Economic News

July Report: U.S. Economy Regains Jobs Lost During Pandemic

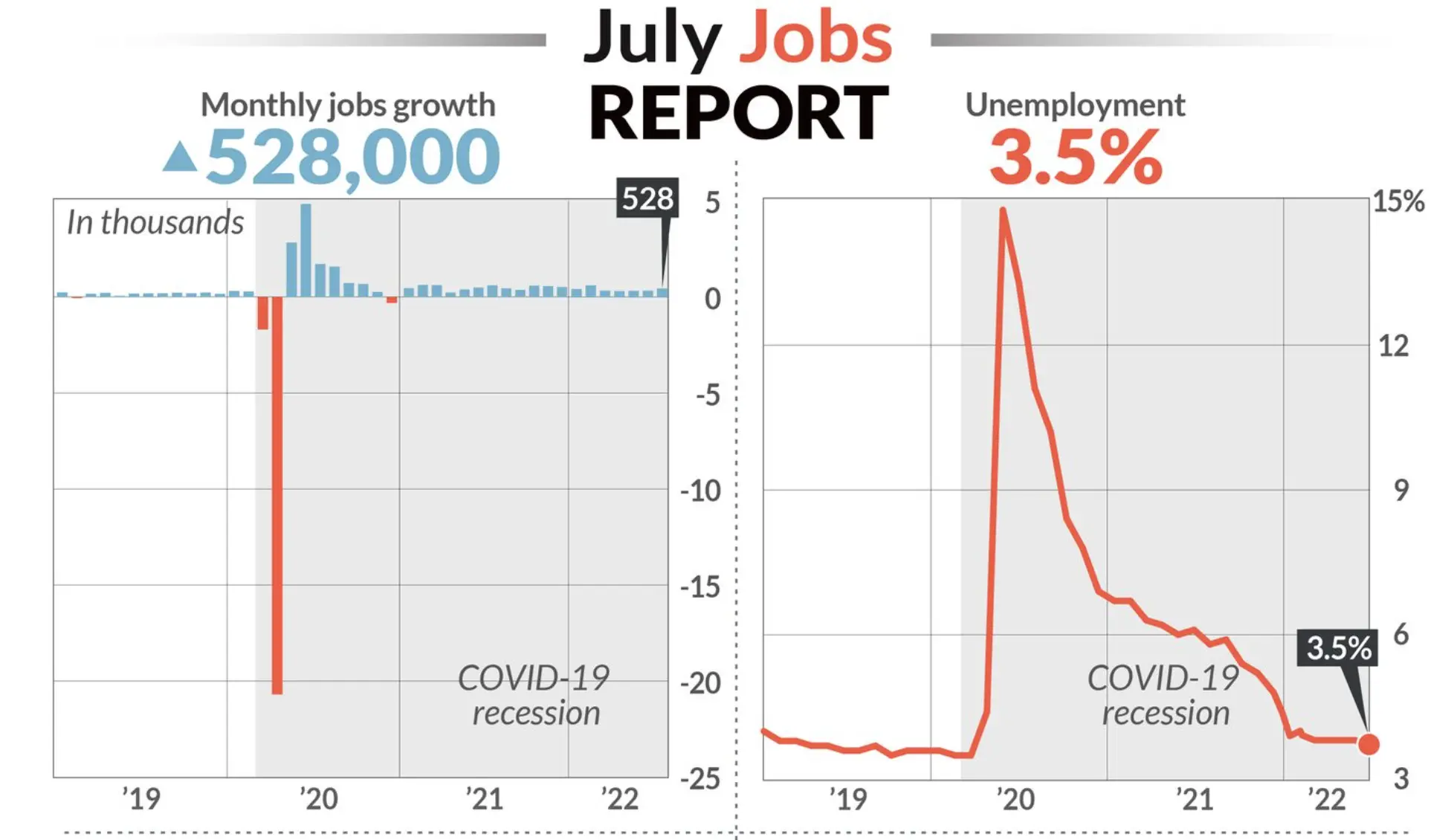

In March of 2020, following a month that saw unemployment fall to 3.5%, the United States economy shed 459,000 jobs. This was followed up by a massive 20.5 million job loss in April, bringing unemployment to 14.7%. Now, 27 months later, the U.S. has returned to that February 2020 high.

According to the latest Bureau of Labor Statistics report, the economy added 528,000 jobs in July. This was more than double the 258,000 jobs economists surveyed by the Wall Street Journal expected (as reported by Marketwatch). Additionally, unemployment ticked down to 3.5%, tying a 50-year low that was also hit in February 2020, just before the COVID-19 pandemic shut down much of the U.S. However, the 62.1% labor force participation rate for July 2022 is still below the pre-pandemic rate of 63.4%.

Notably, the impressive jobs report arrives on the heels of news that the U.S. economy contracted for the second straight quarter. In Q2, gross domestic product (GDP) fell by 0.9% following a 1.6% decline in Q1. Traditionally, this would indicate that the United States was in a recession. However, some economists have argued that this isn’t the case this time, citing strong employment figures.

As expected, hourly pay rates also continued to rise. In July, the average hourly wage increased 0.5% to hit $32.27. Although the 5.2% increase in average wage over the past 12 months is the fastest rate of growth in nearly 40 years, that figure still puts wage growth below the rate of inflation, which reached 9.1% in June.

Offering commentary on the jobs report and the unique economic circumstances, Navy Federal Credit Union corporate economist Robert Frick stated, “A stunningly strong jobs report shows that small cracks in the labor market haven’t slowed the engine of the expansion.” However, Frisk mentions the Federal Reserve, noting,”[T]his will likely cause it to push rates higher, faster.”

Elsewhere, Glassdoor senior economist Daniel Zhao summarized the situation, saying, “The labor market remains a pillar of strength, holding up the economy even as the economy slows around it.”

The counterintuitive nature of the current U.S. economy was already baffling observers prior to this latest jobs report — and the actual results only make matters more interesting. Despite GDP suggesting a recession is in progress, the labor market continues to excel. Meanwhile, inflation complicates the situation even further and will likely result in more Fed intervention. All of this aside, the fact that the United States has now reclaimed the positions it lost at the start of the pandemic is significant. As for the rest, we’ll have to wait and see where this “topsy turvy” economy heads next.