Money Management Tips

Money at 30: How to Finance a New iPhone with Apple Card

Recently, Apple sounded the alarm and built up hype as it stealthily revealed the debut of a new iPhone. Well, a new-ish iPhone. Yes, those waiting for the latest and greatest will have to hold on for at least a few more months as this particular announcement brought a budget edition phone instead. Dubbed the iPhone SE — or the second-generation iPhone SE, technically — this new smartphone features the latest Apple A13 chip housed in an iPhone 8’s body, making it an affordable and potentially nostalgic upgrade for those who don’t mind the older style.

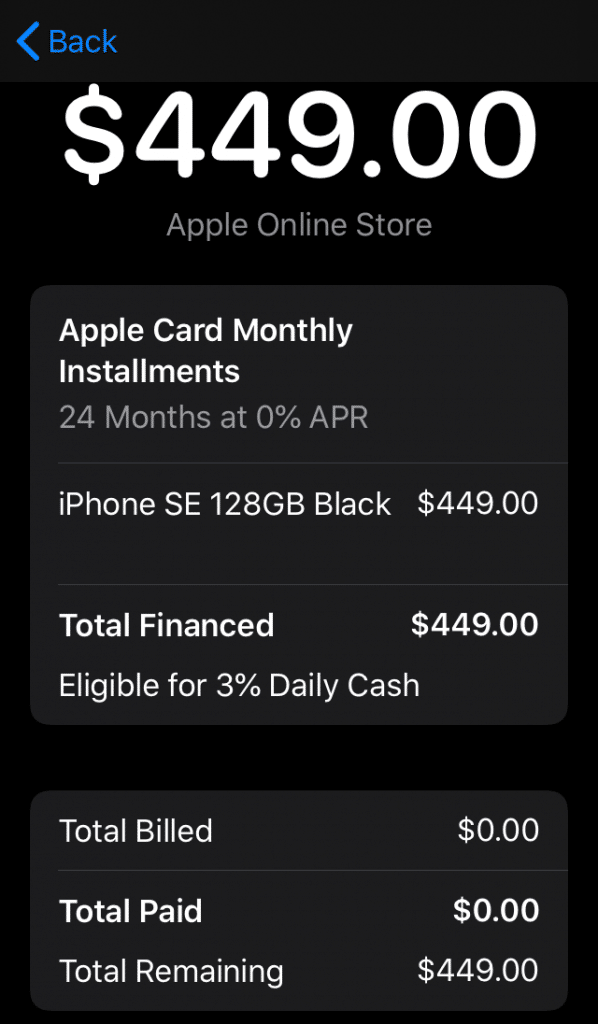

For me, the launch of the new iPhone SE not only gave me the ability to upgrade, while still holding on to my beloved Touch ID and small form factor for a few more years, but also provided me the opportunity to try out another feature of the Apple Card introducing last year: 24-month interest-free financing. Even with the SE fetching a reasonable $399 (or $449 for a 128GB model I opted for), the ability to spread this amount over two years without paying anything extra seemed attractive given the current conditions. Plus, it means I had something else to review — and that’s always a win for me!

With that, let’s take a look at my experience utilizing Apple Card Monthly Installments and what I think you should know about this option.

Setting up your financing

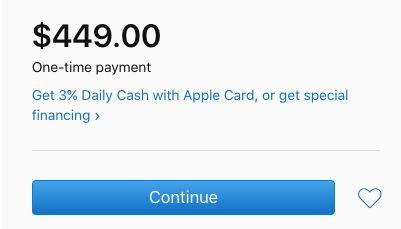

When I went to purchase my iPhone SE and try out Apple Card Monthly Installments, I found myself getting a bit confused by Apple’s website. After selecting the model, color, storage size, carrier, and the rest, it offered two payment options: Apple iPhone Payments or One-Time Payment. Under the Apple iPhone Payments, it noted that this would allow you to “pay for your iPhone with low monthly payments.” Meanwhile, the One-Time Payment option is where it mentioned that Apple Card users could earn 3% Daily Cash. Making things even more confusing, after selecting One-Time Payment, a subsequent box stated “Get 3% Daily Cash with Apple Card, or get special financing” — which sounds like a choice between the two, even though the Apple Card Monthly Installments page makes it clear that financed iPhones still qualify for Daily Cash. Frustrated by the desktop site, I decided to try the mobile version instead, but came across the same issue.

While I’m still not clear on the correct procedure from the website, what I did find was that the easiest way to ensure that you’re properly purchasing your iPhone with interest-free financing and earning 3% Daily Cash is to use the Apple Store app instead. Sure enough, with this route, there was a clear option to pay with my Apple Card while opting into the Monthly Installments program. Right away, it was clear what my monthly payments would be. Then, after a few other standard steps, I was just required to pay the taxes on my phone (which I also put on my Apple Card), while the base amount was properly financed.

By the way, if you don’t already have an Apple Card, you can apply via Wallet or you can apparently apply when checking out (as long as you’re buying while on your iPhone).

