Personal Finance News

Robinhood Reveals More Details on Upcoming Retirement Account

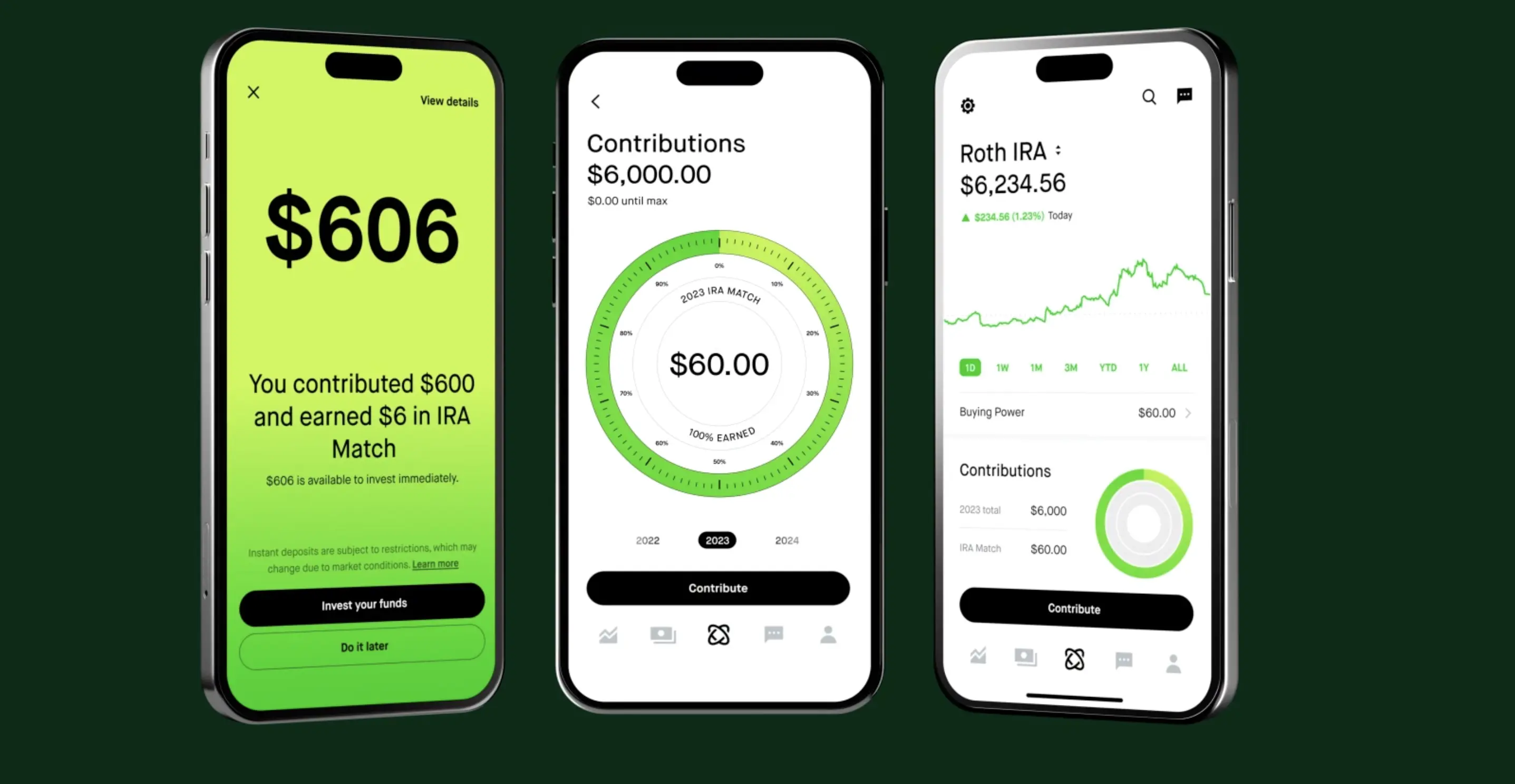

After officially announcing plans for retirement accounts during an earnings call last month, Robinhood has now revealed more details about the upcoming feature and opened a waitlist for customers. First, Robinhood Retirement will offer both Roth and Traditional IRAs to users. With these accounts, customers will be able to invest in stocks and ETFs. Additionally, accountholders will be able to craft a custom portfolio and will be able to view Robinhood recommendations.

Perhaps most notably, Robinhood Retirement will offer a 1% IRA Match feature. This means that, for every dollar that users contribute to their retirement account, the platform will reward them with 1% back, which will typically be instantly available for investment. With the annual contribution limit for IRAs in 2023 coming in at $6,500 for individuals under the age of 50, this means that Robinhood Retirement customers could potentially earn an extra $65 if they max out their contributions. On that note, Robinhood says that the IRA Match funds will count as interest income on the account and will not count toward the contribution limit.

Regarding the IRA Match function, Robinhood’s terms do specify a few conditions. First, in order to qualify, the funds being contributed must come from a linked external bank account (as opposed to a Robinhood brokerage or cash management account). Secondly, while the 1% bonus will be paid at the time of the contribution, customers may be assessed a penalty if they remove their retirement funds from Robinhood less than five years after receiving the Match.

For example, if a user earns a $10 IRA Match from making a $1,000 contribution in January 2023, they’d be able to remove it from the platform in January 2028 without penalty. However, an Early IRA Match Removal Fee could apply if funds are removed before this timeline and the account balance falls below the value of the base contribution. In the case of the $1,000 example, a user who withdraws $800 two years later would be assessed an $8 fee — returning the 1% bonus initially paid on the $800.

Not a Robinhood user? If you haven’t signed up yet just click the button to create an account and get a free share of stock just for opening an account with this Fioney link.

At this time, Robinhood users can join the Retirement account waitlist on the company’s site or in the app. The FInTech says it plans to offer the feature to customers on a rolling basis over the coming weeks. However, the full availability of Robinhood Retirement is expected in January.

Overall, the 1% IRA Match offer does make Robinhood’s retirement accounts a unique option. Furthermore, the app’s marketing is pointing to this function and leaning on the trend of self-employed and freelance workers who likely lack traditional employer matching for their retirement accounts. However, it should be noted that, while Robinhood’s “match” amounts to a 1% bonus on deposited funds, 401(k) matching funds are often a percentage of your salary, not your contributed dollars. On top of that, the five-year restriction does complicate the feature, especially given the quickly-evolving landscape of FinTech. Nevertheless, Robinhood Retirement may be worth a closer look when the feature debuts next year.