Category: Personal Finance

Personal finance and money management can be very confusing. Most people know that optimizing their finances is important but few feel confident that they have the knowledge to do so.

At Fioney we stay on top of the latest economic trends, financial products, and money management strategies in order to provide the knowledge to help you use the money you have today to live the life you want.

Learn to make your money work for you. Whether it’s getting debt free or buying a home we have you covered.

Personal Finance

Galileo Introduces Post-Purchase BNPL Solution for Banks

by Kyle Burbank

Galileo is bringing new purchase financing options to a variety of card customers. About the feature: The FinTech Galileo (which is owned by SoFi) has announced an expansion of its "buy now, pay later" platform. Now, banks and fellow FinTechs can enable a post-purchase installment plan option for debit and credit cardholders. This joins a more traditional pre-purchase BNPL feature. These options are now available via an API. According to...

Personal Finance

Experian Boost Review: How Does it Work? Is it Worth it?

by Kyle Burbank

Building credit has long been a Catch-22 as getting approved for credit often means already having credit established. Luckily for consumers, in recent years there have been a few innovations that have addressed this issue in different ways. One such option is Experian Boost, which comes from Experian — one of the three major credit bureaus in the United States. While you may have seen the ads for the service...

Personal Finance

Survey: 45% of Americans Rely on Credit Amid Inflation

by Kyle Burbank

A new survey highlights the link between continued inflation and how Americans are using credit. About the survey results: According to a Debt.com survey of 1,000 U.S. adults, a significant number of consumers are currently relying on credit. In fact, 45% of respondents cite inflation and price increases as the reason for their credit usage. Furthermore, 35% say they've maxed out their cards in recent years as a result of...

Personal Finance

Costs of Pet Ownership: More of Our Actual Expenses with a Dog

by Kyle Burbank

Back in 2021, my wife and I decided to add a dog to our family. After a lengthy search, that summer, we brought Rigby home. Soon thereafter, I shared a post detailing the expenses we'd encountered as new pet owners. Now, as we mull the idea of potentially getting a "sibling" for Rigby, we've been thinking about what costs that would bring. While we're not ready for that quite yet,...

Personal Finance

Apex FinTech Solutions Acquires AdvisorArch

by Kyle Burbank

Apex FinTech Solutions, which provides clearing services and other solutions, has announced its latest acquisition. About the acquisition and AdvisorArch: Today, Apex FinTech Solutions revealed that it had acquired AdvisorArch — a company that Apex has partnered with since 2023. Terms of the deal were not readily disclosed. According to Apex, the acquisition will allow it to strengthen its platform and expand its digital advice tools. For example, it notes...

Personal Finance

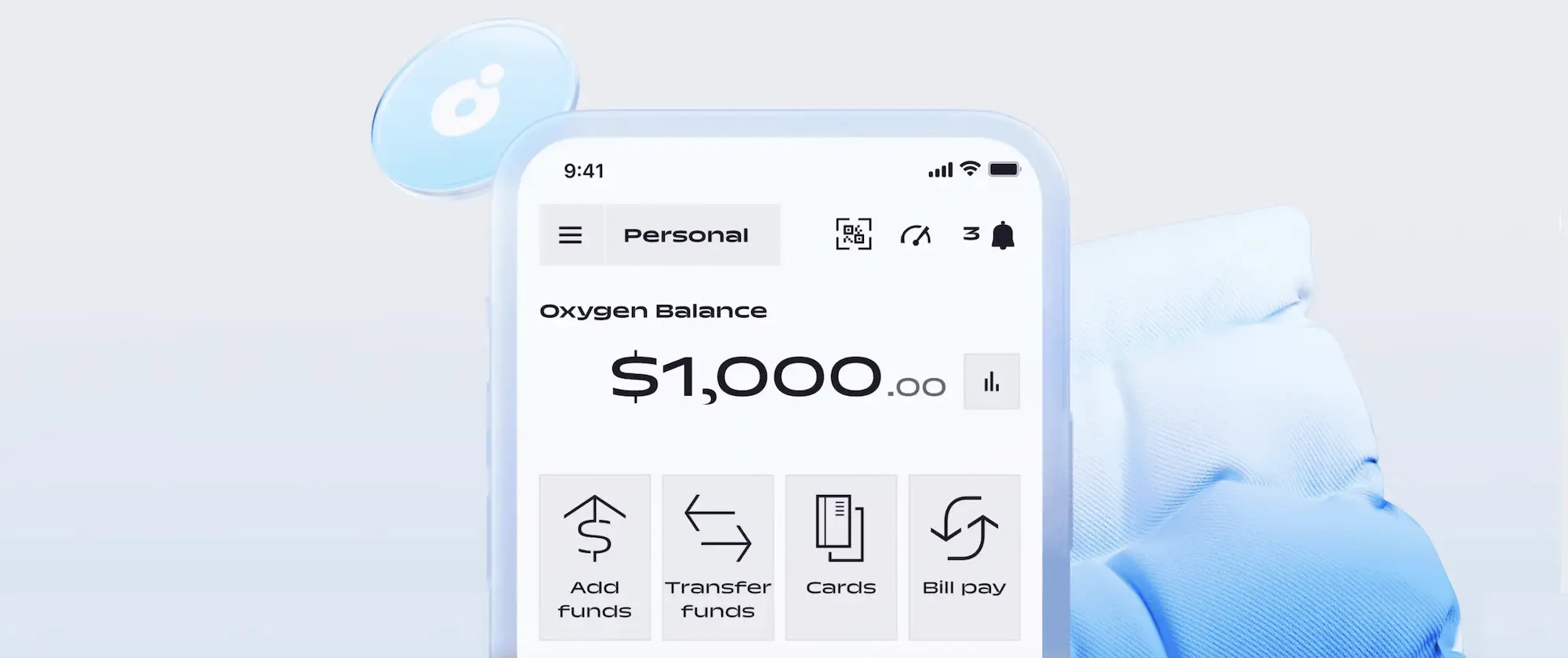

Oxygen Ending Banking Services, Pivoting to Health Solutions

by Kyle Burbank

The business and consumer neobank Oxygen has announced a "temporary" exit from banking services. About the closure: Oxygen has announced that it will be "pausing banking" and will shut down its current accounts. First, as of today, the Total Rewards Program will be discontinued. Effective March 16th, users will no longer be able to deposit money into their Oxygen account. Then, on March 21st, services such as Round Up Spare...

Personal Finance

A Guide to Building Credit and Increasing Your Credit Scores

by Kyle Burbank

When it comes to credit, there’s some good news. The average credit score in the United States has been steadily rising in recent years, coming in at 715 in 2023. That may be because, today, consumers not only have more ways to access their credit reports and scores than ever before but also because there are an increasing number of options that Americans have for building credit in the first...