Financial Advice for a Changing World

Small Business News

Small Business NewsT-Mobile Introduces "Amazon Business Prime Essentials On Us"

by Kyle Burbank

T-Mobile has unveiled a new benefit for its small business customers. About the new benefit, plan, and more Starting April 25th, select T-Mobile small business customers will be able to claim a free year of Amazon Business Prime Essentials. Valued at $179 a year, this membership includes free shipping on eligible orders. Additionally, businesses will have access to more than 60 million items that are exclusive to those with Business…  Personal Finance News

Personal Finance NewsAura Survey Highlights Online Security Habits of Americans

by Kyle Burbank

A new survey shares some insights into how Americans manage their online passwords — and what types of personal information/data they most worry about leaking. About the survey: Online security platform Aura has released the results of a new study. The survey itself was conducted by The Harris Poll, with participation from 2,099 adults in the United States. Starting with password practices, 95% of those surveyed said they have a…  FinTech News

FinTech NewsNonprofit Fundraising Platform Givebutter Raises $50 Million

by Kyle Burbank

A platform built for nonprofit fundraising has raised some funds of its own. About the round: This week, Givebutter has announced that it's raised $50 million in strategy growth investment funds. The round was led by BVP Forge with participation from Ardent Venture Partners. To date, Givebutter has now raised $57 million including a seed round in 2022. These newly raised funds will be used to accelerate the development of Givebutter's… Product Reviews

Money Management Product Reviews

2024 Pay with GasBuddy Review: Yes, You Can Legitimately Save Money Every Time You Fill

by Kyle Burbank

Put simply, the value proposition of Pay with GasBuddy is that you can use a special card that's accepted at most gas stations in order to save a few cents off of every gallon of gas you buy. That sounds good — almost too good, if you think like me.

