Category: FinTech News

FinTech News

Citi Launches Deal-Finding Browser Extension for Cardholders

by Kyle Burbank

Citi Bank has announced the debut of a new browser extension aimed at saving cardholders money. About the platform: This week, Citi unveiled Citi Shop. The new desktop browser extension is now available to eligible Citi credit card customers in the United States. Currently, the extension can be installed on Chrome, Safari, or Microsoft Edge browsers. Cardholders will also need to enroll their card to begin using the service. With...

FinTech News

Financial Wellness Platform Kashable Raises $25.6 Million

by Fioney Staff

A FinTech that helps employees access lower-cost credit options has announced a significant funding raise. About the round: Kashable has revealed a new $25.6 million funding round. The Series B was co-led by Revolution Ventures and Moneta Ventures, while EJF Capital and Krillion Ventures also participated. The company indicates that the capital will help fuel the platform's expansion as well as the development of additional features and services. It also...

FinTech News

Current Partners with Column Tax for Free Tax Filing Feature

by Kyle Burbank

This tax season, users of the app Current will have the option to file their returns for free thanks to a new partnership. About the offering: The neobank Current has announced a partnership with Column Tax. As a result, users will be able to file their taxes using the app. This feature will be available to "members with a payroll" and will allow them to file both federal and state...

FinTech News

Investment Property FinTech Downpayments Raises $32.8 Million

by Kyle Burbank

A FinTech that allows property investors to finance their down payments has announced a new funding round. About the round: This week, Florida-based startup Downpayments announced that it had raised $32.8 million via a mix of debt and equity. According to Crunchbase, the debt financing portion of the round totaled $31.8 million, while the equity seed round accounted for the other $1 million. Partners for Growth facilitated the debt financing,...

FinTech News

Intuit Announces TurboTax Integration in Credit Karma

by Kyle Burbank

With Tax Season ramping up, Intuit has announced a new TurboTax integration for the popular Credit Karma platform. About the integration: Intuit is bringing TurboTax into Credit Karma. As a result, customers will be able to file their 2023 taxes using the TurboTax platform via the Credit Karma interface. In some cases, this includes the ability to file for free. Additionally, those who do file with TurboTax and are due...

FinTech News

FinTech Brokerage Webull Launches in Canada

by Kyle Burbank

The popular brokerage app Webull is expanding up north. About Webull's entry into Canada: Kicking off the new year, Webull has announced its official launch in Canada. This comes after the firm initially gained operating authorization in November of last year. Now, Canadian customers can trade both Canadian and U.S. stocks and ETFs. According to Webull's site, the ability to trade U.S. options is also "coming soon." Although the U.S....

FinTech News

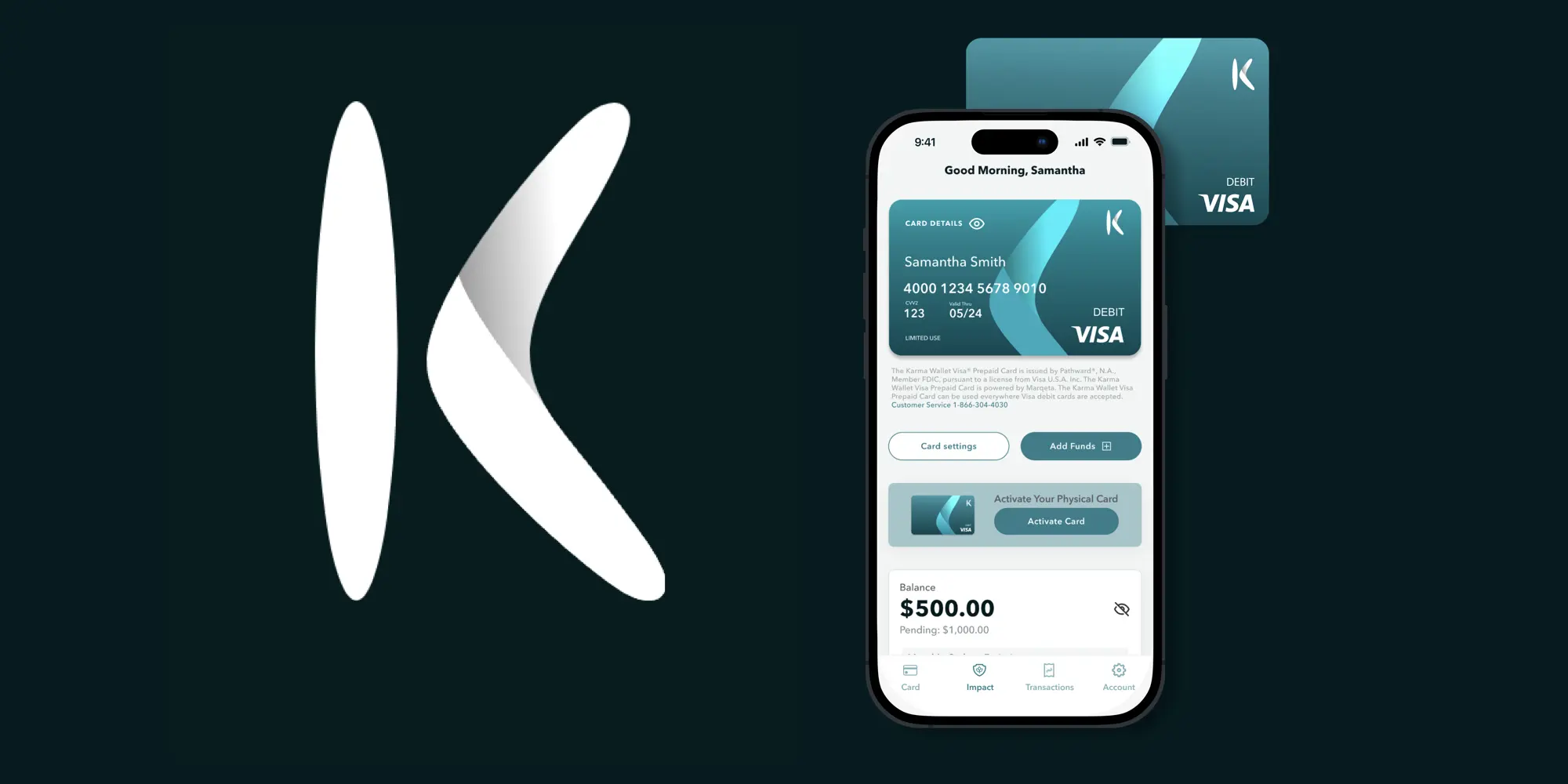

Impact Karma Raises $5.5 Million Seed Round

by Kyle Burbank

Another environmentally-focused FinTech has raised a new round of funding. About the round: Impact Karma has announced a $5.5 million seed round. As Triangle Inno reports, the round included investments from 37 firms — although they were not specified. The site also notes that, according to a securities filing, the startup anticipates that the round will reach $7.2 million. Prior to this round, Impact Karma had raised capital via three...