Economic News

U.S. Economy Adds 266,000 Jobs in November

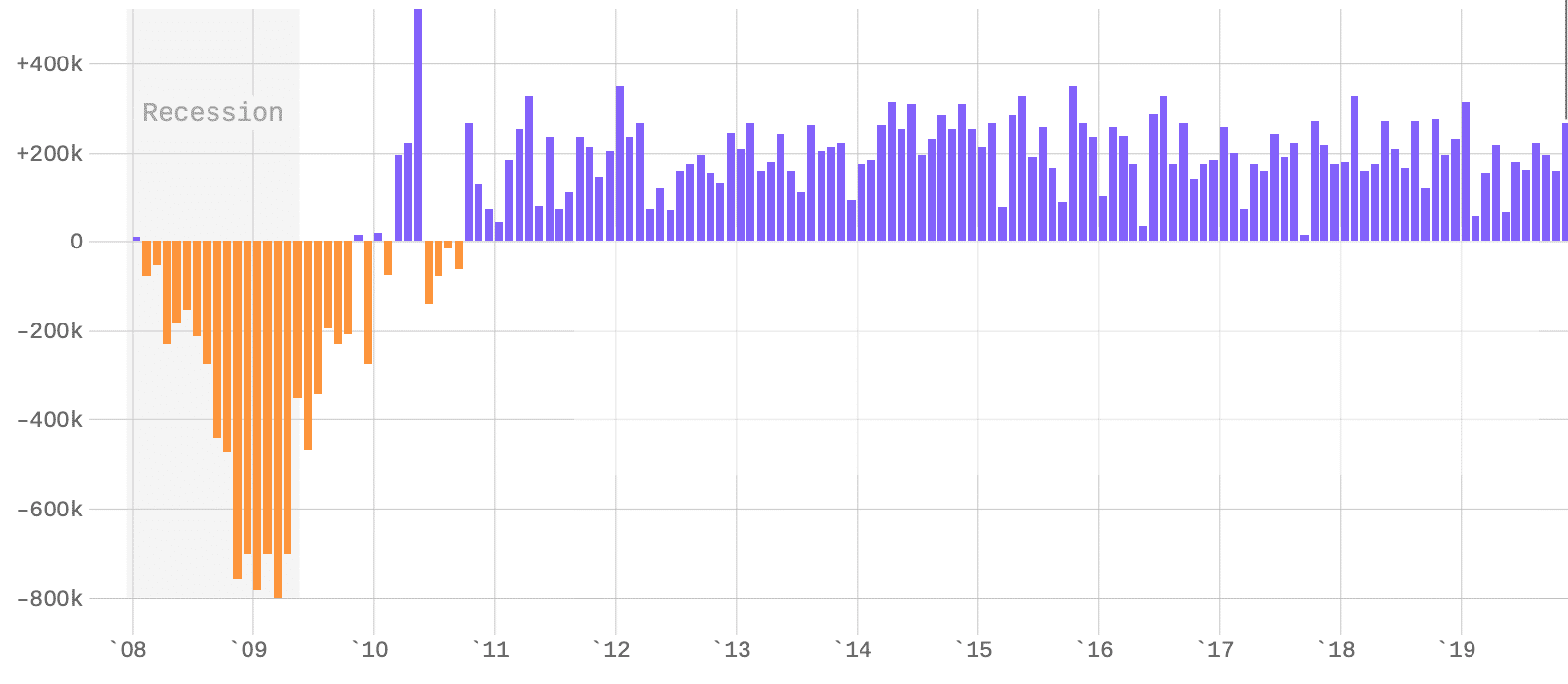

It may be hard to believe but we’re already in the last month of the decade — a decade that’s economically been defined by recovery and growth. Therefore it only seems appropriate that the last jobs report to be released in 2019 would once again show encouraging results. As Axios reports, the latest figures from the Bureau of Labor Statistics featured many pieces of good news.

While experts surveyed by MarketWatch had anticipated this morning’s report to show a gain of 180,000 jobs for the month, the actual number from the Labor Department was 266,000. Although that figure includes the 50,000 striking General Motors employees returning to work, the net number still exceeds analyst expectations. Moreover it makes November the best month for jobs since January of this year.

Given the strong numbers, the unemployment reate also ticked back down one-tenth of a point to 3.5%, matching a 50-year low. Also of note is that the Labor Department made adjustments to job figures from its September and October reports. These revisions amounted to an extra 41,000 jobs added between the two months.

In terms of pay, the average hourly wage increase by seven cents in November and now sits at $28.29 an hour. At the same time, wage growth for the year slowed slightly from 3.2% to 3.1%. As MarketWatch notes, this would suggest that many of the jobs being added are lower-paying.

All this comes at the time when there’s been an increased focus on the economy and when a recession might come — not to mention continued trade fears that contributed to quite a rollercoaster year for the markets. Yet this latest report shows once again that businesses are continuing to hire in spite of it all. As Indeed Hiring Lab research director Nick Bunker explained, “Over 10 years since the official end of the Great Recession, the labor market continues to add more jobs than needed to keep up with population growth and the growth of the labor force. As we start the new year, maybe our resolution should be to not count out this labor market.” Of course, before we get to the new year, there’s still the holiday shopping season. To that point, Sal Guatieri of BMO Capital Markets told MarketWatch, “All these new jobs will only put an extra spring in the step of holiday shoppers.”

With the decade coming to a close, it looks as though the economic expansion that started in the 2010s will ride into the 2020s. At the same time there are still several threats at play that could start turning things around. In the meantime it should be a prosperous holiday season and hopefully a happy new year.