Money Management Product Reviews

Truist Long Game Review (2023): Is the Savings App Still Worth It?

In the minds of many, saving money is no fun. Because of this, in recent years, many personal finance experts and bloggers have advocated for trying various money challenges that aim to turn good money habits into mini-games. But, one mobile app that’s taken a quite literal approach to the finance gamification trend is back yet again.

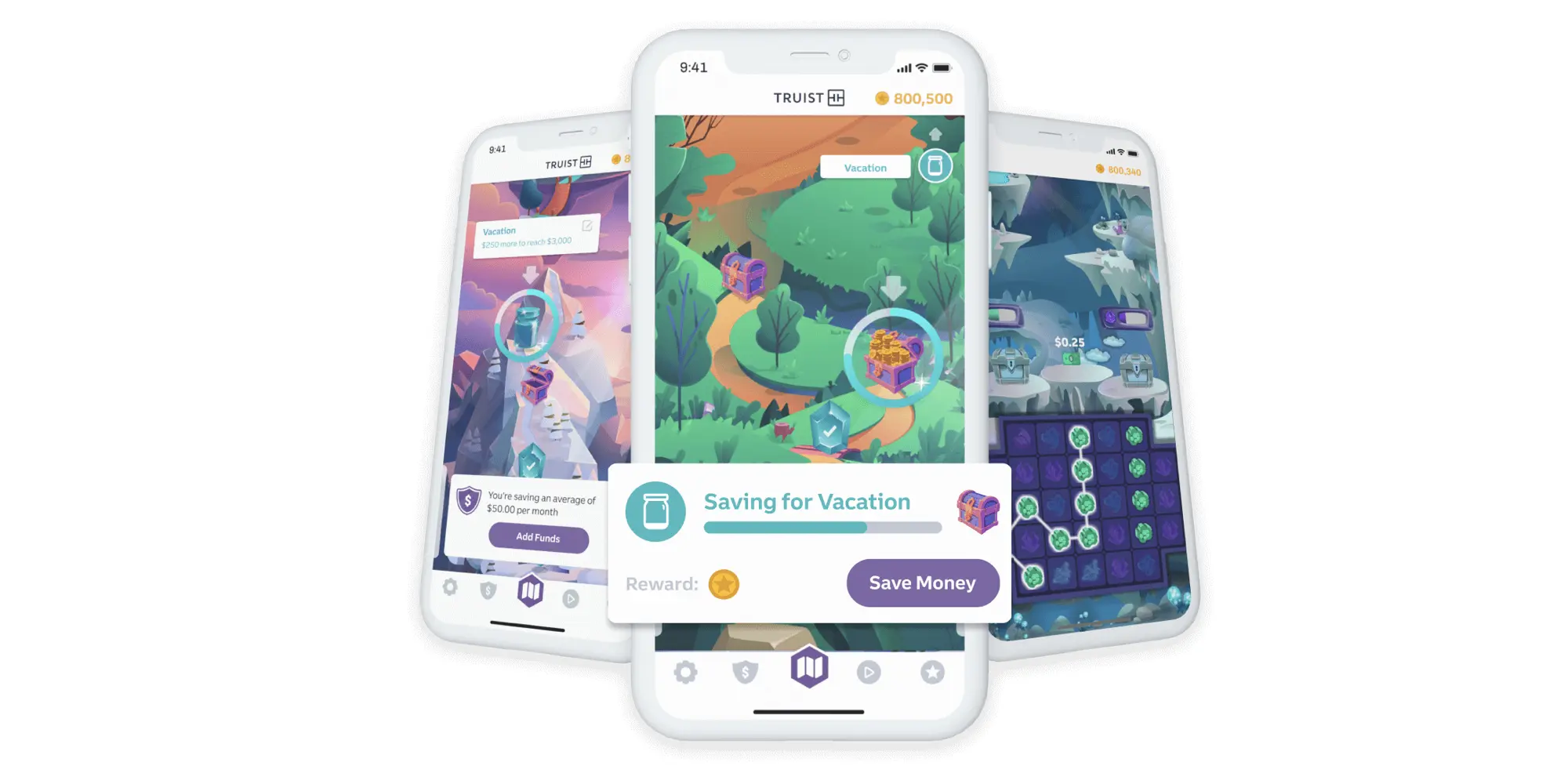

Truist Long Game (formerly Long Game or Long Game Rewards) is a personal finance app that rewards users for setting aside money in a savings account by allowing them to unlock games of chance that could potentially add to their stash. In 2022, the platform was acquired by Truist Bank and was relaunched in 2023. So, is the current version worth it under Truist’s control? Let’s take a look at the current version of the app as well as its long — no pun intended — history:

Truist Long Game: What You Need to Know About the Current App

What is Truist Long Game?

If Long Game sounds familiar, it’s likely because the app has been around for a few years. However, it underwent some changes in 2020, including introducing different tiers of service. Later, the app shut down and reemerged as Long Game Rewards with two new banking partners: NBKC and Varo Bank. That version was closed in 2022 upon Truist’s acquisition of Long Game. Cut to 2023 and Truist Long Game is now available.

After downloading Truist Long Game and logging in with your Truist account, you’ll be able to enjoy a number fun games as well as financial trivia for a chance to win actual cash rewards.

Getting started with Truist Long Game — and the Costs of Truist Account

In order to take advantage of the latest version of Long Game, you’ll need to be a Truist customer. Specifically, you’ll need to have an eligible Truist Bank savings or checking account. Sadly, this is where the trouble with the updated app comes into play.

Looking at Truist’s line-up of accounts, all of the checking and savings options have monthly fees. These fees can be waived if specific criteria — such as making direct deposits, completing a number of debit card transactions a month, or maintaining a certain balance — are met. However, if you should fall short of these required actions, your account will cost you between $5 and $12 a month depending on the option you choose. Furthermore, while online savings accounts are currently (as of April 2023) nearing 4% APY, it looks as though Truist’s interest-bearing savings accounts still only pay 0.01% APY.

