Category: Economic News

The macro economy has a large impact on your personal finances. To help you manage your money better we track the import economic trends. Stay up to date so you can be prepared to adjust your personal finance strategies.

Economic News

Survey: 45% of Americans Rely on Credit Amid Inflation

by Kyle Burbank

A new survey highlights the link between continued inflation and how Americans are using credit. About the survey results: According to a Debt.com survey of 1,000 U.S. adults, a significant number of consumers are currently relying on credit. In fact, 45% of respondents cite inflation and price increases as the reason for their credit usage. Furthermore, 35% say they've maxed out their cards in recent years as a result of...

Economic News

Paterson, NJ Releases Results of Basic Income Test Program

by Kyle Burbank

After completing a basic income pilot program in 2022, Paterson, New Jersey has released some of the initiative's findings. About the program and results: From June 2021 through June 2022, the City of Paterson gave 110 residents monthly payments of $400 with no strings attached. To qualify, individuals needed to make less than $30,000 per year while families with incomes under $88,000 could also qualify. Meanwhile, while the program was...

Economic News

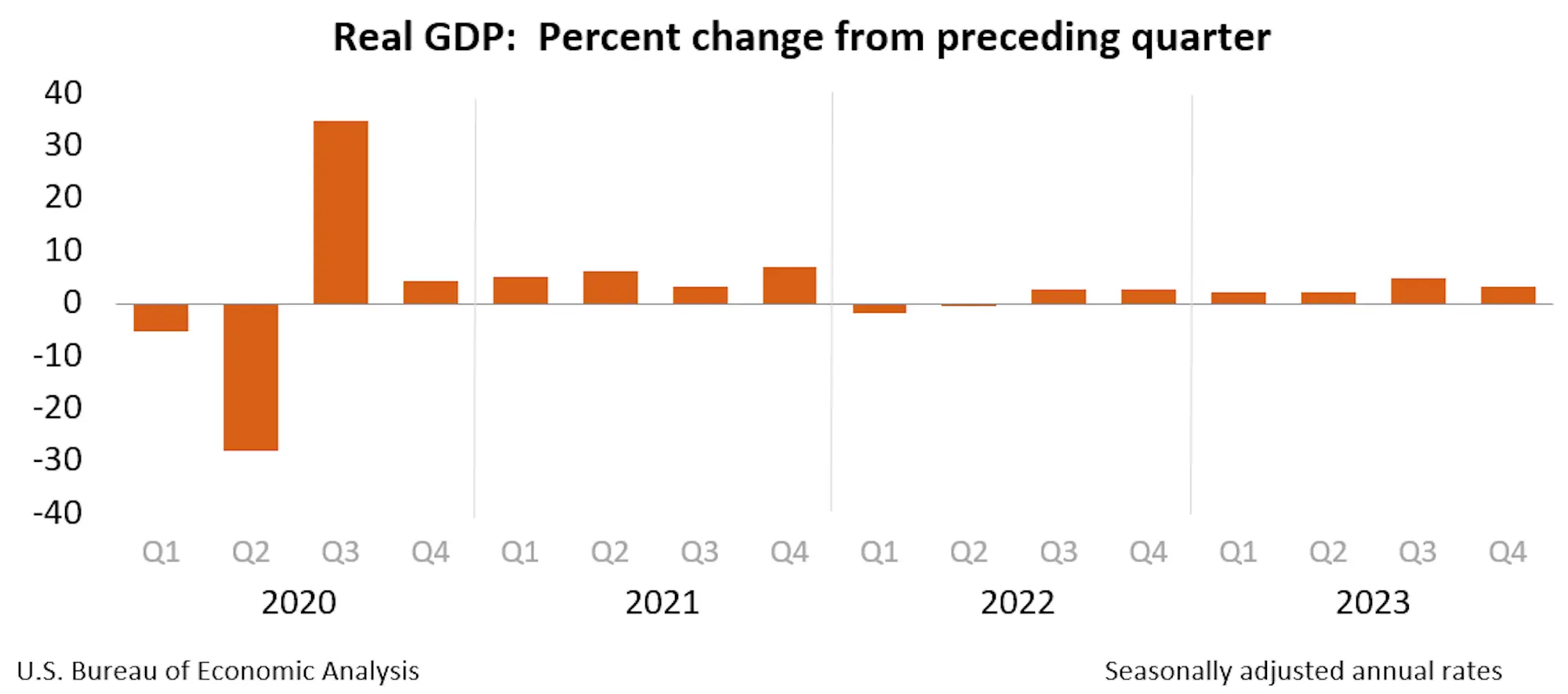

The United States Economy Grew 3.3% in Q4 2023

by Kyle Burbank

A new report shows that the United States economy continued to expand in the last quarter of 2023. About the numbers: According to the Bureau of Economic Analysis, the U.S. gross domestic product (GDP) increased 3.3% in the fourth quarter. As CNN Business notes, although that's down from the 4.9% growth rate recorded in the third quarter of the year, it's more than double the 1.5% growth economists expected. For...

