FinTech News

Credit Sesame Completes Acquisition of STACK

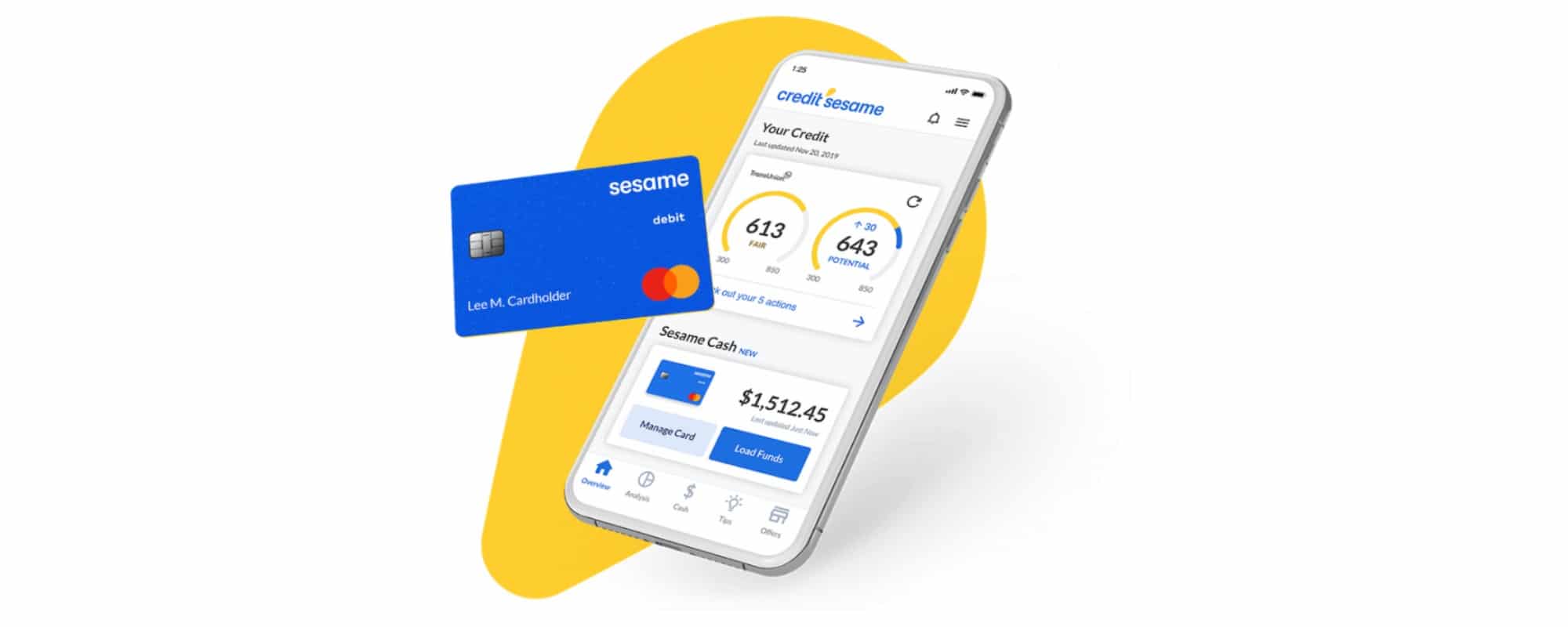

Following several notable deals so far this year, it looks like FinTech’s M&A streak is continuing, with Credit Sesame emerging as the latest buyer. This week, the company announced that it had completed its acquisition of Canadian challenger bank STACK. Previously, the two companies had collaborated to introduce Sesame Cash — a free digital bank account that comes complete with a Mastercard debit card. That product was first released to a waitlist of customers in March and has since been made available to all new and existing users. According to the company, Sesame Cash has seen more than 200,000 sign-ups since its wide release in mid-May. Meanwhile the service itself has more than 15 million members.

With STACK being based in Canada, the acquisition also marks the beginning the Credit Sesame’s planned international expansion. Later this year, the company plans to add its credit services to STACK’s digital banking product. In a press release, Credit Sesame states that, with this move, they’ll be poised to lead the Canadian market. Also notable is that several STACK employees have been given new jobs and titles within Credit Sesame and will continue to work out of the Toronto-based office.

Speaking to their banking aspirations and how their purchase of STACK can help them achieve those goals, Credit Sesame founder and CEO Adrian Nazari said in a statement, “Together with STACK, we are combining the power of smart banking and AI-driven credit management to create a new kind of personal finance.” He continued, “How much cash you have, and how and when you use your cash, have a big impact on your credit. Adding cash management to our credit platform was a natural next step to better help consumers manage their overall financial health, and it creates a unique benefit for our consumers and financial partners.”

Similarly Miro Pavletic (previously CEO of STACK and now General Manager, Canadian & International Business for Credit Sesame) stated, “Credit Sesame and STACK share the belief that technology can help democratize access to smarter services and stronger support to help consumers achieve financial wellness. We’re excited to join the Credit Sesame team to help consumers in the U.S. and Canada keep as much of their money in their pockets as possible, help them grow their credit, and give them access to the right credit products at the right time.”

For Credit Sesame, the closure of this acquisition comes at a time when one of its main competitors — Credit Karma — finds itself on the other end of a separate deal. In February, Intuit announced plans to acquire Credit Karma for a whopping $7.1 billion. On the one hand, this dominance could further threaten Credit Sesame yet, on the other hand, some have wondered if Intuit might eventually neuter the Credit Karma product to the point where consumers might seek alternatives. Regardless, with this deal, Credit Sesame shows that it’s forging its own path and could prove to be a more formidable rival than some might give them credit for.