Savings Account Reviews

Money at 30: PrizePool Review

Over the past few years, there have been a growing number of apps that have sought to make saving a bit more fun (or at least not as painfully boring). This includes tools like Long Game Rewards as well as prize-linked accounts such as Yotta Savings. On that note, I recently came across another prize-linked banking app that has some notable features of its own: PrizePool.

So, how does PrizePool work and is it worth taking a chance on? Let’s take a look at what this unique banking account has to offer.

What is PrizePool and How Does it Work?

Signing up and banking partnership

In order to sign up for PrizePool, you’ll first need to provide your full name and email address as well as create a password. Then, you’ll be required to provide additional information including your date of birth, address, and Social Security number.

Like many financial apps, PrizePool partners with a full-fledged bank in order to provide FDIC insurance. In this case, deposits are held with Evolve Bank & Trust. As a result, funds are FDIC insured up to $250,000 per depositor.

Linking accounts and transfers

Also akin to several other apps, you can link your existing bank accounts to PrizePool using the tool Plaid. If you’re unfamiliar, Plaid allows you to log into a given account in order to securely link it. Once you do this, you’ll be able to set transfers from your account to PrizePool.

One thing that’s annoying to me is that, at this time, PrizePool only allows you to link one bank account at a time. Furthermore, in order to change the account you have linked, you need to contact them using the “Chat with us” function. I’m sure there’s a good reason for this but, to me, it seems like an unnecessary hassle. I’d much prefer the ability to link multiple accounts and arrange transfers from any of them. Alas, this is currently not possible, but I hope that it’s something that could be added down the road.

Anyway, when it comes to transfers, you can set up one-time deposits or arrange for scheduled transfers. With this latter option, you can elect to have money deposited to PrizePool on a weekly, monthly, or every two weeks basis. It seems as though these options come with baked-in transfer dates (1st of the month for monthly, Mondays for weekly, and the 1st and 15th for every two weeks), so I wish this was a bit more flexible. Still, if you want to get into the habit of regularly moving money to savings, then this could be a good option.

Earning tickets

The entry tickets you’ll earn for PrizePool’s weekly drawings are based on your account balance. For every dollar you hold in your account, you’ll earn one ticket per day. These ticket earnings will then continue to accrue over the course of a “Series” — with each Series lasting four weeks.

So, for example, if you have $200 in your account, you’d earn 200 tickets per day. This would mean that you’d earn 1,400 tickets per week and could have a maximum of 5,600 tickets per Series before your earnings are reset. Plus, since tickets are earned daily, any deposits you make will be reflected in your ticket accrual quite quickly.

If you’re confused about how many tickets you’re earning, you can always tap the info icon next to your ticket balance in the PrizePool app. It should also be noted that there is currently a limit on how many tickets one can accrue per period. The current limit is set at 3 million tickets per Series.

Bonus ticket opportunities

Beyond the tickets you earn for holding a balance with PrizePool, there may be other ways to score entries. One example is what’s called Ticket Tuesday. Each week, you’ll have a chance to claim 5,000 bonus tickets by completing a few steps involving social media. This might mean sharing a post from PrizePool, commenting on the answer to a specific question, etc. In each case, you’ll need to include your referral code so that your bonus tickets can be credited to your account. Plus, four Ticket Tuesday participants will score 25,000 bonus tickets. For more info, check the app on Tuesdays or visit PrizePool’s Instagram.

Referrals

Speaking of referral codes, PrizePool offers incentives to those who get their friends to join the app as well. When you refer someone to the app and they use your code, they’ll win a 10% bonus on their winnings and you’ll earn 10% of their win as well. And this isn’t a one-time bonus — it applies for as long as you’re both still using the app. So, if your referred friend wins $100 one week, they’d actually pocket $110 and you’d win $10 as well.

To find your referral code, just scroll down to the “Invite Friend” section of your dashboard. By the way, if you’re interested in joining PrizePool, feel free to use my referral link or referral code: KBV6X.

Drawings Prizes

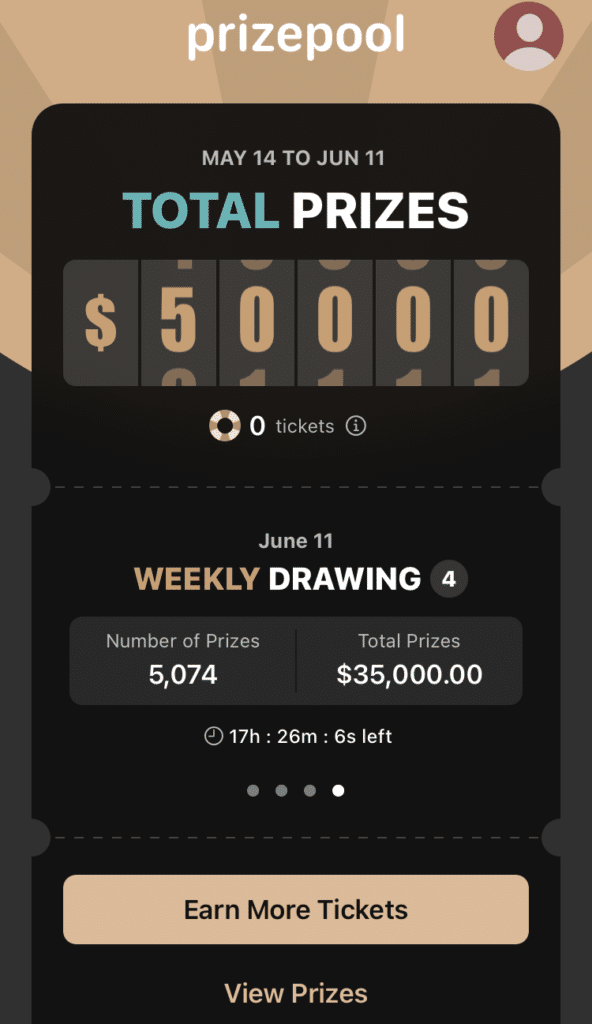

PrizePool drawings take place every Friday afternoon at 2 p.m. ET. At that time, account holders can open the app and shake to reveal their prize. While PrizePool offers weekly drawings, the biggest prizes are reserved for the end of the Series. For Weeks 1-3 of the series, the top prize is set at $500. However, in Week 4, the grand prize climbs to $10,000.