Economic News

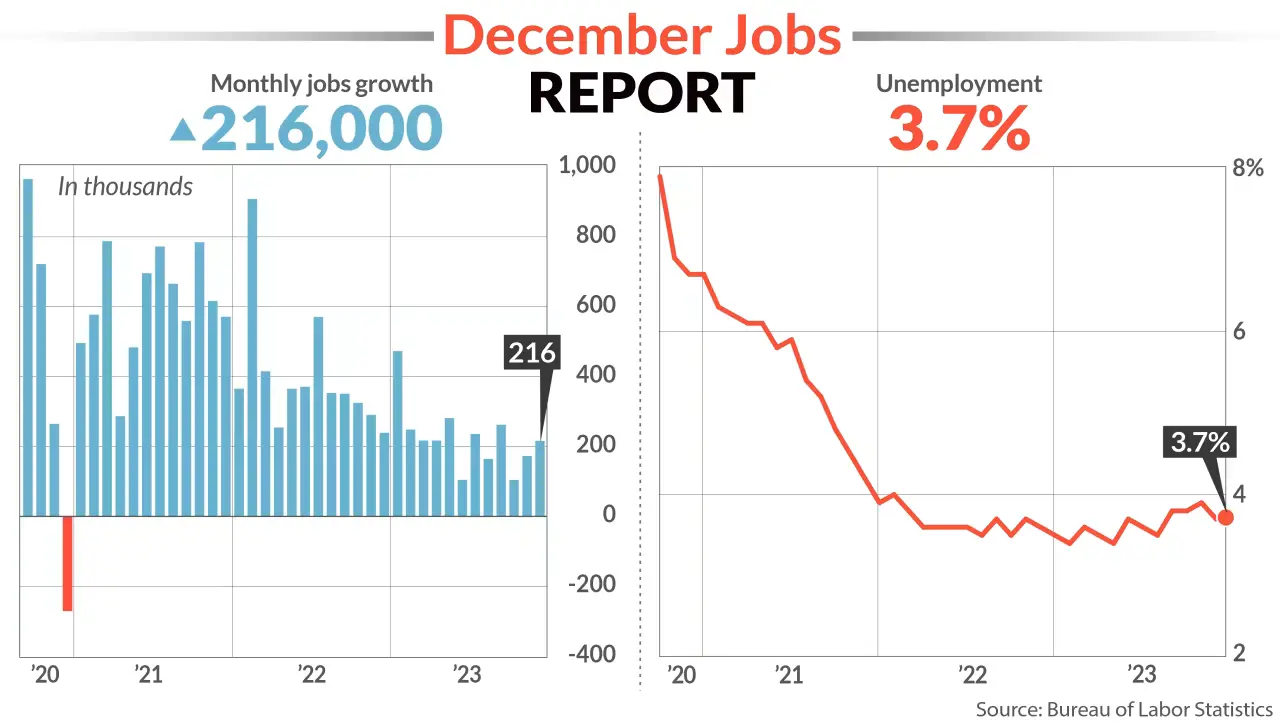

United States Economy Added an Estimated 216,000 in December

by Kyle Burbank

The United States economy closed out 2023 with yet another impressive jobs report. About the report: According to the latest Bureau of Labor Statistics report, the U.S. economy gained 216,000 jobs in the last month of 2023. That easily beat the 175,00 jobs expected by economists surveyed by Bloomberg. Meanwhile, the unemployment rate was flat month-over-month, sticking at 3.7% (economists had anticipated it to tick up). While December's figures were...

Economic News

IRS Announces 2024 Tax Brackets, Adjusted Standard Deduction

by Kyle Burbank

The Internal Revenue Service (IRS) has released its latest inflation adjustments for the next tax year, including updated tax brackets and standard deduction figures. About the updates: As it does nearly every year, the IRS has updated the tax bracket figures for the 2024 tax year. Next year's marginal tax rates will retain the same basic tiers (10%, 12%, 22%, 24%, 32%, 35%, and 37%) that were installed in 2018....

