FinTech News

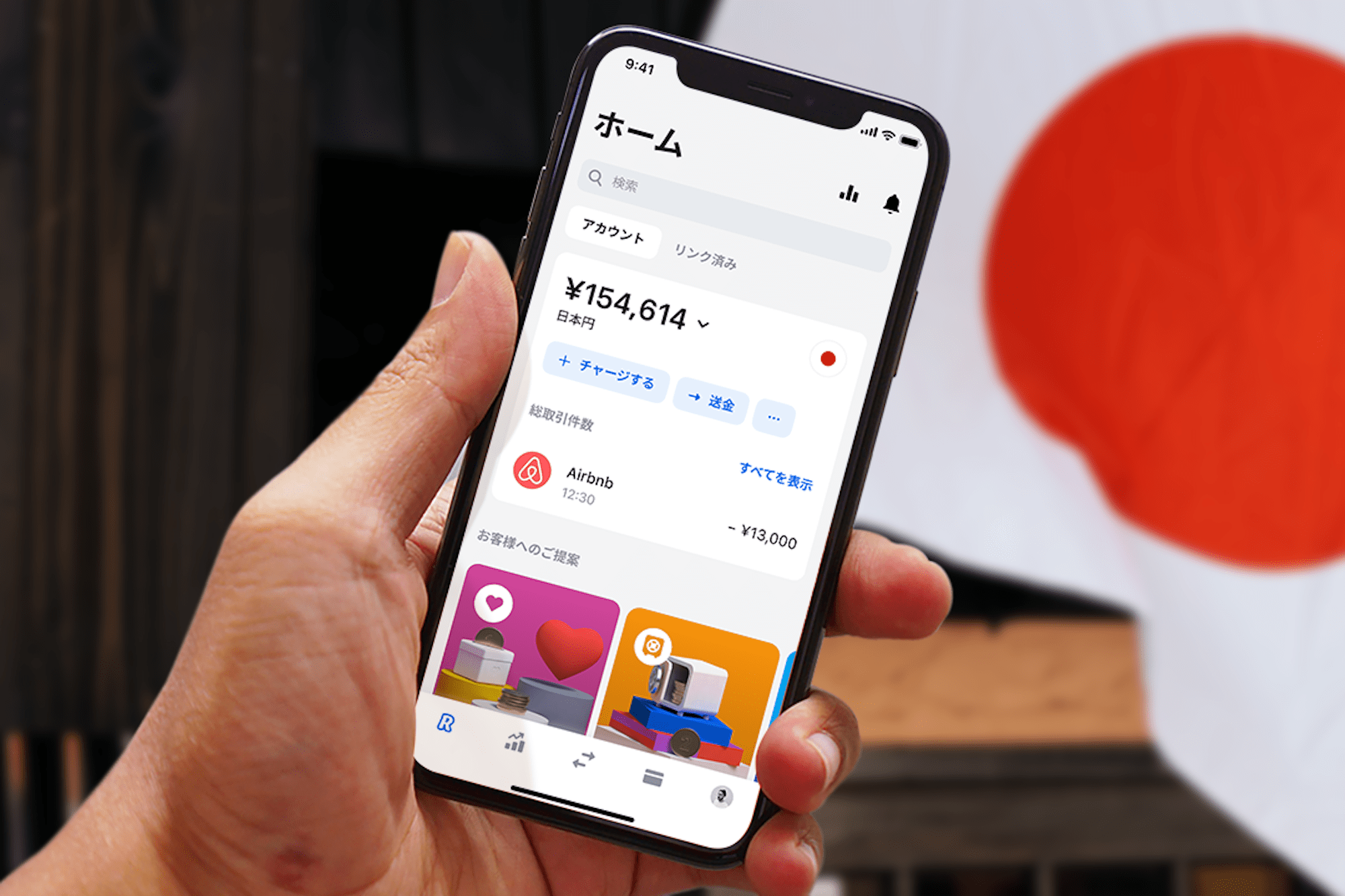

Neobank Revolut Officially Expands to Japan

Over the past few years, neobanks have become some of the largest players in the FinTech space. While many of these startups are based in the United States, Europe has also seen an explosion of challenger banks — with some making their way to America as well. Now one Britain-based banking service is continuing its global expansion by heading to the Land of the Rising Sun.

As TechCrunch reports, Revolut is now available to those in Japan. Previously, the company had been testing the service with 10,000 users in the country. Notably, Revolut first gained authorization to operate in Japan back in 2018.

Currently, the number of features offered to Japanese users is scaled back from what Revolut maintains in Europe and the United States. For example, TechCrunch notes that there is currently no support for cryptocurrency trading, travel insurance, or their Revolut Junior kid’s debit card product. However, many of the core functions are still intact, including the ability to exchange, send, and store fiat currencies. Additionally, premium plans for Japanese users include enhanced debit card designs, the ability to purchase lounge access passe via LoungeKey, and more.

Although all of the features it’s become known for have yet to debut in Japan, Revolut says they are in the works. According to the company, it intends to make crypto and stock trading capabilities available to all of its 13 million global customers in the future, although no firm dates have been announced. For context, cryptocurrencies trading has only recently arrived on the U.S. version of the app, while stock trading has yet to make its way stateside. That said, Revolut has also been testing other features for American users, including offering interest on funds users keep in their Vaults savings product.

Revolut’s Japanese launch comes on the heels of the neobank raising a bundle in funding. Back in July, they announced an increase to their Series D to a total of $580 million in a round led by TCV. To date, the company has now raised $900 million and is valued at $5.5 billion.

With Revolut’s product boasting features for international travelers and investors, it only makes sense that the company would continue to reach its way around the world. That strategy seems to be paying off as their user base is on the rise. At the same time, it is interesting to see how Revolut launches with a basic product and then builds it out over time to match its international counterparts. While that may seem questionable considering the premium plans the company pushes, it seems to have served them well so far. The questions now become, where will Revolut set their eyes on next?