Money Management Product Reviews

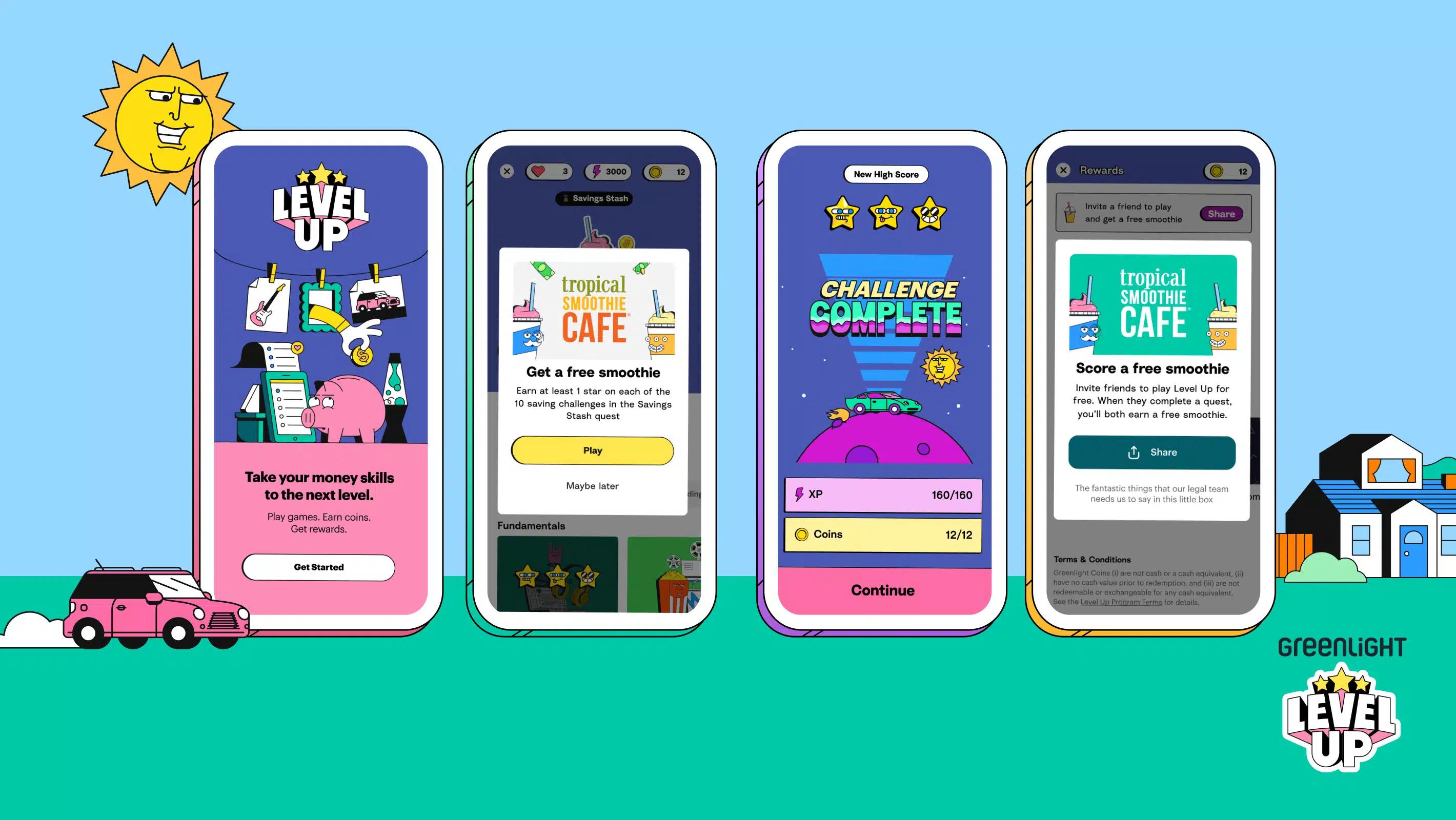

Greenlight Level Up Review: A Free Financial Literacy Game

by Kyle Burbank

Despite personal finance being an important topic for those of all ages, few schools make it a part of their curriculum. In this absesnse, several companies and institutions have offered their own ways for children, teens, and adults to gain financial literacy. Among those looking to lend some assistance is Greenlight, which now offers a free financial learning game called Level Up. Even better, the company recently announced a partnership…

Money Management Product Reviews

Pepper Rewards Review: Earn Rebates on Gift Cards from Top Brands

by Kyle Burbank

Recently, out of nowhere, an app called Pepper seemed to be all the rage in the credit card reward and deal-finding corner of the Internet. Unlike some other apps I've seen mentioned that just seem too convoluted to be worth it, the premise of Pepper is super simple: buy gift cards and earn rewards. While there are some other sites where you can buy discounted gift cards or other apps…

