Personal Finance News

Telecom T-Mobile Launches Mobile-First Checking Account for All

Over the past few years, a lot has changed in the world of mobile service plans. From the dismantling of subsidized devices, the fall and subsequent return of unlimited data, and the bundling of streaming services into mobile plans, U.S. carriers have continually worked to find ways to one-up each other while also increasing profits. In a similar but decidedly different vein, this past week brought some unexpected news as mobile “uncarrier” T-Mobile unveiled a new offering: T-Mobile Money, its mobile-first checking account

Over the past few years, a lot has changed in the world of mobile service plans. From the dismantling of subsidized devices, the fall and subsequent return of unlimited data, and the bundling of streaming services into mobile plans, U.S. carriers have continually worked to find ways to one-up each other while also increasing profits. In a similar but decidedly different vein, this past week brought some unexpected news as mobile “uncarrier” T-Mobile unveiled a new offering: T-Mobile Money, its mobile-first checking account

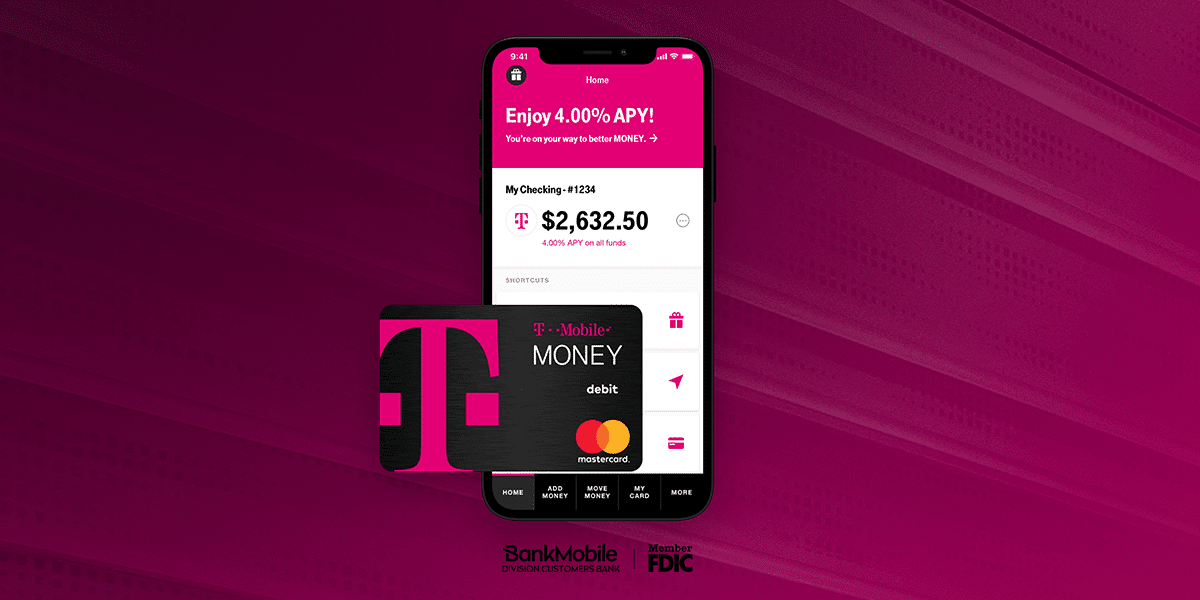

T-Mobile Money is the result of a partnership between the telecom and BankMobile — which is a division of Customers Bank. As a result, T-Mobile Money accounts are FDIC insured. In terms of other benefits, the company says accounts will bear no minimum balance fees, overdraft fees, or monthly fees. T-Mobile Money customers will also be able to access more than 55,000 ATMs that are part of the Allpoint network for free using the Mastercard debit card that comes with the account. Those interested in applying can download the T-Mobile Money app (for Android or iPhone) or visit their website.

Although T-Mobile Money is open to all (or at least all who are residents of the 50 U.S. states, 18 and older, and have a social security number), there are additional perks for the telecom’s customers. Currently those with postpaid T-Mobile accounts can earn a 4% APY on their funds up to $3,000, provided that they deposit at least $200 a month into their account. Every dollar over $3,000 will earn a 1% APY. As for non-T-Mobile customers and those who deposit less than $200 per month, they’ll earn 1% APY regardless of their balance.

In a press release announcing the new checking account, T-Mobile CEO John Legere said, “Traditional banks aren’t mobile-first, and they’re definitely not customer-first. As more and more people use their smartphones to manage money, we saw an opportunity to address another customer pain point.” He went on to declare, “You work hard for your money … you should keep it … and with T-Mobile Money, you can!”

Incidentally, T-Mobile’s push into banking comes as the company is trying to prove itself as a positive force for consumers. That’s because third-place carrier T-Mobile is attempting to merge with fourth-place carrier Sprint. Recent media reports indicate that the Justice Department still isn’t quite sold on the deal as is, although Legere has more or less denied that trouble is afoot. Nevertheless T-Mobile has already made its pitch to consumers and regulators, arguing that the two companies combined would lead to more jobs and lower prices overall. Moreover the company has said it would freeze rates for at least three years if the merger were approved.

If nothing else, T-Mobile’s venture into banking is an interesting turn. With the potential for a 4% APY, the account certainly sounds attractive for current or potential customers. Whether or not the launch of T-Mobile Money has anything to do with their pending Sprint transaction remains to be seen but, either way, their fee-free T-Mobile Money could serve to earn the telecom some goodwill among consumers and bring a new option to America’s unbanked.