FinTech News

MoneyGram Adds Support for Buying, Selling, and Holding Crypto

Before the days of digital peer-to-peer money transfer, consumers relied on such services as MoneyGram to send money to loved ones. As technology as shifted, however, MoneyGram itself has had to evolve beyond its core product. Now, the company is once again expanding its reach by getting into the world of crypto.

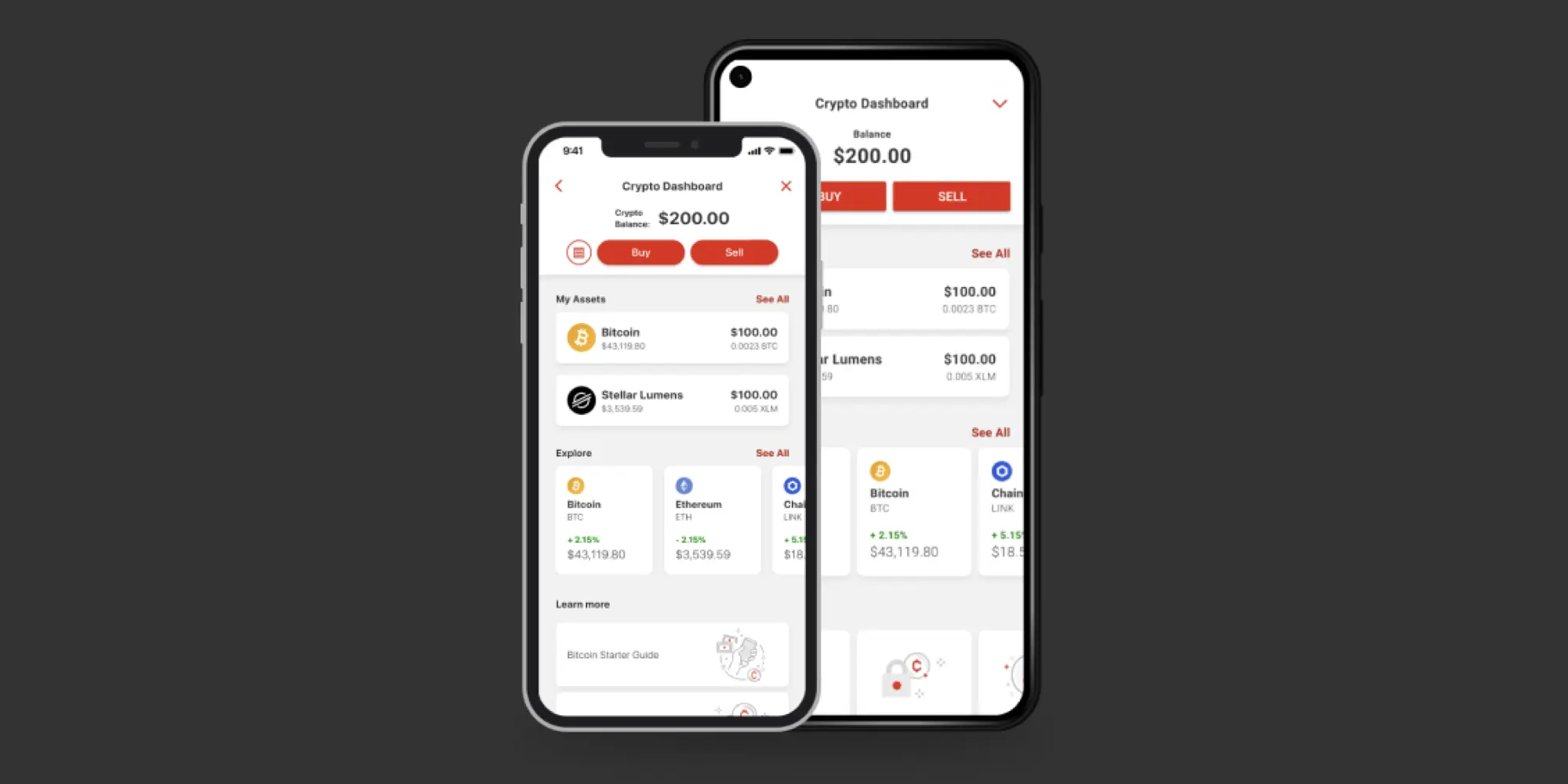

Recently, MoneyGram joined the ranks of P2P apps such as PayPal, Venmo, and Cash App by adding the ability to buy, sell, and hold cryptocurrency. This capability comes via a partnership with Coinme. Currently, the app supports trading Bitcoin, Ethereum, and Litecoin. However, the company states that it plans to add more coins in 2023 and will also explore expanding the platform into other markets. The feature is available to users in all states (as well as the District of Columbia) except Hawaii, Idaho, and New York.

Announcing the new feature, MoneyGram Chairman and CEO Alex Holmes stated, “Cryptocurrencies are additive to everything we’re doing at MoneyGram. From dollars to euros to yen and so on, MoneyGram enables instant access to over 120 currencies around the globe, and we see crypto and digital currencies as another input and output option. As a next step in the evolution of MoneyGram, we’re thrilled to provide our customers with access to a trusted and easy-to-use platform to securely buy, sell and hold select cryptocurrencies.”

Holmes added, “As consumer interest in digital currencies continues to accelerate, we are uniquely positioned to meet that demand and bridge the gap between blockchain and traditional financial services thanks to our global network, leading compliance solutions, and strong culture of FinTech innovation. We are excited for this next chapter in our journey.”

Moneygram’s support for cryptocurrencies comes during what’s been referred to as a “crypto winter,” which has impacted a number of FinTechs. Nevertheless, the company isn’t the only service to recently add crypto trading. For example, the neobank Current rolled out its cryptocurrency platform last month in partnership with Zero Hash. At this time, Current’s lineup of supported assets is much larger than MoneyGram’s, with 27 options including Bitcoin, Ethereum, Dogecoin, Shiba Inu, Polygon, and Solana currently offered.

Despite the much-publicized “crypto winter,” it’s clear that there’s still great interest in cryptocurrencies. Moreover, as more platforms add the ability for consumers to trade these assets, new sets of people are likely finding the process to be much simpler than they may have imagined — especially given how far the industry has come in just a few short years. As for MoneyGram, the expansion seems like a logical one as the company looks to add modern technology to its legacy product.