Money Management Product Reviews

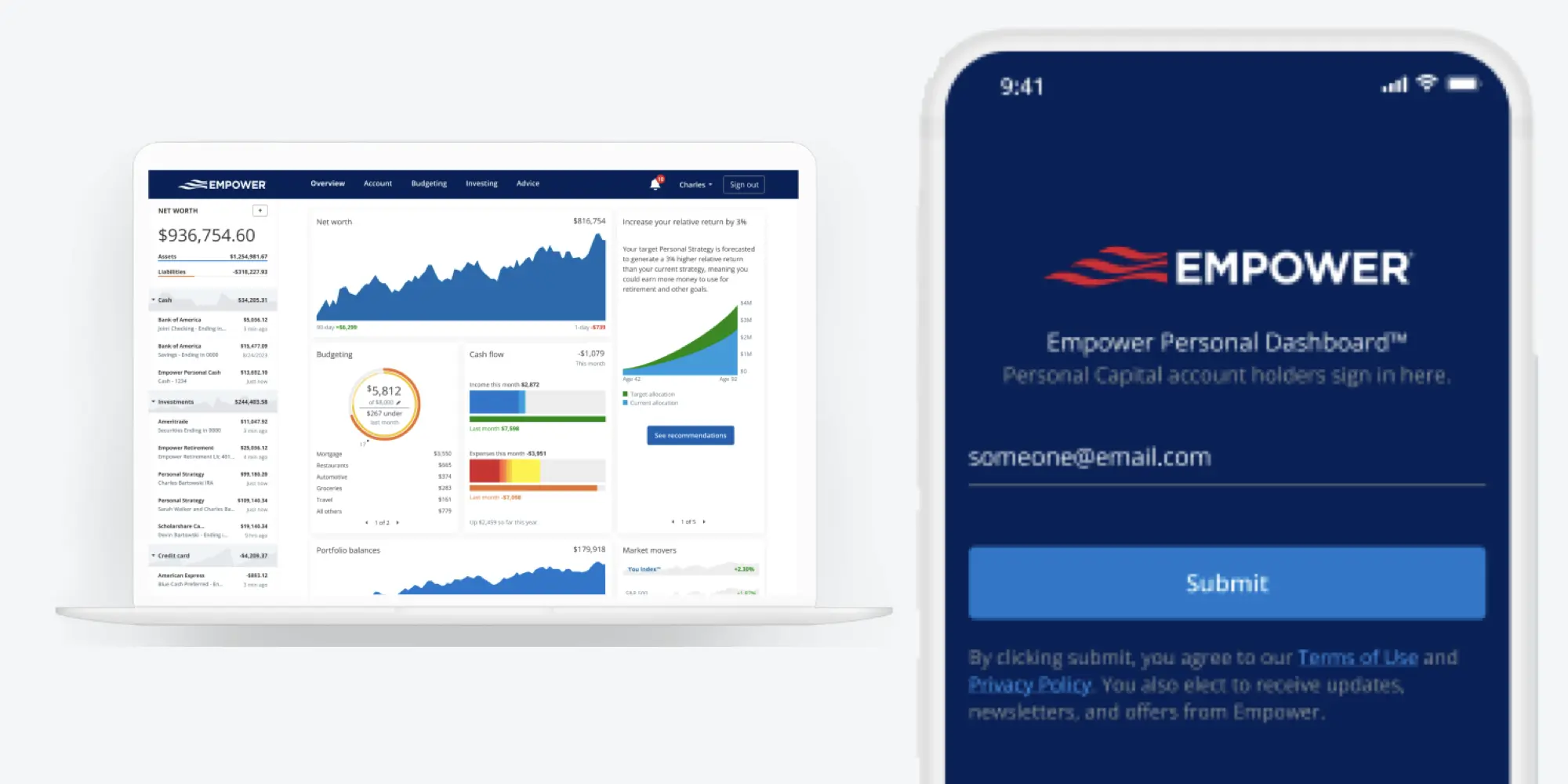

Empower Personal Dashboard Review

by Kyle Burbank

A few years ago, my wife and I opened a new chapter in our financial journey as we resolved to make 2019 the year we learned more about investing. Whether I was reading books on the subject or exploring other blogs for advice, there was one recommendation I came across again and again: Personal Capital — which is now part of Empower and is known as the Empower Personal Dashboard….

Money Management Product Reviews

Mana App Review: The Neobanking App for Gamers

by Kyle Burbank

One of the most intriguing trends I've seen emerge since I've been following FinTech is the advent of niche neobanks. These days, you can find apps geared towards certain communities, interests, and more. Among the latest examples I've seen of this is an app called Mana, which bills itself as the best debit card for gamers. Now, I may not be a big gamer, but I do know a thing…

Money Management Product Reviews

Ibotta App Review (2024)

by Kyle Burbank

I remember the first time I was introduced to the concept of digital coupons. For some reason, I was looking at the website for my local grocery store when I found a section dedicated to coupons. At the time I was confused about how you redeemed these coupons since they weren't in the typical print-and-clip format but, soon enough, I realized that I just needed to link them to my… Featured Articles

Best of the Web

Top 10 Personal Finance Articles of the Month — March 2024

by Fioney Staff

Welcome to Fioney’s look at the top 10 personal finance articles of the month. On the first Friday of each new month, we look back at some of our favorite posts published in the weeks prior and highlight them here. This includes a mix of sites that have become staples of our lists as well as many first-timers. Up first, we’ll be talking about some money lessons and other thoughts…

