Category: Money Management

Money Management

Truist Long Game Review (2023): Is the Savings App Still Worth It?

by Kyle Burbank

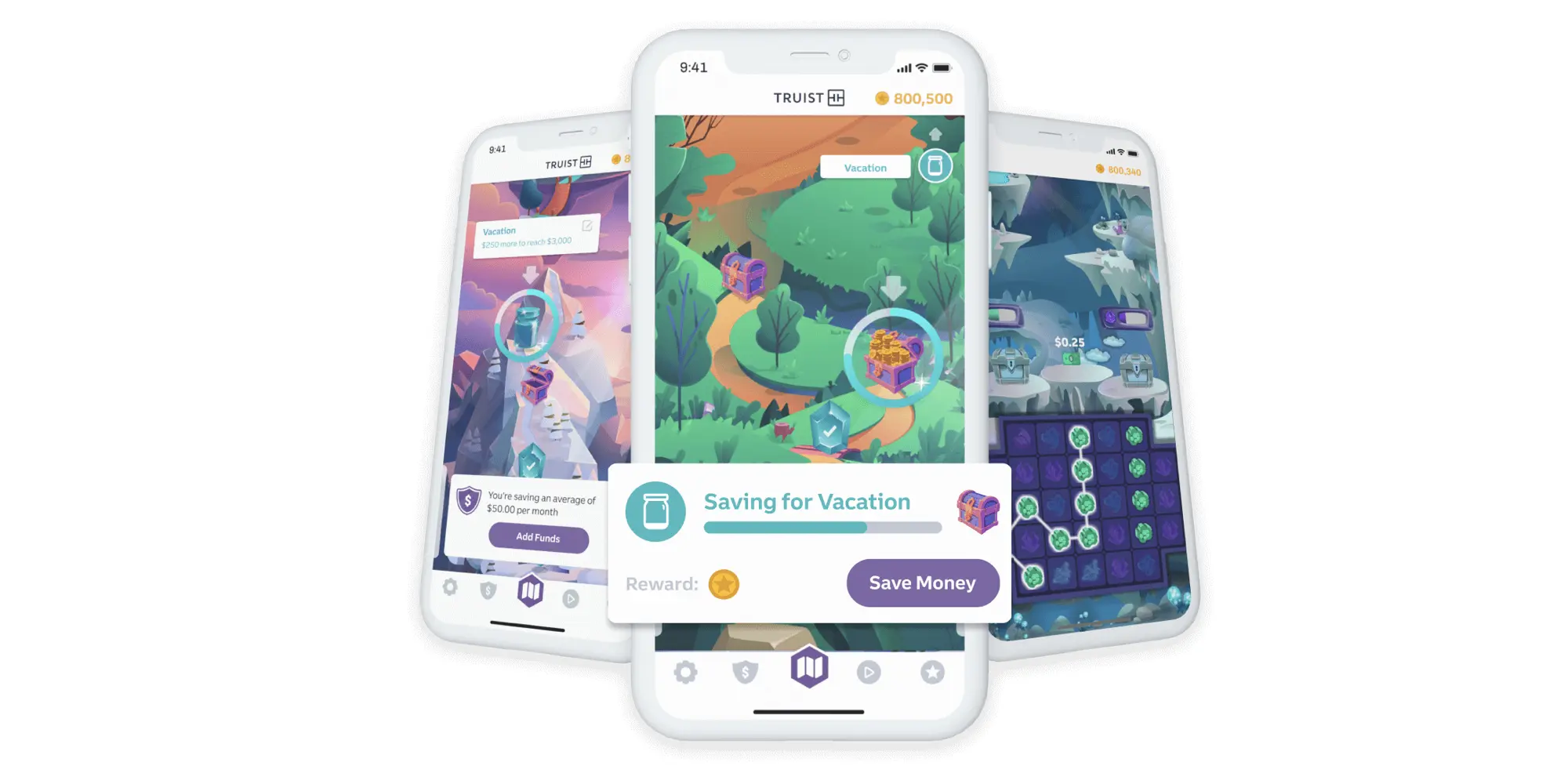

Long Game is a personal finance app that rewards users for setting aside money in savings account by allowing them to unlock games of chance that could potentially add to their stash. It's a novel concept to be sure — but does it actually work?

Money Management

Money at 30: Valuing Your Time (And How You're Wasting Yours)

by Kyle Burbank

Time is money. It's cliche, but it's true. Yet, even when we're all aware of this relationship, there are assuredly times when we devalue our time by trying to save a few dollars. While I'm far from the first to bring this up, if you put the time you spend on certain tasks into the terms of an hourly wage, you might be shocked by just how little you're "paying...

Money Management

Money at 30: How Much Does a Funeral Cost?

by Kyle Burbank

Did you know that dying is expensive? More specifically, the costs associated with funerals can really add up. That's something my wife and I have unfortunately learned recently as her dad passed away a couple of weeks ago after a brief battle with cancer. Luckily, he and my mother-in-law had made some preparations, such as purchasing plots ahead of time. Still, there are plenty of other expenses and options to...

Money Management

Money at 30: T-Mobile Dining Rewards

by Kyle Burbank

Over the years, wireless network provider T-Mobile has routinely ventured outside of the realm of telecommunications. A prime example of this is the brand's banking account T-Mobile Money. On top of that, the company has been known for its various "on Us" and "thankings" for consumers, such as its T-Mobile Tuesdays promotions. In that same vein, the brand has now introduced T-Mobile Dining Rewards, allowing customers to earn cashback on...

Money Management

Money at 30: Why Does Decluttering Feel Like Saving Money?

by Kyle Burbank

A few weeks ago, I shared that I was going on a bit of a subscription cancelation binge — and, let me tell you, I've been on a high ever since. In fact, after slashing those costs and racking up savings, I was inspired to keep the good times rolling... except how? Well, after sitting with this feeling, I realized that what I really wanted to do was engage in...

Money Management

Money at 30: Digital Nomadism Revisited

by Kyle Burbank

A few years back, I shared that listening to a podcast had sent me down a rabbit hole exploring the world of digital nomadism. At the time, I'd firmly concluded that the lifestyle wasn't for me. Yet, more recently, the topic has once again come up in conversations between me and my wife. That's partially due to our current frustrations with our apartment complex and wondering what surprises await us...

Money Management

Money at 30: Rocket Money Review

by Kyle Burbank

There are times when I download an app on my phone... and let it sit there for months before I truly dive into it. Admittedly, that's exactly what happened with Rocket Money. Yet, when I did get around to giving the app I try, not only was I impressed with what I found but also managed to test out some of the features that make the service unique in my...