Economic News

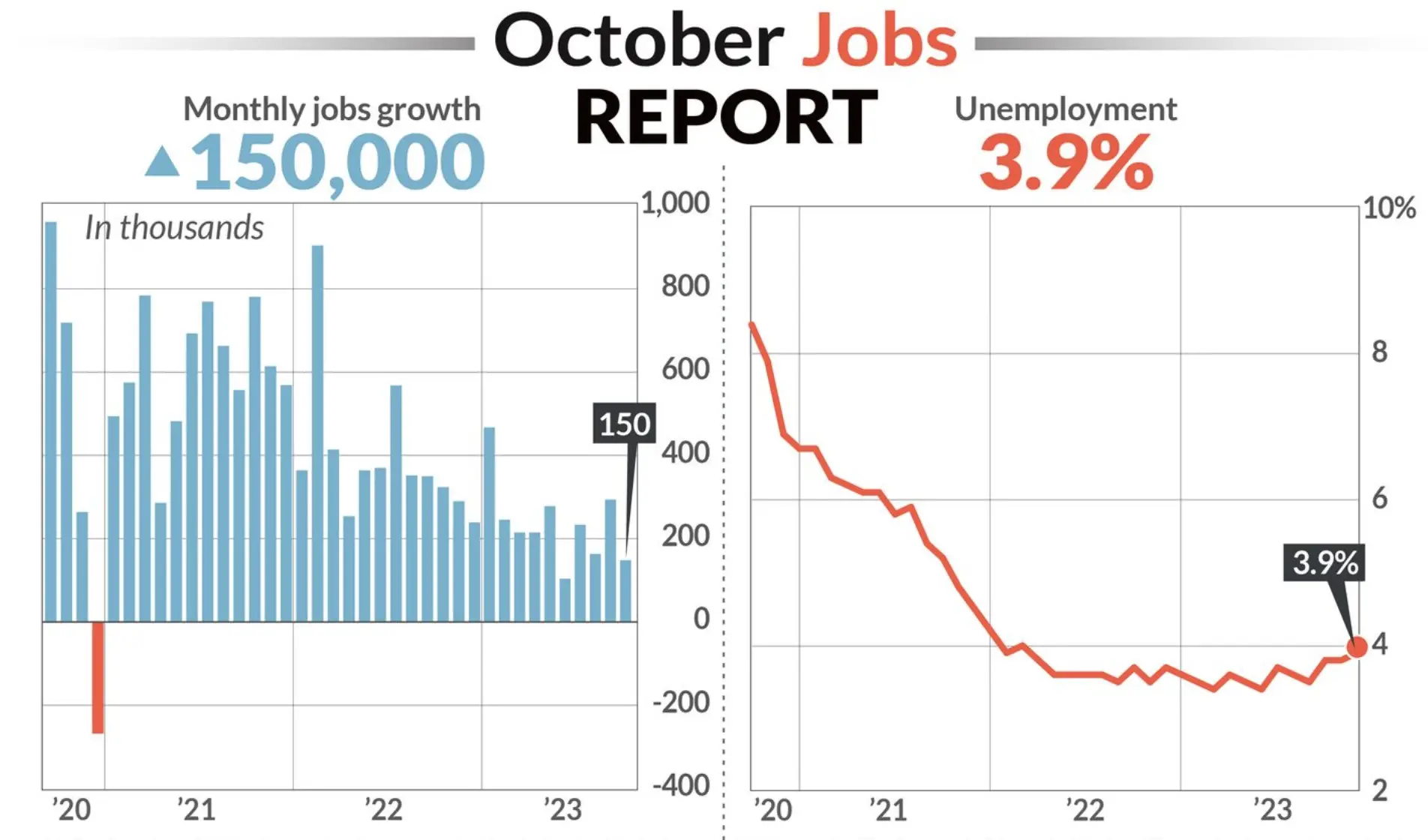

U.S. Economy Adds 150k Jobs in October, Unemployment Ticks Up

by Kyle Burbank

This morning, the United States Bureau of Labor Statistics released its initial jobs report for October 2023. About the report: Headlining today's report, the U.S. economy added an estimated 150,000 jobs last month. That's below the 170,000 jobs that economists surveyed by Wall Street Journal forecasted. But, it's expected that the figures would have been closer to 180,000 jobs if not for the auto workers strike in October. Despite that added...

Economic News

Report: 401(k) Balances Rise, Hardship Withdrawals Increase

by Kyle Burbank

A newly-released report looking at 401(k) account balances at Bank of America shows that, while overall balances are trending upward, more people are also requesting hardship distributions. About the report: According to the BofA report, the average 401(k) account balance at the end of last quarter was $82,300. That's up by $7,250 so far in 2023, representing a 9.6% increase. In the second quarter, the average contribution came in at...