Category: Money Management Tips

Money Management Tips

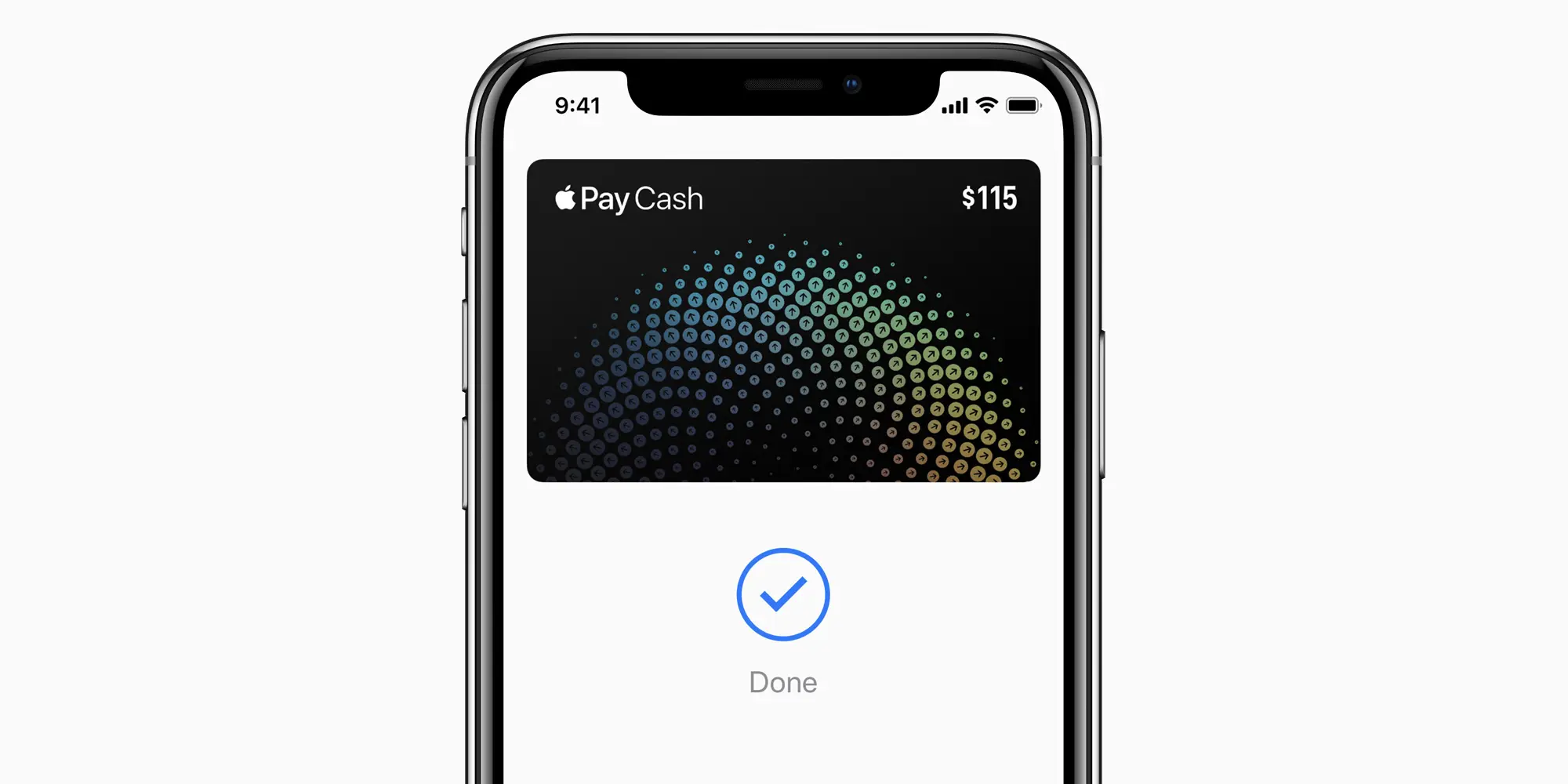

How to Activate a Virtual Card Number on Apple Cash

by Kyle Burbank

In 2017, Apple expanded its FinTech aspirations by introducing a peer-to-peer payment account called Apple Cash. With this account, users could easily send and receive payments via iMessage. What's more, while customers could elect to transfer received funds to a linked bank account, they could also be spent directly using Apple Pay. The only problem was that, for merchants that didn't accept Apple Pay, there wasn't a way to use...

Money Management Tips

Money at 38: The Major Ways My Finances Have Changed

by Kyle Burbank

In 2016, I wrote a guest post for what was then called Dyer News (now Fioney) about my "financial awakening." What inspired that article was the fact I'd just checked my credit for the first time, leading me to take a greater interest not only in my money but in the topic of personal finance in general. Needing a title, I settled on calling it "Money at 30" — which was...

Money Management Tips

The Top 5 Money Tools I'm Using Most in 2024

by Kyle Burbank

Over the past several years, I've reviewed countless apps, platforms, and other tools related to personal finance. Often, I've also taken to naming some of my top picks for each year. Originally, this list featured apps that I was bullish on before transitioning to a collection of what I thought were the "most fascinating" startups. Well, unfortunately, the FinTech market has seen several casualties along the way, wiping out some...

Money Management Tips

5 Ways My 2024 Finances Will Look a Lot Different From 2023

by Kyle Burbank

With Christmas 2023 now in the rearview, it's basically 2024 already. In turn, as one does, I've been thinking a lot about the new year and what changes I can expect. So, rather than discussing my money goals for the new year, I simply wanted to share some ways our finances will differ in 2024. My 2024 Financial Changes Mortgage instead of rent By far the biggest life change my...

Money Management Tips

Comparing Cashback Portals: What's the Best Tool for Holiday Shopping?

by Kyle Burbank

If you're buying anything online, the biggest tip I have is always the same: try a cashback portal. Of course, with the number of these platforms growing, the question becomes, "Which one is the best?" Unfortunately answering that isn't so easy. Luckily, I had an idea: compare some popular cashback tools using a set of real-world parameters. In other words, what types of cashback rates can you get on select...

Money Management Tips

Cutting the Cord Again: 5 Free Streaming Services to Try

by Kyle Burbank

Remember when the hot trend was "cutting the cord" and canceling cable? At the time, this strategy allowed consumers to save a lot of money. Alas, as more streaming services have hit the market, many viewers may once again be spending more than they'd like on entertainment. But there's good news as there are now several free services where you watch movies, TV shows, and more without spending a dime....

Money Management Tips

Why I'm Changing Wireless Providers (Again)

by Kyle Burbank

Four years ago, I wrote a post sharing how I was saving money thanks to moving to T-Mobile (from AT&T) at the time. Well, now my wife and I have once again changed wireless providers. This time, we've landed at Verizon. But why? Well, let me explain how this came to be, how we'll be saving, and what I'll miss about being a T-Mobile customer. Why We've Switched from T-Mobile...