Savings Account Reviews

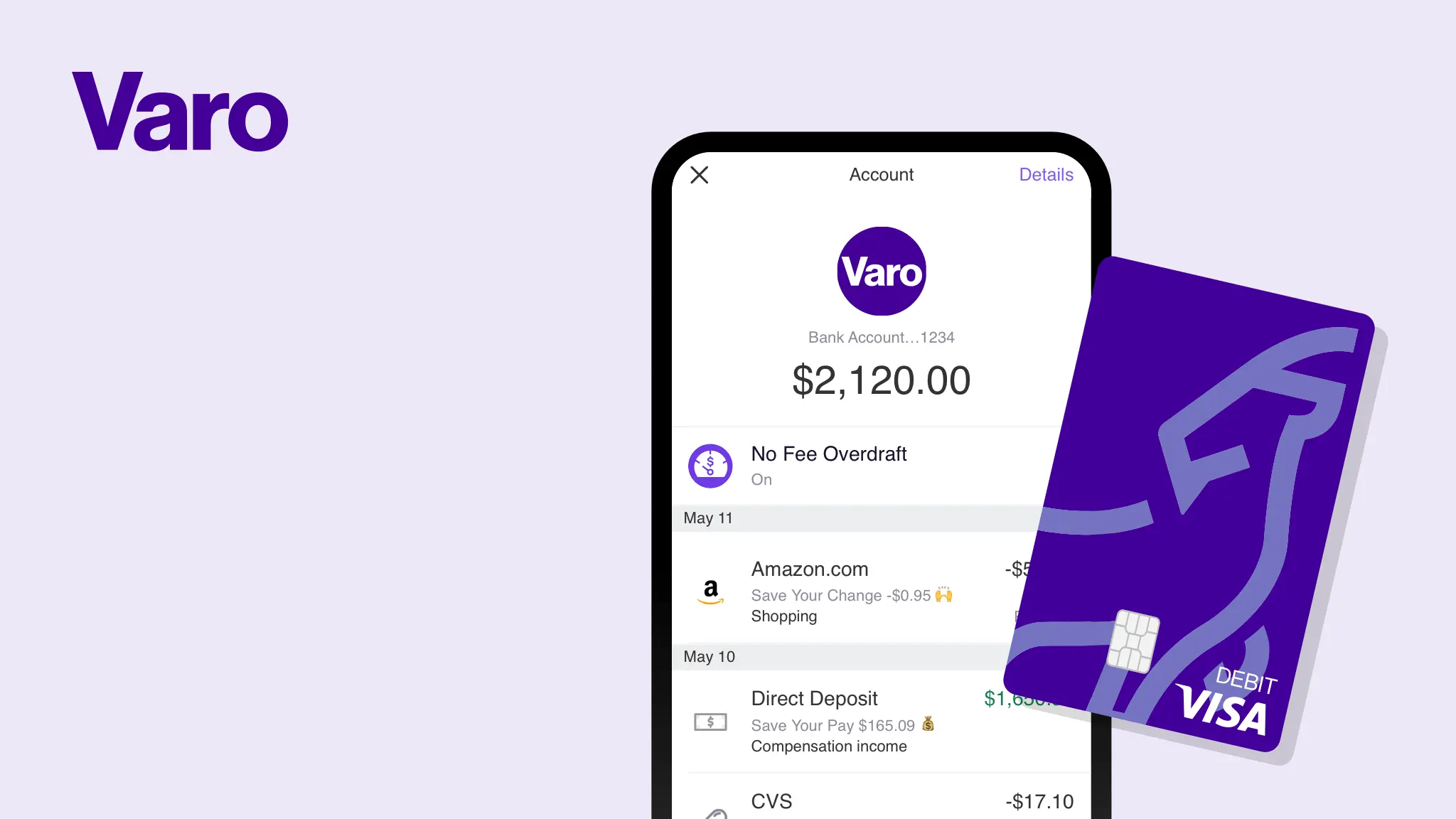

Varo Bank Review: The FinTech With a National Bank Charter

by Kyle Burbank

In 2020, Varo Money made history by becoming the first FinTech firm to be awarded a national bank charter — resulting in the new name Varo Bank. Although I hadn’t previously used Varo Money, they always struck me as an intriguing service that put its customers first. So, is that same spirit still present in Varo Bank? Let’s take a look at what Varo Bank has to offer, including the…

Credit Card Guides

2023 Guide to Travel Credit Cards

by Kyle Burbank

In case you hadn’t heard, travel is back in a big way. With demand for flights, hotels, and more going strong, it may be time to grab a new credit card that will not only reward you on the purchases of these bookings but can also bring some perks to your travel experience. What’s more, several travel-centric credit cards are now offering some of their best welcome bonuses. On that… Popular Posts

Money Management Tips

Money at 30: Top Personal Finance Apps for 2019

by Kyle Burbank

Happy 2019! Okay, so we may already be a few weeks into the new year but I feel like I’m just now getting my bearings. This means I’ve spent the past few days not only contemplating the coming year and working towards some financial goals of my own but also reflecting on the year that was. As part of this, I started thinking about the various personal finance apps I…

