FinTech News

Lottery-Inspired Savings Platform Yotta Raises $13.2 Million

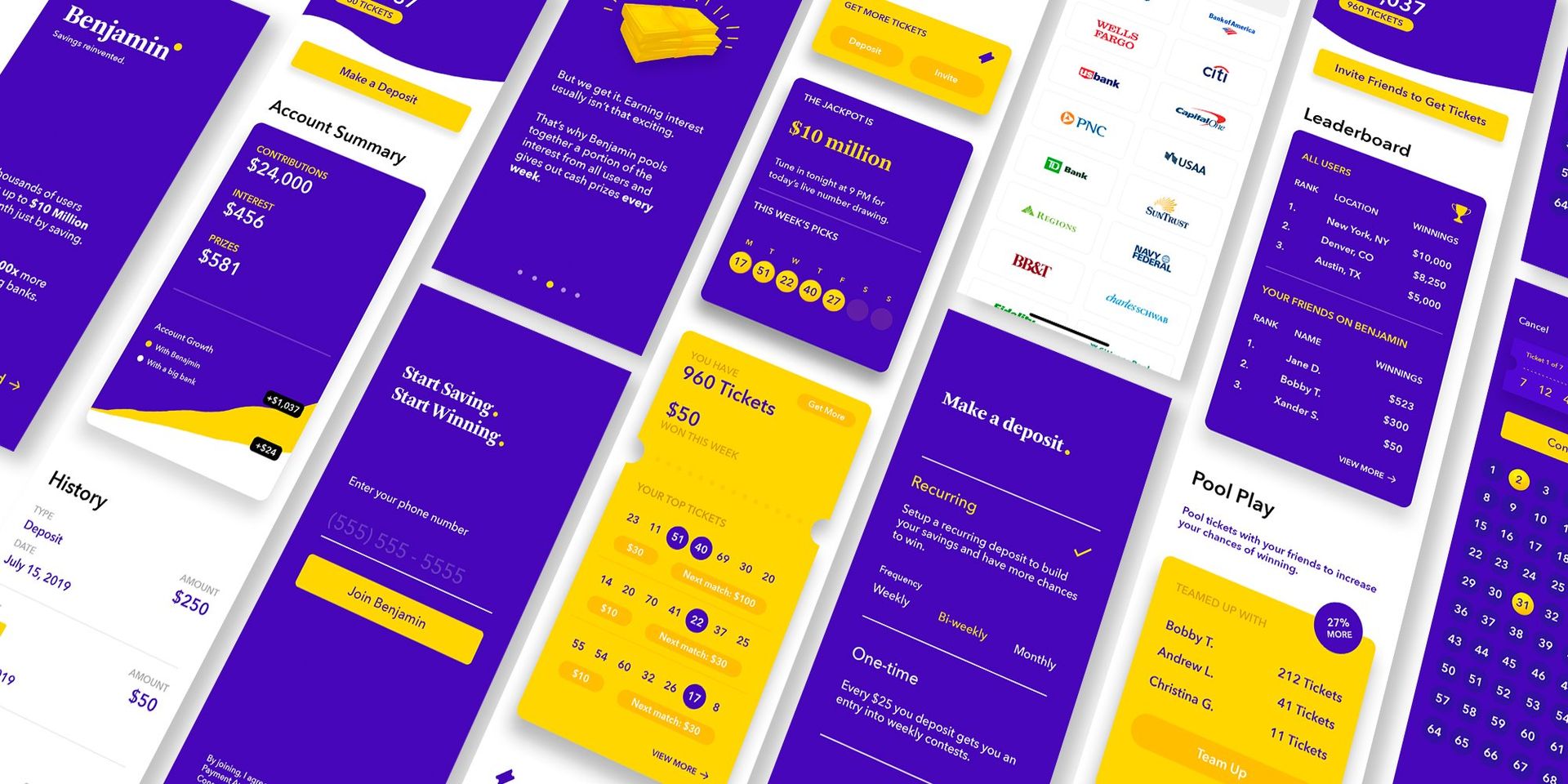

It’s a well known fact that many Americans have trouble building up their savings. With that in mind, several FinTechs have put their spin on digital banking in a bid to encourage good financial habits. Among the firms fitting this description is Yotta, which offers a savings account with a lottery element, allowing account holders to earn weekly prize tickets as they increase their balance. This concept seems to be catching on as Yotta has just revealed another round of funding.

Last week, Yotta announced that it raised $13.2 million in its latest round. The Series A was led by Base10 Partners with participation from Core Innovation Capital as well as returning investors YCombinator and Slow Ventures. This latest round comes just months after Yotta closed a $3.3 million seed round, with the company raising a total of $17.7 million to date.

Since officially debuting last summer, Yotta says it’s grown to 130,000 accounts and $200 million in deposits. Moreover, the platform recently reached a prize milestone, giving away more than $1 million to customers in total. The app has also continued to introduce new features, most recently rolling out a “Pool Play” option where account holders can join their tickets with friends and split their weekly winnings. Additionally, Yotta currently has a waitlist open for its upcoming debit card that will give customers the opportunity to earn extra tickets when they use the card to make purchases.

Speaking to why Yotta has found early success, the company’s co-founder and CEO Adam Moelis said, “Savings accounts have worked the same, boring way for decades. We are excited to make saving money and managing personal finances fun, so that it’s easier for Americans to build up their financial safety net.” As for what led Base10 to invest in the FinTech, the firm’s managing partner TJ Nahigian explained, “Yotta’s recent exponential growth is what attracted us to the company, and we are equally excited by the potential for societal good their platform stands to bring to people across the U.S.” Nahigian continued, “Adam and Ben are out to change habits for the better and we’re proud to be partnering with them.”

Yotta’s Series A is among several recent funding rounds from digital banking firms. Last month, U.K.-based Curve announced a $95 million Series C as it set its sights on a U.S. launch and small business banking app Oxygen closed a $17 million series A. Meanwhile, family-centric financial platform GoHenry raised $40 million late last year.

Incidentally, Dyer News contribution Kyle Burbank recently named Yotta one of his top five apps to watch in 2021. With this impressive fundraising round, it seems that his prediction of Yotta’s big year is already coming to fruition. That said, with the platform only operating in a world of low banking APYs so far, it will be interesting to see if a potential increase in interest rates down the road impact its customer base. Outside of that minor risk, it appears that Yotta is well on its way to becoming a FinTech banking hit that could also help Americans grow their savings.