FinTech News

Chainalysis Announces Expansion of Series B to $49 Million

The blockchain analysis company cleverly named Chainalysis has just upped its latest funding effort. Originally announced last year as a $36 million round with participation from Accel, Benchmark, MUFG, and Sozo Ventures, Chainalysis has now expanded the Series B by $13 million. The additional investments come from Ribbit Capital and Sound Ventures. As part of the deal, Ribbit Capital General Partner (and former Under Secretary for Terrorism and Financial Intelligence at the U.S. Department of the Treasury) Sigal Mandelker will serve as an advisor to the firm. With the newfound funds, Chainalysis says it will continue to “further unite the public and private sectors to fuel the cryptocurrency industry’s growth through the addition of software engineers, government sales, and other business roles.”

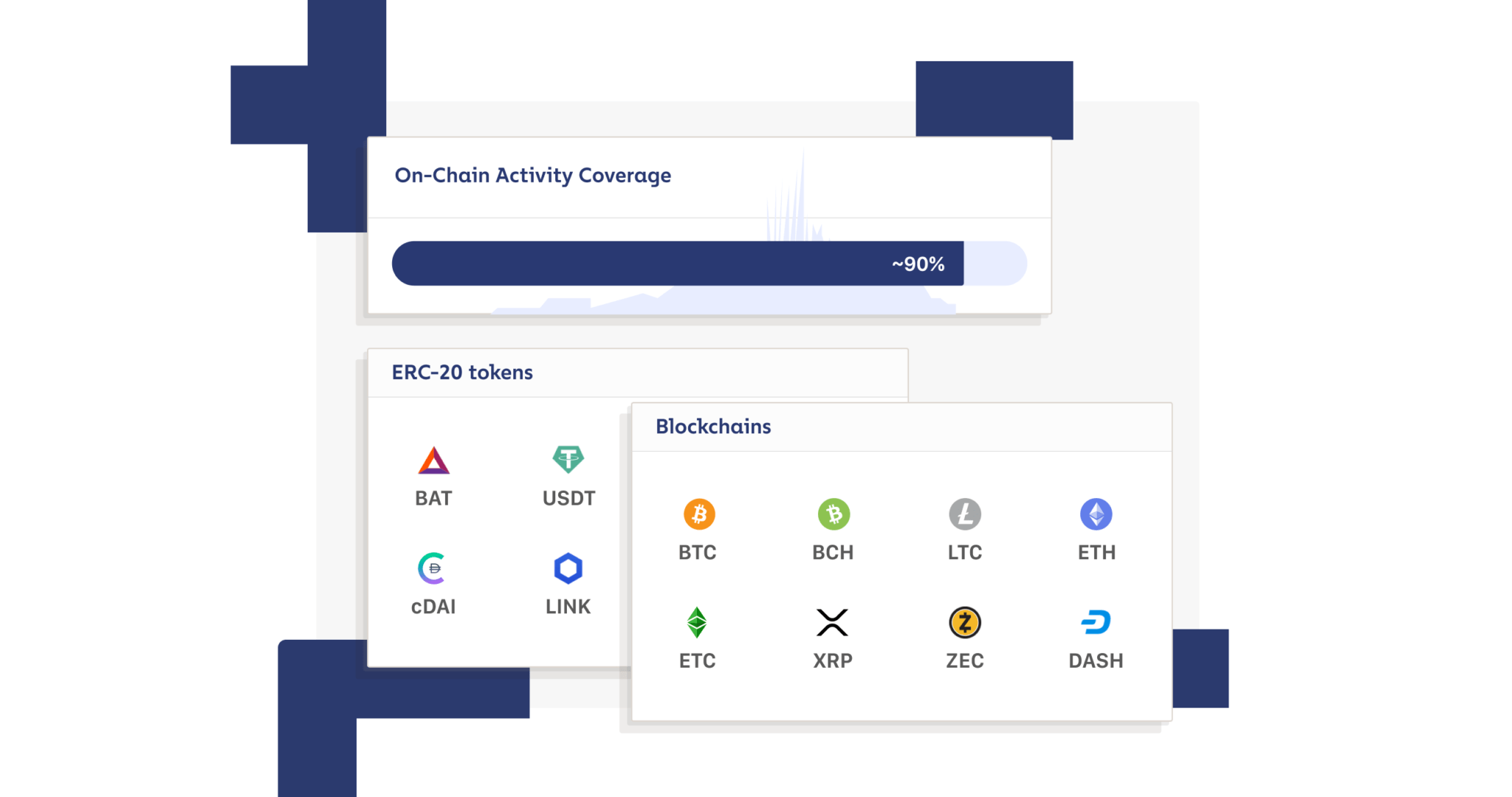

Chainalysis offers a number of products revolving around blockchain technologies and data. For example, their KYT (Know Your Transaction) offers automated cryptocurrency transaction monitoring while Kryptos provides risk analysis for crypto businesses. According to the company, 180 private sector businesses located in 44 countries currently utilize these services.

Elsewhere Chainalysis has gained some notoriety for some of their reports. Among them was the revelation that as much as $2.8 billion in Bitcoin was laundered throughout 2019. In particular, this report raised the ire of two companies singled out in it: Binance and Huobi — although Chainalysis did make clear that the laundering transactions still amounted to a small fraction of the trade volume seen on both platforms.

In a press release about the latest funding, Chainalysis co-founder and CEO Michael Gronager stated, “Chainalysis is founded on the belief that providing data insights into cryptocurrency activity will unite government agencies, exchanges, and financial institutions to fuel the industry’s growth.” He added, “Ribbit Capital’s deep FinTech, cryptocurrency, and government experience and Sound Venture’s commitment to creating safer digital environments through enterprise software make them natural partners as we continue our high-growth trajectory and global expansion.” Addtionally, Ribbit Capital managing partner Micky Malka said of his firm’s investment, “Chainalysis is the data platform bet, as crypto-asset adoption increases across the world. We’re convinced that the firm’s technology provides foundational infrastructure for the future of finance. Chainalysis has already seen impressive growth, and the economic opportunity is massive.”

Although more important matters have occupied the news in recent months, the cryptocurrency market hasn’t faded during the current crisis. In fact, as governments and citizens look toward establishing the new normal, there are plenty of reasons to think that blockchain and crypto will be even larger topics of conversation. However, looking at where we left off, it’s clear that regulators still have plenty of concerns about these technologies. Therefore, if Chainalysis can help calm those fears to any degree, it’s easy to see why their latest funding round has grown larger. With this still only being a Series B, it seems we’ll be hearing a lot more from the firm in the years ahead.