Money Management Product Reviews

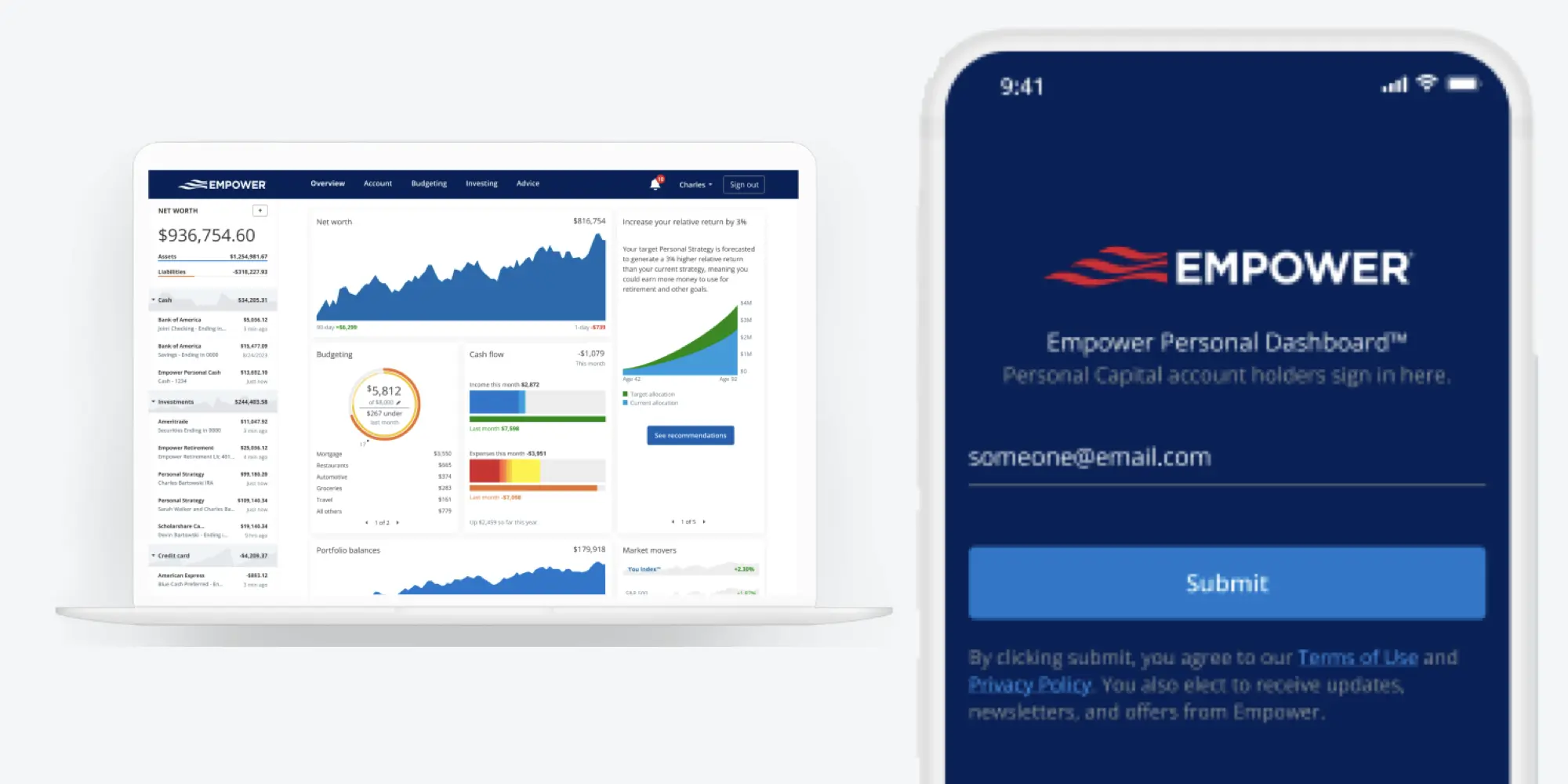

Empower Personal Dashboard Review

by Kyle Burbank

A few years ago, my wife and I opened a new chapter in our financial journey as we resolved to make 2019 the year we learned more about investing. Whether I was reading books on the subject or exploring other blogs for advice, there was one recommendation I came across again and again: Personal Capital — which is now part of Empower and is known as the Empower Personal Dashboard….

Money Management Product Reviews

Yes, You Can Earn Cash Back With Dosh

by Kyle Burbank

The bottom line is that the Dosh app works as well as I could have hoped for earning cash back and I’m excited to try some of the other features (namely the travel bookings) it has to offer. So, if you’re looking to maximize your savings and perhaps even double up on your credit card rewards, I’d recommend checking out Dosh and seeing what cash back you can earn.

