FinTech News

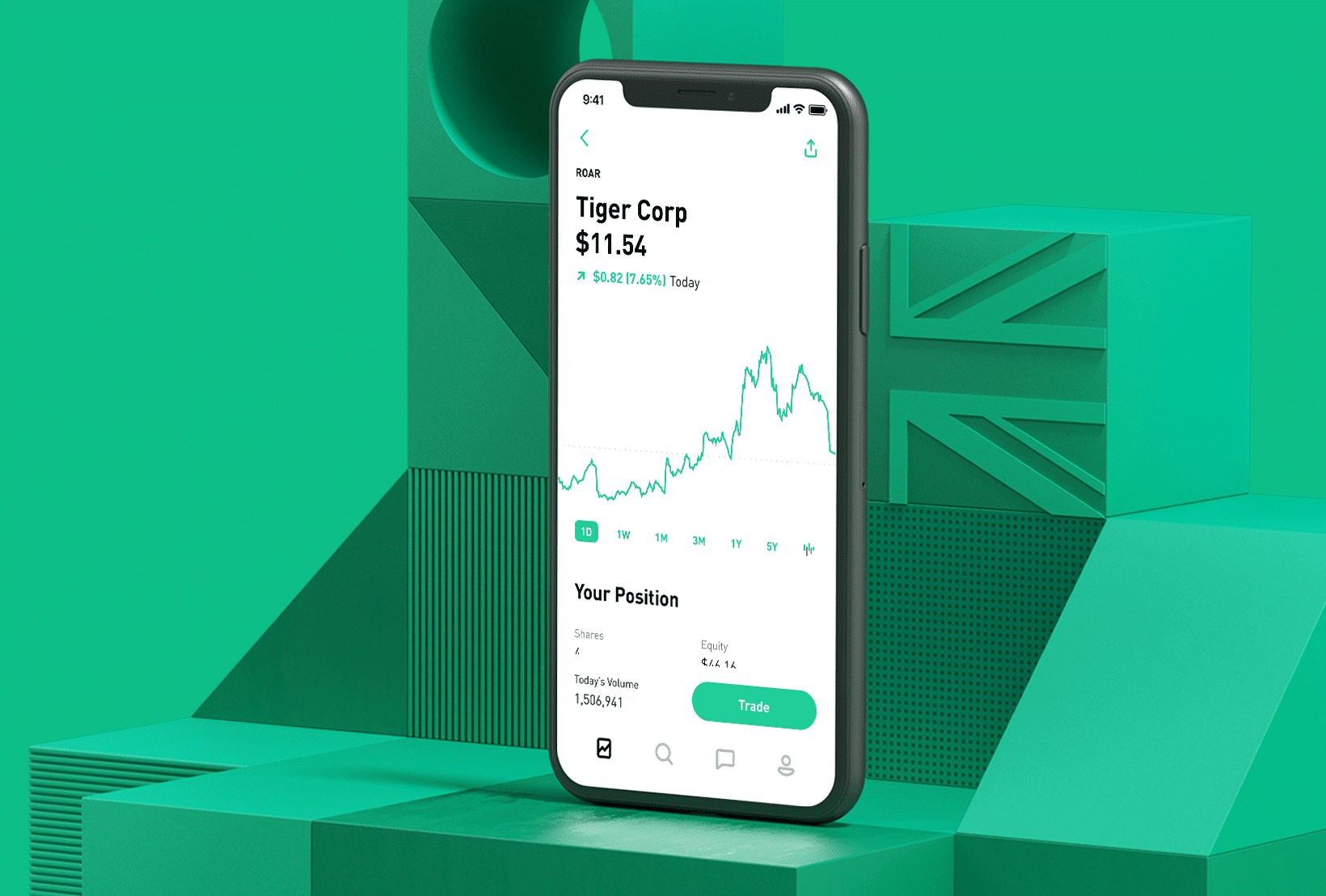

Is Robinhood Playing a Role in the Bull Market Rally?

When the situation surrounding the COVID-19 pandemic worsened early this year, it became clear that the longest bull market in history would soon be coming to an end. While that did indeed happen, it was then followed by one of the shortest bear markets in history as stocks managed to rally — right up until volatility was reintroduced last week. Now, some observers are wondering if the runaway market could have any connection to the influx of investors using the FinTech app Robinhood.

As TechRadar reports, Robinhood’s popularity has only continued to rise amid the pandemic. In fact, while the app started the year with 10 million active users, that number has since swelled to 13 million. Notably this growth comes even as competition for Robinhood increases, thanks to discount brokerages such as Charles Schwab not only cutting trade commissions but also going after young investors via features, such as fractional shares. It’s also worth recalling that a surge in sign-ups was at least partially responsible for downtime that affected Robinhood’s platform on back-to-back days in March.

It’s commonly believed that the surge Robinhood is seeing comes from Millennials and Gen Zers who have viewed the pandemic-related market crash as their chance to jump on board. To that point, some of the most popular stocks on the app lately include well-battered industries such as airlines, cruise lines, and others. More specifically, TechRadar reports that Hertz — which recently filed for bankruptcy — was among the top stocks being purchased by Robinhood traders. Commenting on this phenomenon, Intrepid Capital portfolio manager Mark Travis told Reuters that he’s avoiding such stock, adding, “With no sports right now, people have turned to day trading as their new sport. There’s a lot of speculation in the market now.”

However, while some have suggested that retail investors including those on Robinhood have helped fuel the market, Barclays recently arrived at a slightly different conclusion. Their findings (as reported by Business Insider) found no clear connection between Robinhood traders and the S&P 500’s performance. Moreover, it seems that the opposite could be true, with analyst Ryan Preclaw writing, “The more Robinhood customers add the stock to their portfolios (measure either by simple count, or percentage change), the worse the return of that stock at the same time.” He went on to clarify, “While we would not view these results as truly causal—we are not using instruments to control for confounding—we do see this as compelling correlational evidence that Robinhood investors are not systematically pushing up stock prices.”

Even if the market may not be directly influenced by Robinhood or other FinTech brokerages, this episode could possibly serve as a preview for what’s ahead as more retail investors enter the market. For better or worse, first-time traders are pouring in at a time when Wall Street is already experiencing dramatic times. With the pandemic’s effects promising to linger for years to come, it will certainly be interesting to see what role investors on Robinhood and other platforms end up playing in any possible recovery.