Closinglock announced that it had raised $12 million round of funding. The Series A was led by Headline with participation from LiveOak Ventures, RWT Horizons, and GTMfund. With a seed round in 2022, the company has now raised a total of $16 million. According to Closinglock, the new...

FinTech News

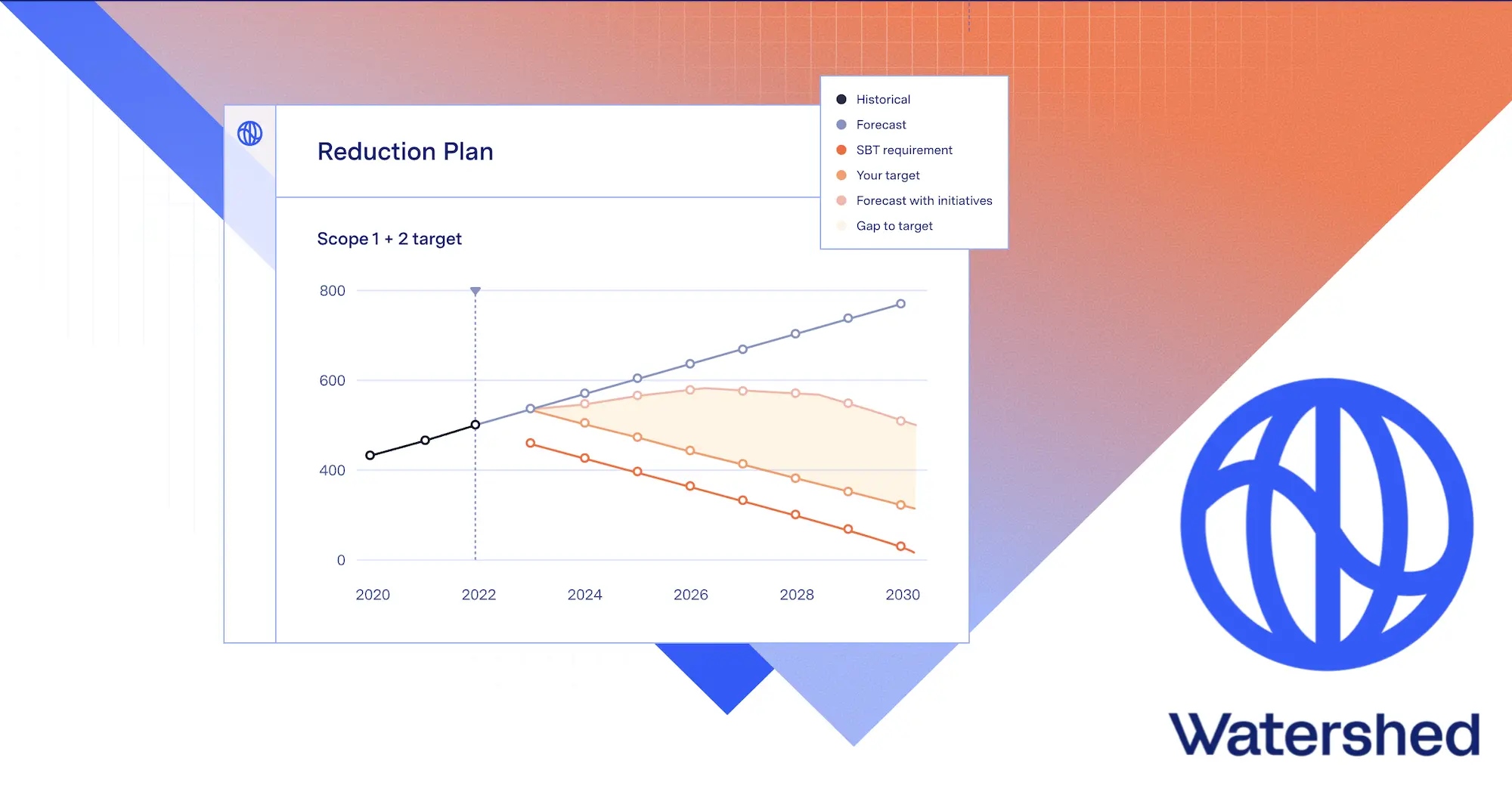

Climate Metrics FinTech Watershed Announces $100 Million Round

by Kyle Burbank

A climate-focused FinTech has just closed the latest "megaround." About the round: Watershed has announced a $100 million round that values the company at $1.8 billion. The Series C was led by Greenoak while Kleiner Perkins, Sequoia Capital, Elad Gil, Emerson Collective, Galvanize Climate Solutions, and Neo also participated. To date, the company has now raised a total of $239 million in funding including a Series B in 2022. With...