Earning Daily Cash

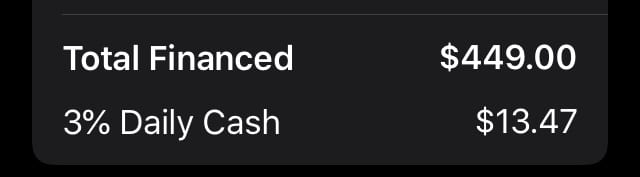

As I alluded to, one great perk of using your Apple Card to finance a new iPhone is that you’ll earn 3% Daily Cash on your purchase. What’s more, this will be issued in a lump sum upfront — meaning you won’t need to wait two years to take advantage of the cash back. That said, this bonus is unlikely to hit your account right away. In my experience, it wasn’t until my phone officially shipped that the Daily Cash was issued.

Considering that Daily Cash is typically a bit delayed anyway, this isn’t too big of a change but it is worth noting just in case you were already mentally spending that kickback cash.

Your credit limit

Something important to note is that, while your financed amount won’t display as part of your current Card Balance in Wallet, it will be reflected in your available credit amount. For example, with a total $8,500 Credit Limit, $449 Installment Balance, and $135.90 in New Spending, my Available Credit is currently $7,915.10. Moreover, tapping the Card Balance button in Wallet reveals that my Total Balance is $584.90. While I have yet to confirm as much, I’d suspect that this is the figure that will be reported to credit bureaus and, thus, could impact your credit utilization. That’s something to be aware of as carrying a high utilization (more than 30% of your limit) on your Apple Card could negatively impact your credit scores.

Speaking of credit limits, you may be asking yourself, “What if my Apple Card limit isn’t enough to cover the price of the phone I want?” Well, Apple actually has a section of their Support page dedicated to this question… but the answer is unlikely to thrill you. Instead of offering to extend your credit or reevaluate you, they advise that you can select a device that costs less (seriously, that’s pretty much what it says). Alternatively, they suggest trying out Apple’s Trade-In program to help bring down the cost of your phone and hopefully help it to fit your limit. That said, once again, it’s worth considering how maxing out your card could affect your credit scores.

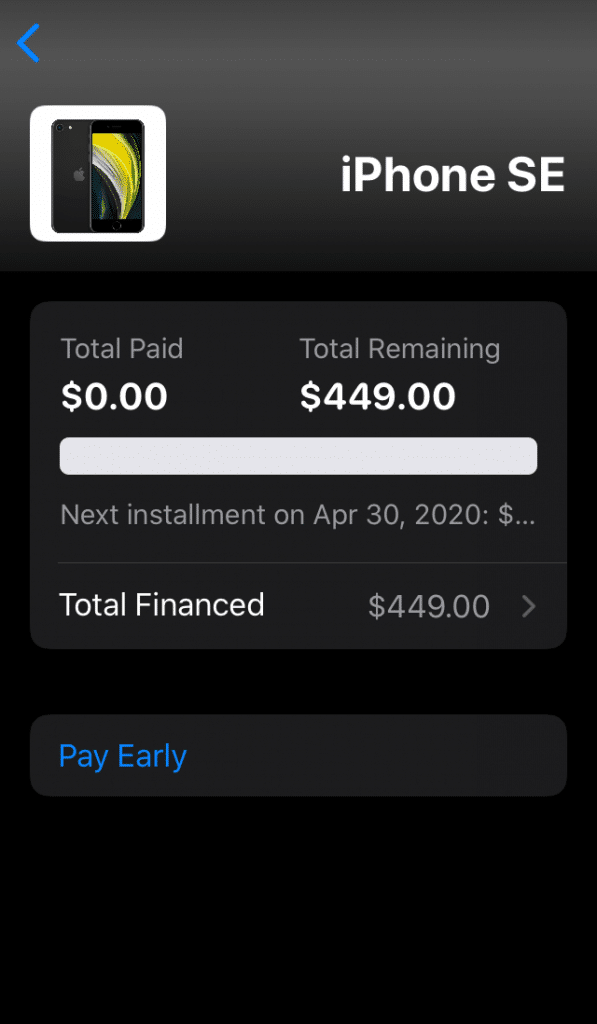

Managing your payment plan

Like I just mentioned above, your installment plan won’t automatically display when you view your Apple Card dashboard in Wallet. However, if you tap the three dots in the upper right corner, you should see a section for Monthly Installment with a number next to it (‘1’ in my case since I only have one active financing). Then, tapping that entry will launch a new mini-dashboard showing the phone you purchased, the total amount financed, your remaining balance, and more. You can also use this dashboard to make additional payments or pay off your installment loan early.

On the topic of payments, what’s nice about the Apple Card Monthly Installments plan is that the amount you owe will be lumped into your standard Apple Card payment. That way, you don’t have to worry about making a separate payment or possibly even forgetting to do so. Per the Apple Card’s standard billing cycle, these payments will be due on the last day of the month.

Despite the slightly frustrating and confusing start to my iPhone-buying adventure, overall, I’ve been impressed with the Apple Card Monthly Installments program. Beyond the 3% Daily Cash perk that helped make my decision to apply for the Apple Card in the first place, the interest-free aspect of this offer makes upgrading much easier. At the same time, I’d still advise those considering a new phone to pay attention to how much they’re actually spending and refrain from buying a new device just because they can technically afford it — this goes double for those who might be near maxing-out their Apple Cards with a new phone purchase. But, if it is time for a new iPhone and you see other benefits in the Apple Card, the Apple Card Monthly Installments program may make a lot of sense.