Category: Personal Finance

Personal finance and money management can be very confusing. Most people know that optimizing their finances is important but few feel confident that they have the knowledge to do so.

At Fioney we stay on top of the latest economic trends, financial products, and money management strategies in order to provide the knowledge to help you use the money you have today to live the life you want.

Learn to make your money work for you. Whether it’s getting debt free or buying a home we have you covered.

Personal Finance

Credit Builder Petal Raises $35 Million, Spins Off Prism Data

by Kyle Burbank

The credit-building credit card FinTech Petal has announced a fresh round of funding and a big change to their business. First, the company disclosed that it's raised $35 million. The new funding was led by Valar Ventures with Story Ventures, Core Innovation Capital, and RiverPark Ventures participating as well. Strategic investments from Synchrony and Samsung Next were also included. To date, Petal has now raised nearly $300 million in equity...

Personal Finance

48% of Americans Worry About Money in Banks Following Failures

by Kyle Burbank

Following a series of bank failures in recent weeks, some Americans may be wondering about just how safe their deposited funds are. With that in mind, a new poll from Gallup sought to measure banking consumer confidence — and compare those results to a pair of 2008 surveys. According to the poll, a total of 48% of respondents expressed worry about the safety of funds they had deposited with banks...

Personal Finance

What to Do With Your 401(k) From a Previous Employer

by Fioney Staff

When leaving a job with an employer, there are obviously a number of changes you will experience and decisions you will need to make about your future. One such decision that is sometimes forgotten is what to do with the 401(k) you had under your former employer. In addition to any contributions you may have made to your account, you may also have a vested chunk of matching funds or...

Personal Finance

Vera Equity Announces $20 Million Fund to Invest in Startups

by Fioney Staff

Financial technology companies looking for investment have a new potential partner to turn to. This week, the venture capital firm Vera Equity announced that it has raised a $20 million fund. With this capital, the company will invest in early-stage FinTech startups. While the announcement of the fund has arrived now, Vera has already invested in a number of startups. This includes participating in StellarFi's $15 million Series A in...

Personal Finance

"Poverty, By America" Audiobook Review

by Kyle Burbank

It's been a while since I've reviewed a book for this site. To a point, that's because books about finance often cover the same few topics, making them harder to assess on my part. In turn, I'm always excited to find a book that fits into my wheelhouse but does something different. Luckily, I found that in the recently-released Poverty, By America from author Matthew Desmond. While I wasn't 100%...

Personal Finance

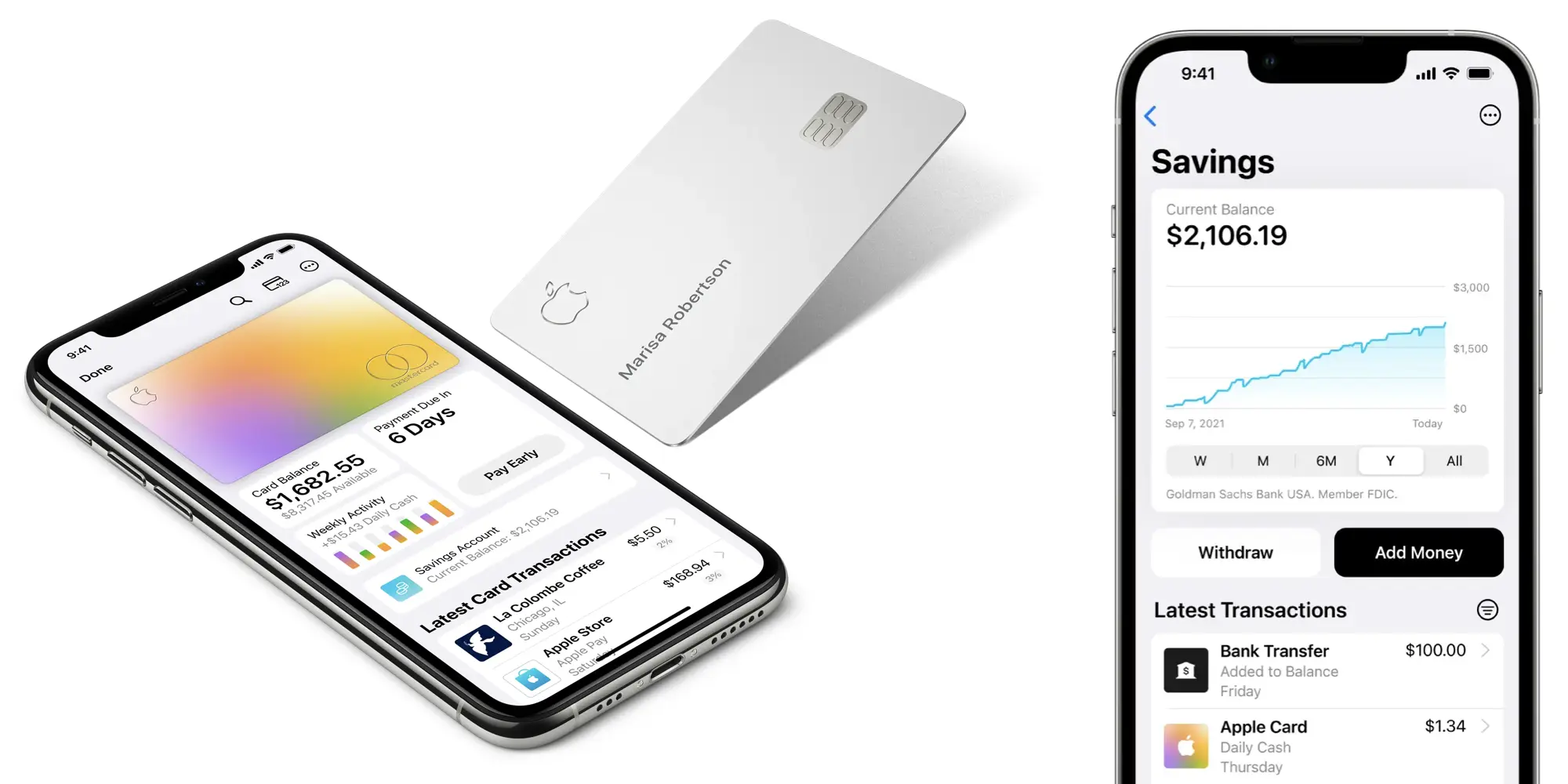

Apple Card Savings Nears $1 Billion in Deposits During First Days

by Fioney Staff

Last month, after previously announcing plans to introduce a savings account, Apple debuted Apple Card Savings. The new offering allows Apple Card customers to automatically deposit their earned cashback into high-yield savings. Now, the account has seemingly seen early success based on the value of initial deposits. According to a report from Forbes, Apple Card Savings managed to accrue $400 million in deposits on its launch day. Furthermore, after four...

Personal Finance

Student Loan Benefit FinTech Summer Raises $6 Million

by Fioney Staff

For years, student debt has been one of the most talked about financial topics. What's more, while the debt itself has become a major part of many Americans' lives, discussion of student loans has become political due to efforts to forgive certain loan repayments. However, while we wait for resolution on that front, a FinTech that brings student debt benefit solutions to employers and consumers has raised a new round...