Of course, the odds of hitting one of these jackpots are pretty slim. So, to spread the love around, PrizePool offers a number of smaller cash prizes throughout the Series. Currently (as of August 2021) these prize tiers break down like this:

Weeks 1-3

- $500: 1 winner

- $100: 4 winners

- $20: 70 winners

- $10: 237 winners

- $5: 496 winners

- $2: 573 winners

- $1: 665 winners

- $0.20: 1,500 winners

- $0.10: 2,390 winners

Weeks 4

- $10,000: 1 winner

- $500: 4 winners

- $100: 9 winners

- $20: 70 winners

- $10: 237 winners

- $5: 496 winners

- $2: 573 winners

- $1: 665 winners

- $0.20: 1,500 winners

- $0.10: 2,390 winners

Should you win a smaller cash prize, the money will arrive in your account within 24 hours. What’s even better is that you’ll then begin earning tickets based on your new balance. As for the larger prizes, PrizePool says that they’ll be in touch before transferring the funds into your account.

In the event that you don’t win any cash prizes, you’ll be awarded bonus tickets instead. Like with your normal ticket accrual, the number of bonus tickets you can win is based on your balance. That said, 33% of ticket winners will see their bonus tickets multiplied by 10x, another 33% will earn 5x, and the rest will earn 1x.

It’s worth pointing out that, since these are cash prizes, you may be required to declare winnings on your taxes. According to PrizePool’s FAQ, those who win over $600 (either at one time or in total throughout the year), will be sent a 1099-MISC form. Although those whose winnings amount to less than $600 per year won’t be sent a 1099, the app advises that customers claim winnings as income on their taxes per tax code. If you have more questions about this aspect of PrizePool, it’s probably best to consult a tax professional.

Looking to get started with PrizePool? For a limited time you can get a 10% bonus when you win if you open a new account with this Dyer News link.

Savings Bonuses

Regardless of whether or not you end up winning a cash prize, you may still be able to see your PrizePool balance grow thanks to their monthly Savings Bonus. At this time, your Saving Bonus is equal to 0.30% APY and is paid out on the last day of the month. However, while these bonuses function very similarly to interest, PrizePool notes, “The Savings Bonus is not bank interest, is not an annual percentage yield and is solely an obligation of PrizePool.” Regardless, these Savings Bonuses are a nice feature even if they don’t amount to a whole lot. Then again, with interest being slashed on most banking accounts right now, this Bonus coupled with the chance to win prizes makes this fairly generous.

Upcoming debit card

Finally, like so many other FinTechs, PrizePool is looking to roll out a debit card of its own. Some of the features of this upcoming product will include bonus tickets for customers (100 tickets for every dollar spent on the card), randomly refunded purchases (a la Credit Karma’s Instant Karma or Bella Loves Me’s Bella Surprises), an extra 0.05% Saving Bonus when you spend $1,000 per month (so 0.35% total), and more. Those interested in such a card can now join the waitlist, with PrizePool targetting an autumn release for the product.

Final Thoughts on PrizePool

It’s now been a couple of months since I first opened a PrizePool account. In that time, I’ve managed to win $2.60 while retaining the relatively low balance of just $120. As my PrizePool dashboard advises me, when the 4¢ I’ve earned in Savings Bonuses are added, this works out to a realized APY of 15.32% so far. Needless to say, that’s pretty outstanding.

While I don’t expect that my effective APY will stay nearly that high for long, it’s been fun when I’ve opened the app on a Friday evening to find that I’ve won — this was especially true when my largest win ($2) came in. Plus, with the Savings Bonus alone equaling what I’d get from most of my accounts these days, the opportunity to win money on top makes this seem like a no brainer. That said, I am still in the process of deciding whether I like PrizePool more or less than Yotta and will need to report back accordingly.

All things considered, I’ve really enjoyed using PrizePool and will likely start diverting a larger amount of my cash there to see what happens. Of course, it will also be interesting to see how my luck is impacted as the app grows and more users jump on board. On the one hand, this could mean more money for the app to offer larger prizes but, on the other, it also means increased competition. That latter point also applies to the upcoming debit card, which could mean that non-debit card customers have a much harder chance of winning prizes as bonus tickets flood each contest. In any case, for now, I think PrizePool is definitely an account worth checking out and I hope that future changes are only for the better.

There are no minimum balance requirements with PrizePool. Furthermore, there are no account service charges or other fees.

PrizePool’s grand prizes go as high as $10,000, while other cash prizes range from 10¢ to $500. The app’s drawings are broken into 4-week Series, with the fourth week seeing the largest grand prize.

Each week, PrizePool compiles all of the eligible entry tickets and draws prize winners, starting with the largest prize amount. As winners are chosen, other tickets from the same user are removed as users can only win one prize per drawing.

PrizePool deposits are held with Evolve Bank & Trust. As a result, funds are FDIC insured up to $250,000 per depositor.