FinTech News

Credit Karma Reportedly in Talks to Sell Tax Prep Platform to Square

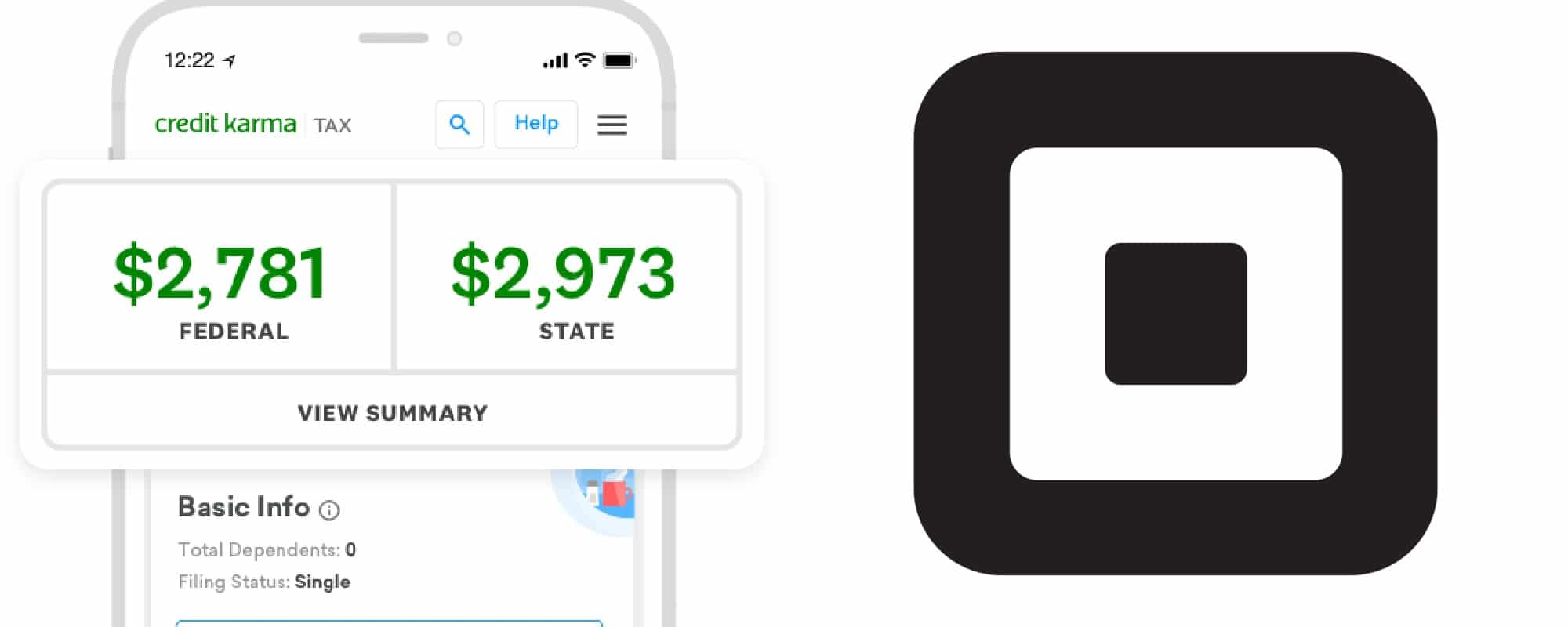

Earlier this year, Intuit announced plans to purchase the personal finance tool Credit Karma for a whopping $7.1 billion. Of course, with Intuit perhaps being best known for its TurboTax software, one major question about the proposed purchase was what would become of Credit Karma’s free Credit Karma Tax service? Now reports suggest that that the company could be seeking to offload the platform onto a fellow FinTech: Square.

Initially launched in 2016, Credit Karma Tax is an extension of the credit score site that not only allows users to prepare and file their Federal tax returns without a fee but also file their state taxes for free as well. With each passing year, the service has expanded to support more tax situations and states. In each case, the service remained 100% free, standing in contrast to other platforms — including TurboTax — that typically charge more to prepare more complicated returns as well as charge a separate fee for filing state returns.

According to the Wall Street Journal, Credit Karma is now in discussions with Square to purchase the tax portion of its business. This comes as regulators are said to have concerns that the sale of Credit Karma to Intuit will result in the removal of a low-cost tax prep option for consumers. Details about the potential sale including a price tag are not known at this time and the deal is not yet done.

For Square, the acquisition could make a lot of sense. In recent years, the company has continued to expand beyond the card readers that made them famous, branching into financial services for small business owners and everyday consumers alike. This includes growing its Cash app to include a free debit card. In fact, earlier this year, the platform added routing and account numbers to the app so that users could receive CARES Act stimulus checks directly to their Cash accounts. So, while Square may not be in the tax preparation business today, it’s certainly shown a willingness to add services that it believes will fit the needs of their customers. Incidentally, WSJ notes that Credit Karma has been seeking bidders that “have the financial wherewithal and strategic vision to grow tax businesses,” implying that they see these qualities in Square as a company.

Reports of these talks between Credit Karma and Square come as another major FinTech deal also faces antitrust scrutiny. According to WSJ, the United States Department of Justice could seek to block Visa’s planned purchase of the FinTech API Plaid for $5.3 billion. Earlier this week, the department filed a petition to obtain more information on the businesses. Elsewhere, regulators are apparently also investigating Mastercard’s takeover bid for Finicity.

All things considered, it was fairly foreseeable that Credit Karma would need to do something with its tax platform either before or after their purchase as the removal of the feature would surely be a lightning rod for criticism of Intuit. Nevertheless, it’s fascinating to see the company seemingly landing on Square as a potential buyer. Meanwhile, should the deal come to fruition, it will be even more interesting to see how the tax service blossoms as part of Square’s platform — and if it could perhaps truly compete with TurboTax and others in the years ahead.