Category: Small Business News

Small Business News

Amex Increases Grants for 4th Historic Small Restaurant Program

by Kyle Burbank

American Express has launched its latest Backing Historic Small Restaurants Program — and has significantly increased the grant money up for grabs. About this year's Backing Historic Small Restaurants Program: For the fourth annual Backing Historic Small Restaurants Program, American Express and the National Trust for Historic Preservation have announced that it will not only double the number of grant recipients but also increase the total funding. This year, 50 historic...

Small Business News

Barclays Unveils Fourth Annual "Small Business Big Wins" Contest

by Kyle Burbank

Barclays has announced that its "Small Business Big Wins" contest will be returning for its fourth year. About the contest: Entries for the fourth annual Small Business Big Wins program are now open. Once again this year, the content will offer up a total of $255,000. This includes one $60,000 Grand Prize winner as well as a $40,000 Second Place Prize winner and a $20,000 Third Place Prize winner. Seven...

Small Business News

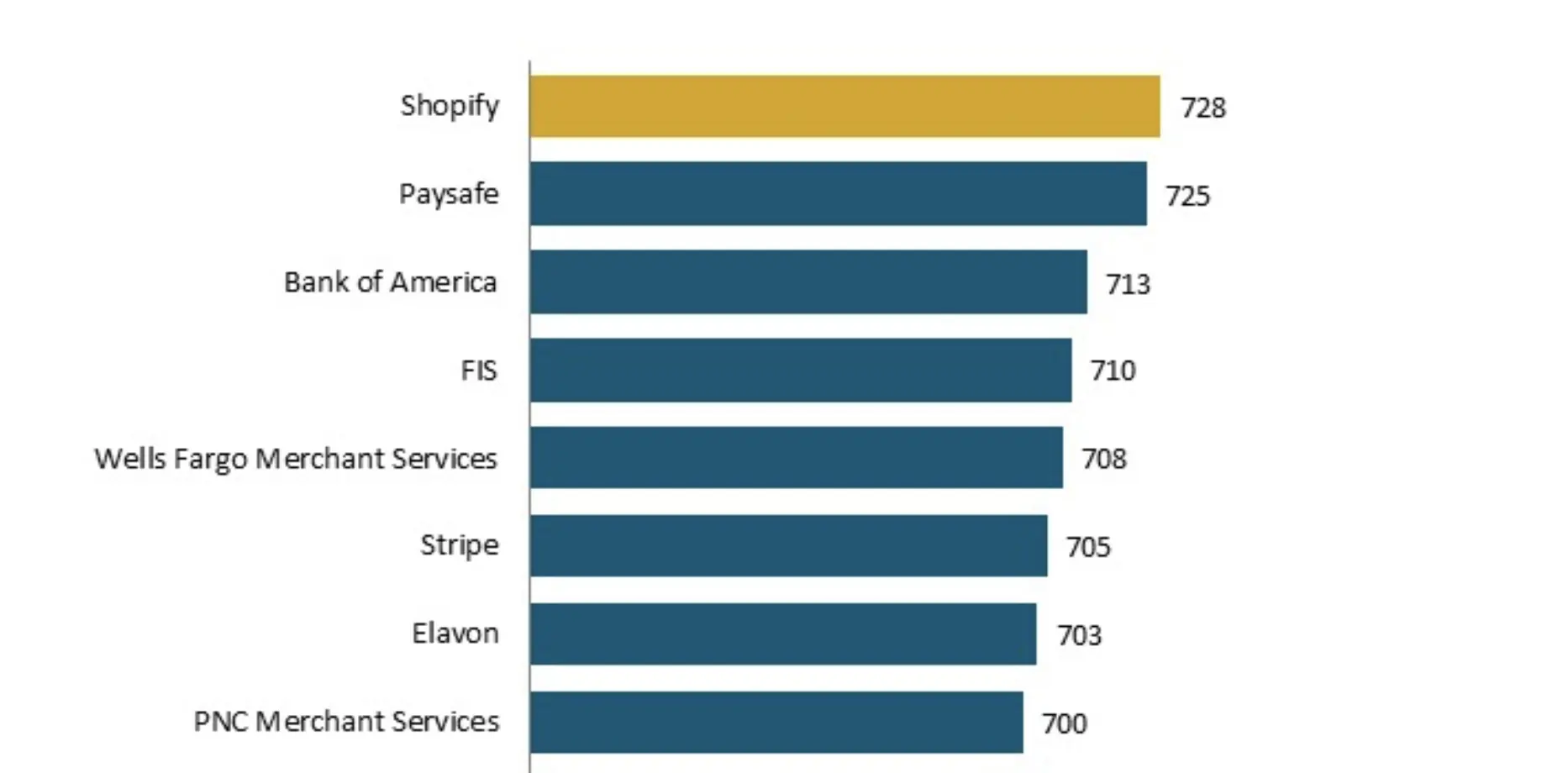

Survey: 94% of Small Business Merchants Accept Card Payments

by Kyle Burbank

A new survey highlights how the vast majority of small businesses are now accepting modern forms of payments — although satisfaction with some popular payment platforms is waning. About the survey results: J.D. Power has released its 2024 U.S. Merchant Services Satisfaction Study, which compiled responses from 5,383 small businesses. Conducted between September and November of last year, the survey inquired about provider satisfaction is several areas, including the cost...

Small Business News

SoFi Launches Marketplace for Small Business Loans

by Kyle Burbank

SoFi is bringing a small business loan hub to its core user experience. About the marketplace: SoFi has announced an expansion of its small business marketplace. Now, small businesses can connect to the bank's network of providers and view funding options within the SoFi ecosystem. The loan marketplace can be found at SoFi.com/Small-Business-Loans. Among the loan types/users currently supported by SoFi's marketplace are expansion loans, equipment loans, working capital, payroll...

Small Business News

Survey: 23% Considering Starting a Small Business in 2024

by Kyle Burbank

Intuit has released its Entrepreneurship in 2024 Report, which features some interesting tidbits. About the findings: Intuit's report was derived from surveying more than 4,500 adults in the United States. Headlining the report is the fact that nearly one-quarter (23%) of respondents stated that they considered starting a business in the new year. Members of Gen Z were the most likely to be mulling the idea, with 28% responding affirmatively....

Small Business News

2023 Small Business Credit Card Satisfaction Tops 2019 Highs

by Kyle Burbank

The latest small business credit card study from J.D. Power shows satisfaction continuing to rise. About the study and results: This week, J.D Power released its 2023 U.S. Small Business Credit Card Satisfaction Study, which includes responses from more than 3,400 small business credit card customers. In this case, the study looked at businesses with annual revenues between $10,000 and $10 million. First, it was discovered that overall satisfaction among...

Small Business News

2023 Small Business Saturday Sees $17 Billion in Spending

by Kyle Burbank

American Express has released results from the 14th annual Small Business Saturday event. About this year's sales: According to initial projections via the Amex 2023 Small Business Saturday Consumer Insights Survey, consumers in the United States spent a total of $17 billion at small businesses on Small Business Saturday. That figure puts it below last year's $17.9 billion total and well off the record $23.3 billion seen in 2021. In...