Unfortunately, as much as I love Long Game and want to check out the current version, Truist’s banking products are non-starters for me. Therefore, I won’t be able to explore the latest updates for myself. However, looking at screenshots for the app, it appears to be largely the same — so I’ll be referring to my previous experience with the app for the rest of this review.

The gaming aspect of Long Game

Now for the fun part — literally. As I mentioned, the way Long Game aims to take the sting out of saving is to reward users for their good savings habits. This is mostly accomplished via their coin system.

Simply put, the more money you set aside, the greater the number of coins you can earn. From there, these coins can be used to play mini-games that call to mind many gambling favorites. Take, for example, the Flip It games that resemble lottery scratchers and the Spin It games that might just make you feel like you’re on Wheel of Fortune. While some of these games pay out in additional coins, others offer real-life, legal tender cash that will be added to your balance if you win.

One of my favorite game additions that arrived with the revamped app is Lucky Bounce. In this game, you’ll drop a ball that bounces off various pegs before eventually falling into one of several chests — each containing a prize (although some chests rudely have 0 coins). You can kind of think of this one as a take on Plinko, but with a twist.

Two other types of new games are Connect 3 and Puzzles & Prizes. With Connect 3, you’ll spend a certain number of coins each time you draw a line to connect similar adjacent icons. When you do, you’ll get closer to opening one of the chests above. Once you’ve unlocked a chest, you’ll earn the prize inside. Meanwhile, Puzzles & Prizes offers a similar concept, except that you’ll be swapping pieces to make matches of three or more instead of drawing lines to connect icons. Ultimately, you’d be forgiven if you confused these two types of games, but both are fairly fun regardless.

