Small Business News

SBA Lowers Interest Rates for 504 Loan Program

Small business owners looking to undergo major projects may now be able to borrow funds at a better rate. Last week, the U.S. Small Business Administration announced updated interest rates for their 504 loan program as offered by Certified Development Companies (CDCs). Now 20-year loans will carry a 2.214% rate while the 25-year option has a 2.269% rate. This marks the lowest these interest rates have been in two years.

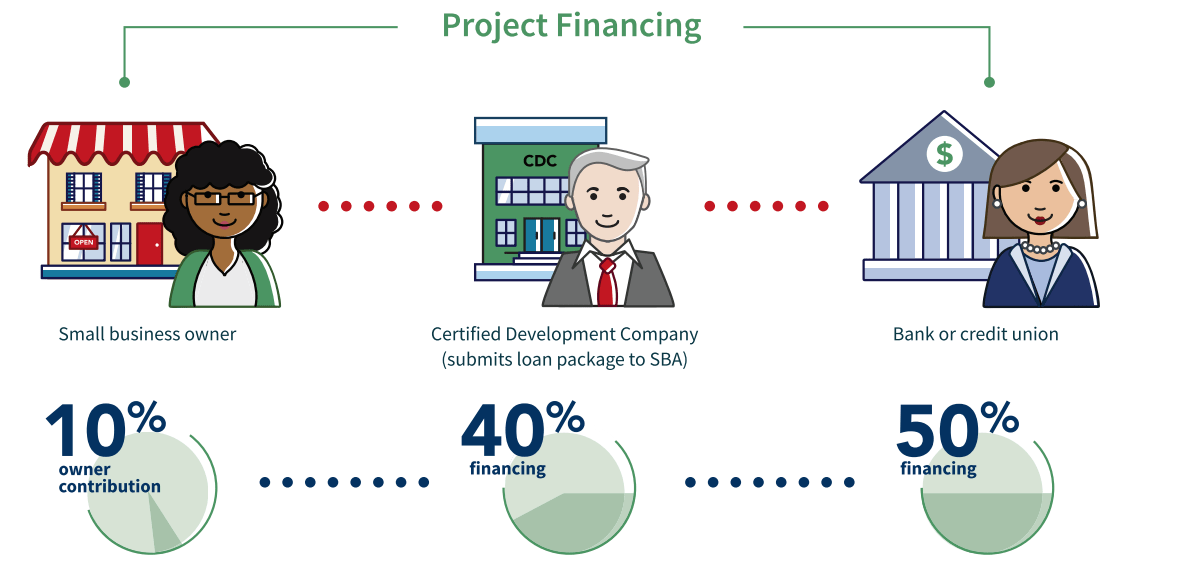

The SBA’s 504 loans enable businesses to purchase land, existing buildings, long-term machinery, or other assets for their projects. They can also be used as a means of refinancing such assets in some cases. For these loans, owners can put as little as 10% down (with up to 20% required in select circumstances), allowing them to preserve their capital. Typically 504 loans are capped at $5 million, although eligible energy-efficient or manufacturing projects may qualify for more. In fiscal year 2019, the agency issued 6,000 loans under this program, totaling $4.9 billion — up 4.3% from the year prior. By comparison, approved applications for the agency’s flagship 7(a) loans topped 52,000 and $23.17 billion for FY 2019.

Announcing the new interest rates for the 504 loan program, SBA Chief of Staff and Associate Administrator for the Office of Capital Access William Manger said, “These are very encouraging terms and very supportive of our nation’s goal to bounce-back from COVID-19. CDCs are the driving force behind the 504 Loan Program. The longer terms and low interest rates support and encourage entrepreneurs to step outside of the box and look at real investments.” Manger added, “We are pleased that the 504 Loan Program continues to show double-digit year-over-year growth, especially in these extraordinary times.”

This change in 504 loan interest rate takes place in a year when the SBA has seen unprecedented demand for loans. Thanks to the Paycheck Protection Program (PPP), the agency doled out more than 14-years worth of loans in less than two weeks — which was then followed by another round after initial applications exceeded funding. In other SBA news, it was revealed that the federal government has exceeded its small business contracting goal. Last fiscal year, it awarded 26.5% of federal contract dollars to small businesses. This amounted to $132.9 billion, which is a $12 billion increase from the year prior.

While the lower 504 loan interest rate is certainly good news for small business owners, it’s unclear how many entrepreneurs are in a position to undertake large projects at this time. That said, there is also the possibility that those who are able to invest in their businesses now will see benefits when the economy does rebound as their expansions will be ready. In any case, this announcement is just another reminder that there’s a lot more to the Small Business Administration than just PPP.