Economic News

Which States are Most Affected by Government Shutdowns?

As you’re surely aware the United States federal government is currently involved in a partial shutdown. While such shutdowns have become fairly common in recent years, the latest seems a bit different in that its now past the two-week mark with no end in sight. This led the personal finance site WalletHub to study which states are the most and least impacted by the federal government shutdown.

Easily topping WalletHub’s study of the most affected states was actually not a state at all — it was the District of Columbia. Washington D.C. is not only home to a great number of federal employees who have either been furloughed or may be working without a paycheck but also relies on the federal government for services that would fall to the state elsewhere in the country. Moreover D.C. has the highest percentage of families receiving SNAP (Supplemental Nutrition Assistance Program) benefits, which could run out depending on how long the shutdown lasts. Because of these factors the District ended up with a total score of 78.59.

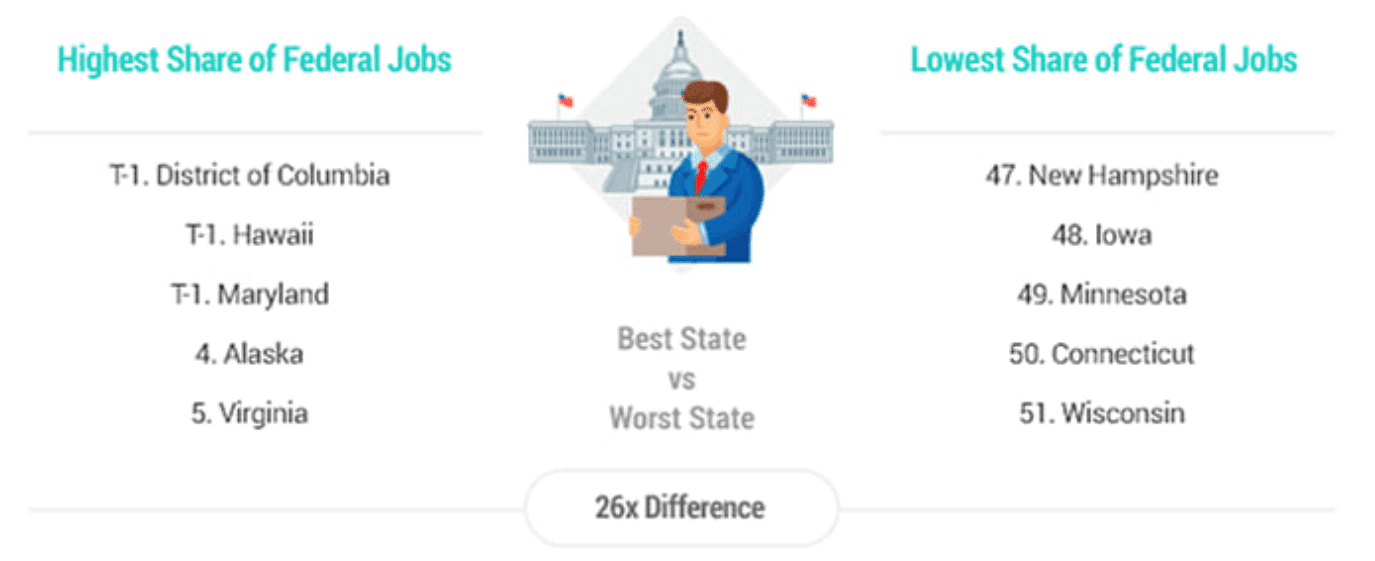

In a distant second was New Mexico with a score of 65.95. That surprising second-place finish is due to several different factors, including both the state’s relatively high per capita of federal contract dollars and percentage of families reliant on SNAP benefits. Meanwhile District-adjacent Maryland landed at number three on the list with 65.70 while non-continental states Hawaii and Alaska ranked fourth and fifth with scores of 62.91 and 61.08 respectively. Not by coincidence these three states all ranked highly on the list of states with the largest share of federal jobs, with Maryland and Hawaii actually tying D.C. for first and Alaska coming in fourth. Alaska also has the highest access to national parks, which have been hit by the shutdown as well. Meanwhile, on the other end of the spectrum, Minnesota was found to be the least affected state with a score of 10.54, joined by New Hampshire (15.59), Nebraska (16.40), Iowa (16.49), and Indiana (17.02).

Nationwide, the ongoing shutdown has affected Americans in some unexpected ways. For example, reports indicated that the Transportation Security Administration (TSA) agents have been calling out in greater numbers, potentially leading to issues at major airports. Additionally, with tax season just around the corner, the Internal Revenue Service (IRS) is currently unable to process refunds or even answer tax-related queries. Similarly, as we noted last week, the Small Business Administration has halted loan applications, leaving some business owners to seek funding from elsewhere. All of this and more has people across the country asking, “when will it end?”