Category: Money Management

Money Management

2024 Pay with GasBuddy Review: Yes, You Can Legitimately Save Money Every Time You Fill

by Kyle Burbank

Put simply, the value proposition of Pay with GasBuddy is that you can use a special card that's accepted at most gas stations in order to save a few cents off of every gallon of gas you buy. That sounds good — almost too good, if you think like me.

Money Management

How to Activate a Virtual Card Number on Apple Cash

by Kyle Burbank

In 2017, Apple expanded its FinTech aspirations by introducing a peer-to-peer payment account called Apple Cash. With this account, users could easily send and receive payments via iMessage. What's more, while customers could elect to transfer received funds to a linked bank account, they could also be spent directly using Apple Pay. The only problem was that, for merchants that didn't accept Apple Pay, there wasn't a way to use...

Money Management

Greenlight Level Up Review: A Free Financial Literacy Game

by Kyle Burbank

Despite personal finance being an important topic for those of all ages, few schools make it a part of their curriculum. In this absesnse, several companies and institutions have offered their own ways for children, teens, and adults to gain financial literacy. Among those looking to lend some assistance is Greenlight, which now offers a free financial learning game called Level Up. Even better, the company recently announced a partnership...

Money Management

Pepper Rewards Review: Earn Rebates on Gift Cards from Top Brands

by Kyle Burbank

Recently, out of nowhere, an app called Pepper seemed to be all the rage in the credit card reward and deal-finding corner of the Internet. Unlike some other apps I've seen mentioned that just seem too convoluted to be worth it, the premise of Pepper is super simple: buy gift cards and earn rewards. While there are some other sites where you can buy discounted gift cards or other apps...

Money Management

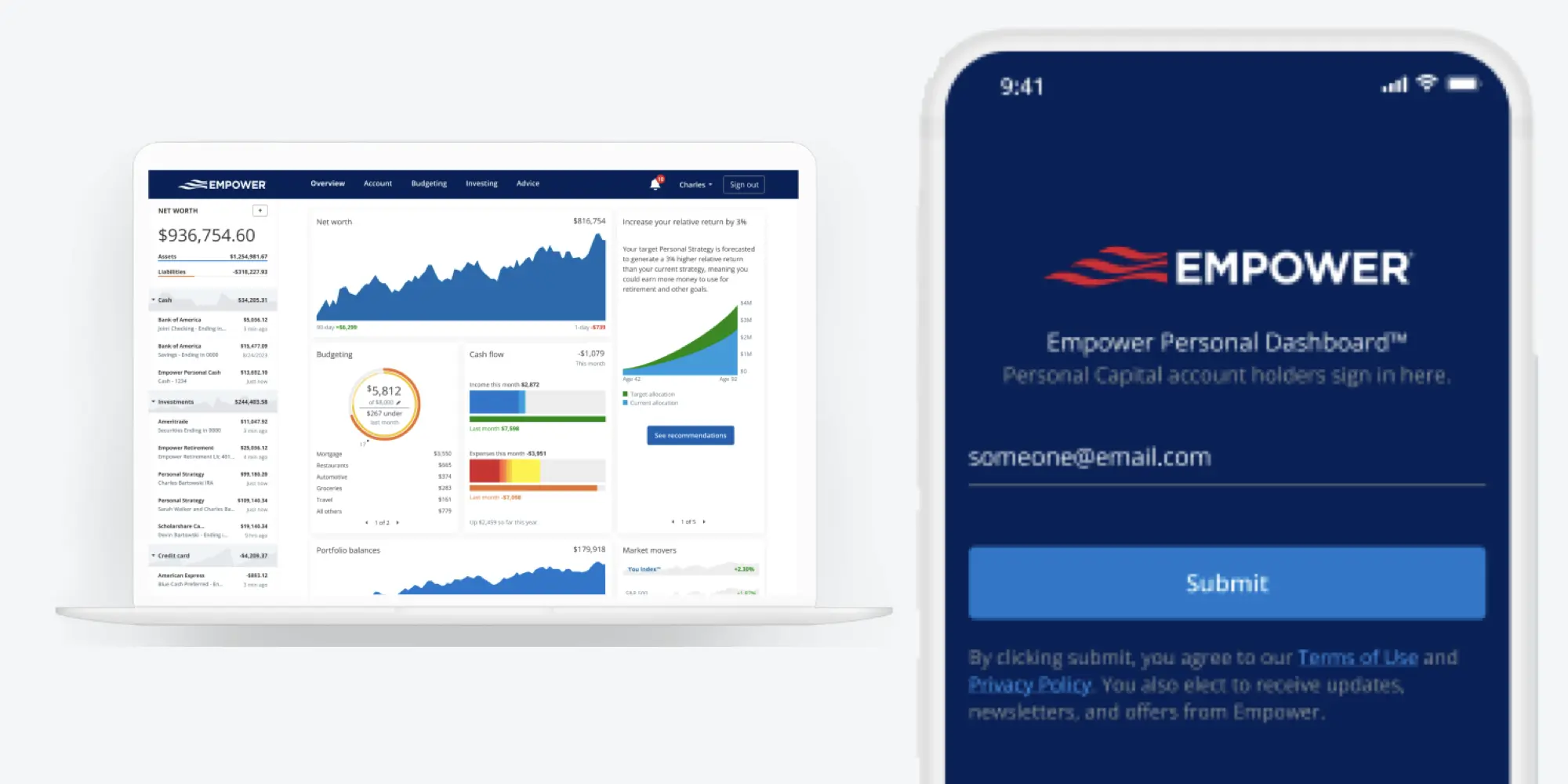

Empower Personal Dashboard Review

by Kyle Burbank

A few years ago, my wife and I opened a new chapter in our financial journey as we resolved to make 2019 the year we learned more about investing. Whether I was reading books on the subject or exploring other blogs for advice, there was one recommendation I came across again and again: Personal Capital — which is now part of Empower and is known as the Empower Personal Dashboard....

Money Management

Mana App Review: The Neobanking App for Gamers

by Kyle Burbank

One of the most intriguing trends I've seen emerge since I've been following FinTech is the advent of niche neobanks. These days, you can find apps geared towards certain communities, interests, and more. Among the latest examples I've seen of this is an app called Mana, which bills itself as the best debit card for gamers. Now, I may not be a big gamer, but I do know a thing...

Money Management

Ibotta App Review (2024)

by Kyle Burbank

I remember the first time I was introduced to the concept of digital coupons. For some reason, I was looking at the website for my local grocery store when I found a section dedicated to coupons. At the time I was confused about how you redeemed these coupons since they weren't in the typical print-and-clip format but, soon enough, I realized that I just needed to link them to my...