Money Management Product Reviews

SoFi Active Investing Review (2023)

by Kyle Burbank

Has there ever been a better time to be a newbie investor? It wasn’t long ago that trading stocks and purchasing ETFs required “a guy” who you could give orders to and they’d make it happen. Oh, but they would charge you a significant commission for the service. Cut to 2023 and things are much different. Not only has stock market trading moved online, allowing investors to make trades for… Latest News

Delta, Amex Launch Another Round of Airline-Metal Credit Cards

by Kyle Burbank

Delta and American Express are bringing back their popular and unique cards made from actual airplane metal. About the cards: Today, a new limited edition credit card design was unveiled for the Delta SkyMiles Reserve and Reserve Business American Express Cards. These special cards are made from metal used on a retired Boeing 747 aircraft that were in Delta’s fleet. Specifically, each card is made using 33% metal from the planes…. T-Mobile Introduces “Amazon Business Prime Essentials On Us”

by Kyle Burbank

T-Mobile has unveiled a new benefit for its small business customers. About the new benefit, plan, and more Starting April 25th, select T-Mobile small business customers will be able to claim a free year of Amazon Business Prime Essentials. Valued at $179 a year, this membership includes free shipping on eligible orders. Additionally, businesses will have access to more than 60 million items that are exclusive to those with Business… Aura Survey Highlights Online Security Habits of Americans

by Kyle Burbank

A new survey shares some insights into how Americans manage their online passwords — and what types of personal information/data they most worry about leaking. About the survey: Online security platform Aura has released the results of a new study. The survey itself was conducted by The Harris Poll, with participation from 2,099 adults in the United States. Starting with password practices, 95% of those surveyed said they have a… Nonprofit Fundraising Platform Givebutter Raises $50 Million

by Kyle Burbank

A platform built for nonprofit fundraising has raised some funds of its own. About the round: This week, Givebutter has announced that it’s raised $50 million in strategy growth investment funds. The round was led by BVP Forge with participation from Ardent Venture Partners. To date, Givebutter has now raised $57 million including a seed round in 2022. These newly raised funds will be used to accelerate the development of Givebutter’s… Bilt Announces Partnership with Blade Helicopter Service

by Kyle Burbank

Bilt is bringing more perks to its most loyal customers thanks to a new partnership. About the partnership: This week, Bilt Rewards revealed a collaboration with Blade. As part of this partnership, not only will Bilt members earn bonus rewards on Blade bookings but elite members will also enjoy special benefits from the helicopter taxi service. Now, Bilt Platinum elite customers will receive one complimentary Blade flight per year. This… Spend Management FinTech Ramp Raises $150 Million

by Kyle Burbank

The FinTech startup Ramp has revealed its latest “mega-round.” About the round: This week, Ramp announced that it had raised $150 million. The Series D-2 was co-led by Khosla Ventures and Founders Fund. Additionally, new investors Sequoia Capital, Greylock, and 8VC joined existing investors Thrive Capital, General Catalyst, Sands Capital, D1 Capital Partners, Lux Capital, Iconiq Capital, Definition Capital, Contrary Capital, and others in participating in the round. To date,… SBA and Score Announce Small Business Week Virtual Summit

by Kyle Burbank

With National Small Business Week quickly approaching, the U.S. Small Business Administration (SBA) and SCORE have announced a virtual summit event. About the event: On April 30th and May 1st, the SBA and SCORE will co-host the 2024 National Small Business Week Virtual Summit. The special event will feature educational webinars with actionable insights, business resources, networking opportunities, a virtual exhibitor hall, and more. Additionally, as part of the programming,… Pepper Rewards Offering Spring Project-Themed Bonus Mission

by Kyle Burbank

Pepper Rewards has announced its latest special offer, allowing users to earn bonuses on select gift card purchases. About the offer: For a limited time, Pepper Rewards users can earn a bonus when buying gift cards from select brands. Specifically, this batch of bonus brands includes several stores perfect for spring projects and cleaning. The list includes: Lowe’s Ace Hardware The Home Depot TJ Maxx Marshalls HomeGoods Bath & Body… Karma Wallet Announces Acquisition of DoneGood Marketplace

by Kyle Burbank

An eco-conscious FinTech is adding a sustainable shopping marketplace to its offerings via an acquisition. About the acquisition: This week, Karma Wallet announced that it had acquired DoneGood. Terms of the deal were not disclosed. However, as a result of the purchase, DoneGood will be integrated into the Karma Wallet ecosystem, simplifying the sustainable shopping process. According to Karma Wallet, the acquisition of DoneGood will further empower consumers to make… Credit Card Delinquency Rates Reach Decade High in Q4 2023

by Kyle Burbank

According to new data from the Federal Reserve Bank of Philidelphia, credit card delinquencies grew to new “series highs” in the last quarter of 2023. About the report: As Bloomberg reports, credit card delinquencies increased in the fourth quarter. In total, nearly 3.5% of consumer card balances were at least 30 days late. Furthermore, the percentage of card accounts that were 30, 60, and 90 days past due all rose during…