Economic News

Now-Ended Partial Government Shutdown to Complicate Jobs Report

On Friday, the Labor Department will release its monthly jobs report for the first month of the year. While the figures it will contain are expected to be solid, the partial government shutdown that was in place for much of January will lead to a very interesting report overall. For example CNN notes that the 800,000 federal workers affected by the shutdown — either being furloughed or forced to work without pay — will be considered employed for the purpose of the payroll figures. However the 380,000 furloughed workers will impact the unemployment rate, which will also be announced on Friday. Moreover, thanks largely to the shutdown, initial jobless claims recently reached a 16-month high.

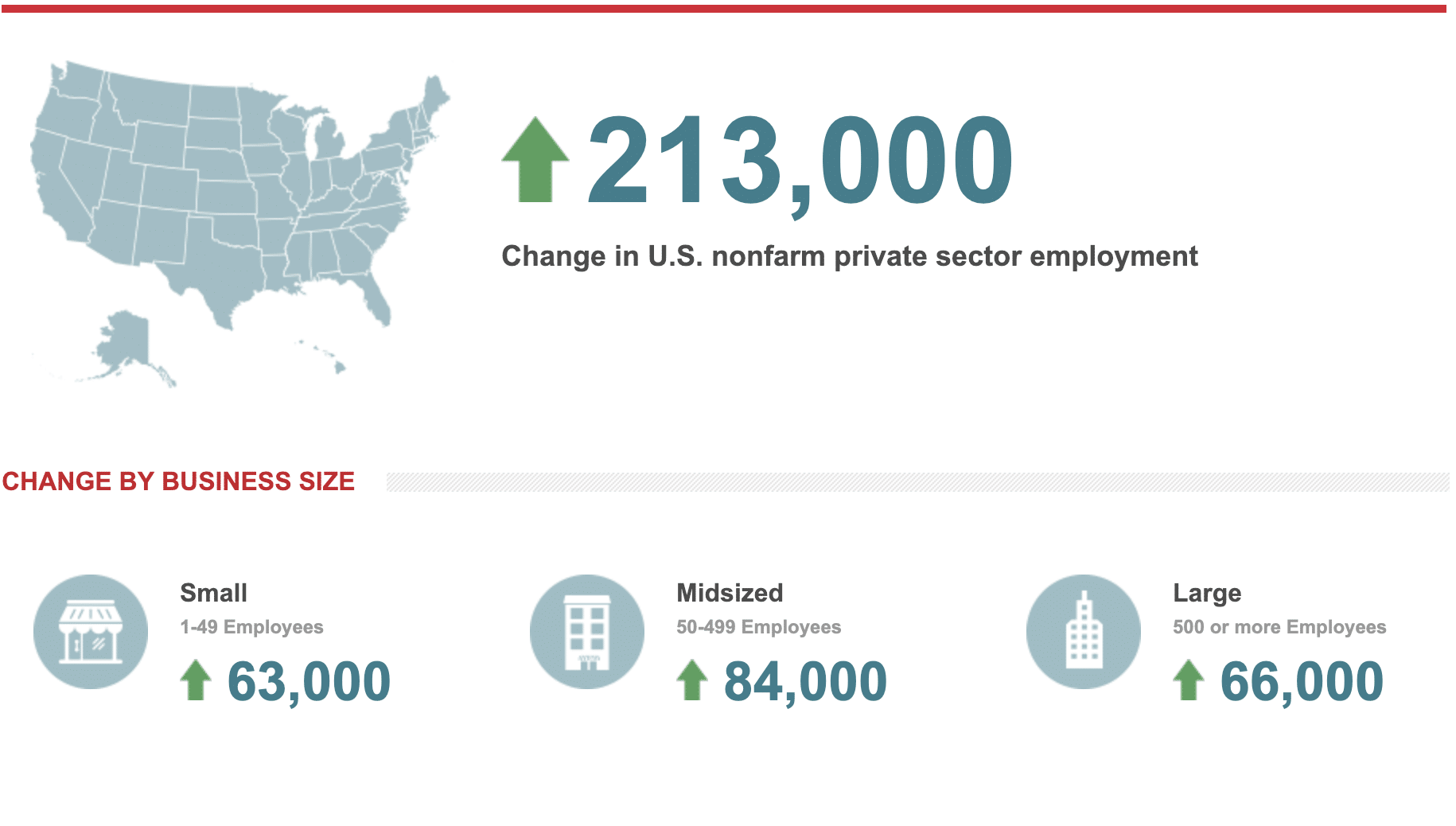

Before we get into how the federal shutdown will affect this month’s jobs report, we can look to ADP‘s just-released payroll figures to get a preview of what to expect from the private sector. According to ADP the U.S. added 213,000 jobs from December to January. Of these jobs, 84,000 came from midsize companies with 50 to 499 employees. Meanwhile 66,000 were from larger corporations, with the remaining 63,000 coming from small businesses with fewer than 50 employees.

Looking ahead to the Labor Department’s report, a poll of economists expects that it will show 165,000 jobs added for the month. If so, that’d be below the 220,000 a month average the U.S. has been seeing. Despite the furloughed federal workers being included, the same respondents also predicted that unemployment will remain at 3.9%. Additionally economists expect to see 3.2% in wage growth, which would mark the fourth month in a row where growth exceeded 3%. This latest increase may be at least partially due to 20 states increasing their minimum wages at the start of the year.

Unfortunately, as mentioned earlier, initial jobless claims climbed to their highest point since September of 2017. Jumping from a 49-year-low of 200,000 the week prior, initial claims jumped to a seasonally adjusted 253,000. That also well exceeds the 215,000 average claims had been seen in recent weeks. The good news is that, with the shutdown over (for now), these figures should retreat once again.

Obviously, when a month includes the longest partial federal government shutdown in history, there’s bound to be a discrepancy between public and private sector job reports. On top of that, with a clear scapegoat to blame if figures are disappointing, the latest report may not signal much in terms of what’s ahead. Still all of these factors will certainly make for an interesting snapshot — that may or may not tell the entire tale.