FinTech News

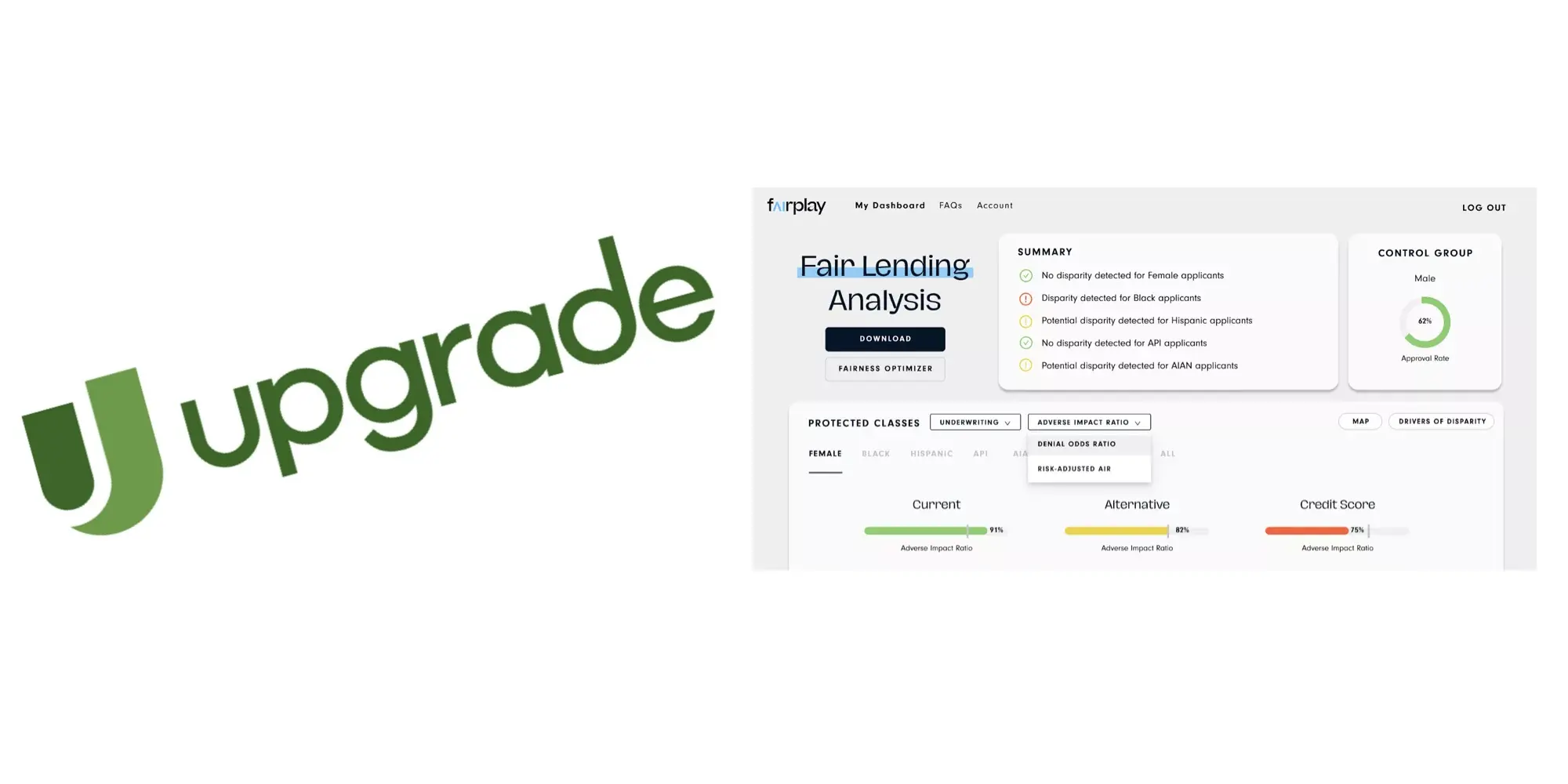

FairPlay Announces Partnership with Upgrade

by Kyle Burbank

The FinTech Upgrade will be working with another startup in a bid to make its lending practices more fair. About the partnership and about FairPlay: This week, FairPlay and Upgrade announced a new partnership. As a result, Upgrade will implement FairPlay solutions. In doing so, the company is looking to monitor and improve the fairness of the site's underwriting — which is also expected to result in more "positive outcomes"...

FinTech News

SoFi Launching Alternative Investments Feature

by Kyle Burbank

A FinTech brokerage is bringing more investment options to its platform. About the feature: SoFi has announced that alternative investments will soon be offered as part of SoFi Invest. These include the ability to invest in commodities, pre-IPO unicorns, private credit, and more. According to SoFi, they'll begin by offering more than 6,000 mutual funds. Plus, customers will be able to invest in ARK Venture Fund, Carlyle Tactical Credit Fund,...