Game options

In addition to choosing what types of games you want to play, you can select games based on their maximum prize. Aside from the weekly lottery drawing (which has a $1 million grand prize), the biggest fiat cash prize in the app currently is $10,000. Of course, if you want to win big money, you’ll need to pay more coins.

Currently, the lowest-priced game starts at 1,000 coins — although the reward here isn’t actually cash but 1 million coins instead. Meanwhile, if you did want to go for that $10,000 cash, it’d cost you 1 million coins per play. Elsewhere, be aware that the coin prizes listed for Connect 3 and Prizes & Puzzles are per move, which is why they may seem lower when compared to other options.

Cash prizes

When you win cash prizes on Long Game, they’ll automatically be deposited into your Truist bank account. Previously, since this required a transfer, it could take a few days for these wins to show up in your account and be accessible. However, I would expect this aspect to be streamlined under Truist’s ownership.

Crypto prizes

Funny enough, what first introduced me to Long Game was a post about how they were rolling out a feature that would earn cryptocurrencies as prizes. Announcing the addition of tokens like Ethereum to the app, Long Game CEO and Founder Lindsay Holden said, “Crypto Rewards will serve to educate our customers and introduce them to crypto markets while protecting them from the risk that comes with investing.” That protection from risk comes as you aren’t actually able to purchase cryptocurrencies on the app — you can only win them. This could involve getting gifted with crypto for leveling up or playing the Crypto Spin game.

From what I’ve seen, it would appear that crypto prizes are no longer a part of Truist Long Game. Honestly, this makes a lot of sense seeing as the app is now owned by a bank. Plus, given the recent issues with crypto, it is probably better to just let this aspect of the app disappear.

Earning More Coins

Daily Games

Even if you run out of coins with Long Game, the good news is that you’ll have a chance to earn more every day. With Daily Games, you’ll have a chance to win coins just by visiting the app daily. Since this is game based, it’s hard to say exactly how much you’ll win — but it’s always fun regardless.

Using and Saving with Long Game

How much does Truist Long Game cost?

The latest version of Long Game is free to use. However, as mentioned, Truist accounts may include fees.

Does Long Game actually help you save money?

I think so — but of course this will depend on your personality. In my case, I can say that I was always excited about the prospect of setting money aside in my Long Game account and earning coins as a result. Similarly, my younger brother (who happened to find the app independently of me) attested that he had managed to save up hundreds of dollars thanks to the gamification the app offered. Meanwhile, even if you don’t care about the games themselves all that much, the opportunity to win more money might be appealing. With all of that considered, I think that Long Game could help you save and is at least worth a try.

Do you actually win money on Long Game?

Honestly, it’s pretty impossible to declare whether or not you’ll win money on Long Game — but I can tell you that I have. Well, not lottery-level piles of cash, but a few cents here and there. Still, between the old version of the app and the new one, my winnings have amounted to some free cups of coffee.

Do Long Game accounts earn interest?

The short answer here is “it depends.” If you have a Truist savings account, you may earn interest on your funds. For the record, the original version of Long Game included a small level of interest on top of any winning (and even that topped what Truist’s main accounts offer).

What if I need to pull money out?

What’s great about the new version of Long Game is that you no longer need to transfer money to the app itself. Instead, it should all be part of your Truist account.

Looking Back at the History of Long Game

My Experience with the Previous Long Game

Earning Prizes

So far, I feel like my winnings with the new Long Game are on-par with or even better than what I was receiving previously. In fact, while writing this, I won $.50 and $1 back to back, which may rank as two of my largest single-swoop scores. Plus, as I noted early, I really like some of the new mini-games that have joined the app and the varied mechanics (both in play and in wager) that come with them.

The new model

The more time I spend using the new Long Game, the more I realize that this current model works a lot better for the app. By allowing you to simply link your existing bank account instead of having to transfer money to the app itself, a lot of issues I had with the previous version become moot. Most notably, my concern that slow transfer times might put someone in a bind if they needed to access their funds quickly has been erased as the only money moving is the money you win.

