Category: FinTech News

FinTech News

FinTech Firm One Announces $40 Million Funding Round

by Fioney Staff

Another neobanking app has just closed a significant investment round. This week, FinTech app One has revealed that it raised $40 million. The Series B was led by Progressive Investment Company, Inc. while Obvious Ventures, Foundation Capital, Core Innovation Capital, and others also participated. With the newly-acquired funds, the company says it plans on scaling its team, expanding their product offerings, and growing its user base. Previously, the FinTech raised...

FinTech News

Neobank Chime Now Valued at $25 Billion Following Latest Round

by Fioney Staff

So far in 2021, the FinTech industry has been on a winning streak. Between record-breaking investment rounds, major acquisitions, IPOs, and big announcements, the sector has garnered plenty of attention. Now, Chime is earning FinTech even more headlines following its latest eye-popping funding round and valuation. As CNBC reports, Chime has announced that it raised a whopping $750 million in its latest funding round. The Series G was led by...

FinTech News

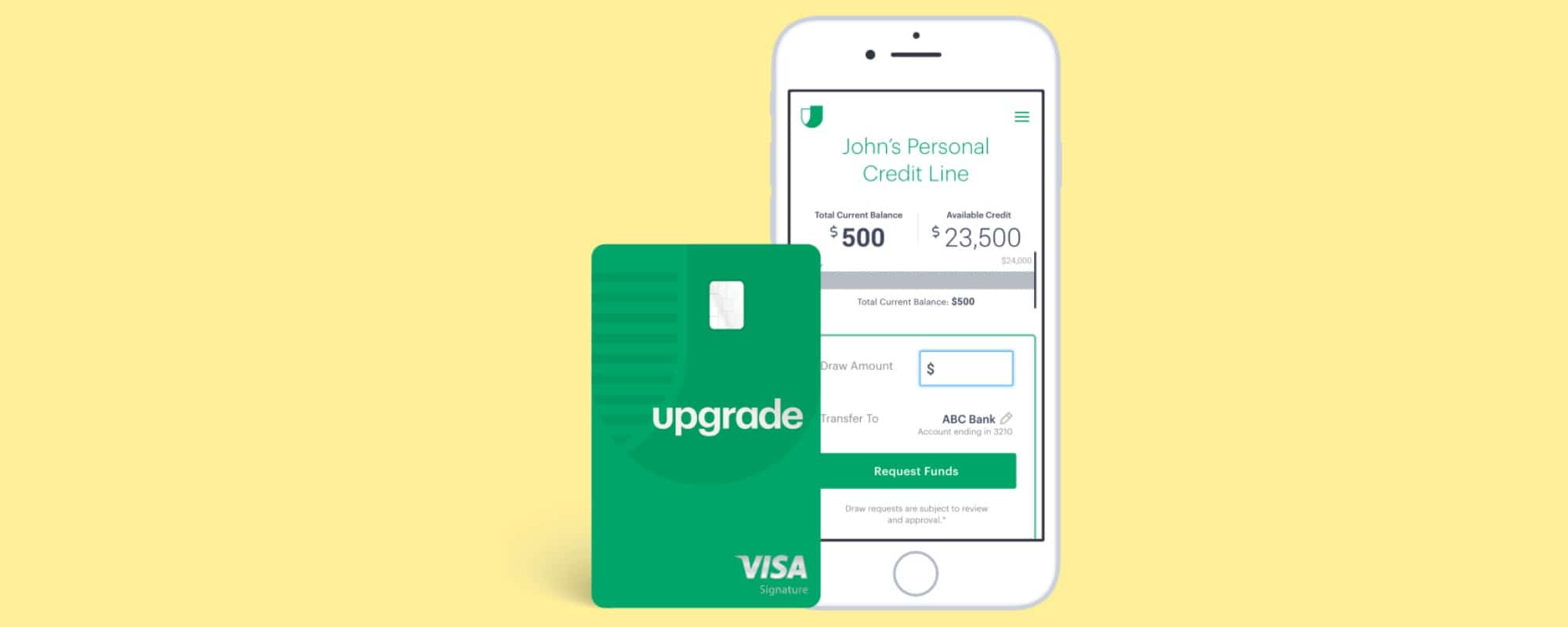

Upgrade Announces $105 Million Round at $3.3 Billion Valuation

by Fioney Staff

Another FinTech megadeal is in the books as Upgrade has just announced that it raised $105 million in its latest investment round. The Series E was led by Koch Disruptive Technologies (KDT) with BRV and Ventura Capital also participating. To date, Upgrade has raised a total of $307 million, including a $40 million Series D led by Mouro Capital last year. This latest raise valued the company at $3.325 billion....

FinTech News

Venmo Adds Automatic Cryptocurrency Rewards Option to Credit Card

by Fioney Staff

With interest in cryptocurrencies continuing to expand, another brand is adding crypto support to its credit card offering. Venmo has announced its new Cash Back to Crypto program for Venmo Credit Card customers. With this new option, cardholders can elect to automatically purchase cryptocurrency with the cashback rewards they earn each month. Additionally, those who opt into this program will not have any purchase fees associated with their "Cash Back...

FinTech News

Credit Karma Money Adds Bill Tracking Features for Accountholders

by Fioney Staff

The past few years have been busy ones for Credit Karma. In 2019, the free credit score site — which is now owned by Intuit — launched Credit Karma Savings. Later, when an accompanying checking account was added to the mix, the name was changed slightly to Credit Karma Money, including both Save and Spend accounts. Since then, the offering has gained popularity, thanks in part to its Instant Karma...

FinTech News

"FinTech as a Service" Company Rapyd Raises $300 Million

by Fioney Staff

As a record year for FinTech continues, this week, Rapyd announced that it had raised another $300 million. The Series E round was led by Target Global with participation from new investors Fidelity Management and Research Company, Altimeter Capital, Whale Rock Capital, BlackRock Funds, and Dragoneer as well as returning investors General Catalyst, Latitude, Durable Capital Partners, Tal Capital, Avid Ventures, and Spark Capital. To date, Rapyd has now raised...

FinTech News

Square to Acquire Afterpay, Integrate BNPL Into Existing Platforms

by Fioney Staff

FinTech giant Square is once again looking to expand its reach and venture into other aspects of finance — this time setting its sights on "buy now, pay later" (BNPL). Over the weekend, Square announced plans to acquire the Australia-based service Afterpay. With the deal anticipated to be paid in stock, the implied value of the transaction is $29 billion based on Square's share price as of July 30th. The transaction...