On that note, one somewhat humorous quirk I found involves winnings. Since your prizes may only amount to a few cents at a time, I’ve received a few emails from Varo telling me that my test deposits were ready. That’s because one method of linking or verifying an account is for a company to make tiny, temporary deposits and then have you confirm how much each of these transactions is for. So, when Varo sees a transaction for a penny followed by a nickel, it must think that’s what’s happening. Obviously this isn’t a big deal but I found it funny.

Simplified

If there was one word I’d use to sum up the difference between the old Long Game and the new, it’d have to be “simplified.” Not only is the app easier to use since you don’t need to transfer money in but the whole “brains” component is gone and there aren’t three tiers of service to worry about. These are all upgrades in my book — although I do kind of miss Savings Jars. Other than that, I’m really happy with the simplified nature of Long Game 2.0.

Crypto

With all of that noted, the only real disappointment I’ve found with the latest version of Long Game involves crypto. Previously, I could take my sliver of crypto and transfer it out to an external wallet right away. Unfortunately, you now need to earn $5 worth before you can do that. I’m not sure why this is in place — especially considering that fiat winnings are transferred right away — but it’s a tad annoying to me. Given that I’m typically only winning 10 to 20 cents at a time in crypto, it could be a while before I have enough to transfer out. Perhaps that’s why the cost of playing the crypto games is a bit lower on a dollar for dollar level, but this is something I wish I knew about before bothering to play them at all.

Questions About the Former Version of Long Game

What is the Long Game Debit Card?

The Long Game Debit card was the result of a partnership between Long Game and NBKC. Baring a colorful design inspired by the app’s map and aesthetic, it not only gave users the chance to win coins when they made purchases but also enabled such features as “round-ups.” However, when Long Game shut down in 2020, the debit card closed with it. Currently, it doesn’t seem as though there are any plans to revive the Long Game debit card as the product no longer fits with the new model of the app.

What are Savings Jars?

Savings Jars were a former feature of Long Game that helped customers earmark their savings for specific goals. For example, you could create a Savings Jar for an upcoming trip as well as one for an emergency fund and set up automated savings plans for each (while earning coins on the total balance). Since Long Game now links to your existing bank account, the Savings Jars feature as it once was has been discontinued.

What are the Teal Tier, Gold Tier, and Diamond Tier in Long Game?

In May of 2020, Long Game introduced a tiered service model with three options: Teal Tier, Gold Tier, and Diamond Tier. By making a certain amount of AutoDeposits, direct deposits, and/or debit card purchases, users could obtain Gold or Diamond status and use the app for free. Meanwhile, users who failed to meet this requirement would be charged $3 a month for Teal Tier.

Now, the 2021 version of Long Game has done away with these tiers and requirements. Instead, the app is free to use for customers of NBKC and Varo Bank.

Final Thoughts on Truist Long Game

As a long-time fan of Long Game, I was very excited to see that it was not only making a return — having escaped death previously. That’s why I was so disappointed to see how uncompetitive Truist’s eligible banking accounts are. In fact, I found the fees and low interest rates to be such dealbreakers that I decided that it wasn’t even worth trying the new app as I simply couldn’t recommend it to most people.

With that said, if you are already a Truist customer, I have faith that the new version of Long Game will still provide a rewarding experience. Assuming the latest iteration is anything like the past versions, I’m sure it’s filled with fun games — not to mention the thrill of winning prizes. Plus, looking at the App Store page, it appears as though Truist has added financial quizzes to the app, which I think is a smart and logical expansion.

Ultimately, as long as Truist’s account options remain as limited as they are, I don’t foresee myself trying Truist Long Game. However, if they ever introduce a no-fee (with no direct deposit or debit card purchase requirements) account, I’ll be happy to open one up and return to Long Game. Until then, however, I’ll have to keep considering Long Game as dead.