FinTech News

Zogo, MoneyLion Partner to Provide Users with Financial Education

In recent years, FinTech brands have often discussed how their platforms help make financial services more accessible. Furthermore, many have touted the educational resources they offer alongside these tools, increasing financial literacy as a result. Now, a popular neobank and a growing educational app are teaming up to help meet a similar goal.

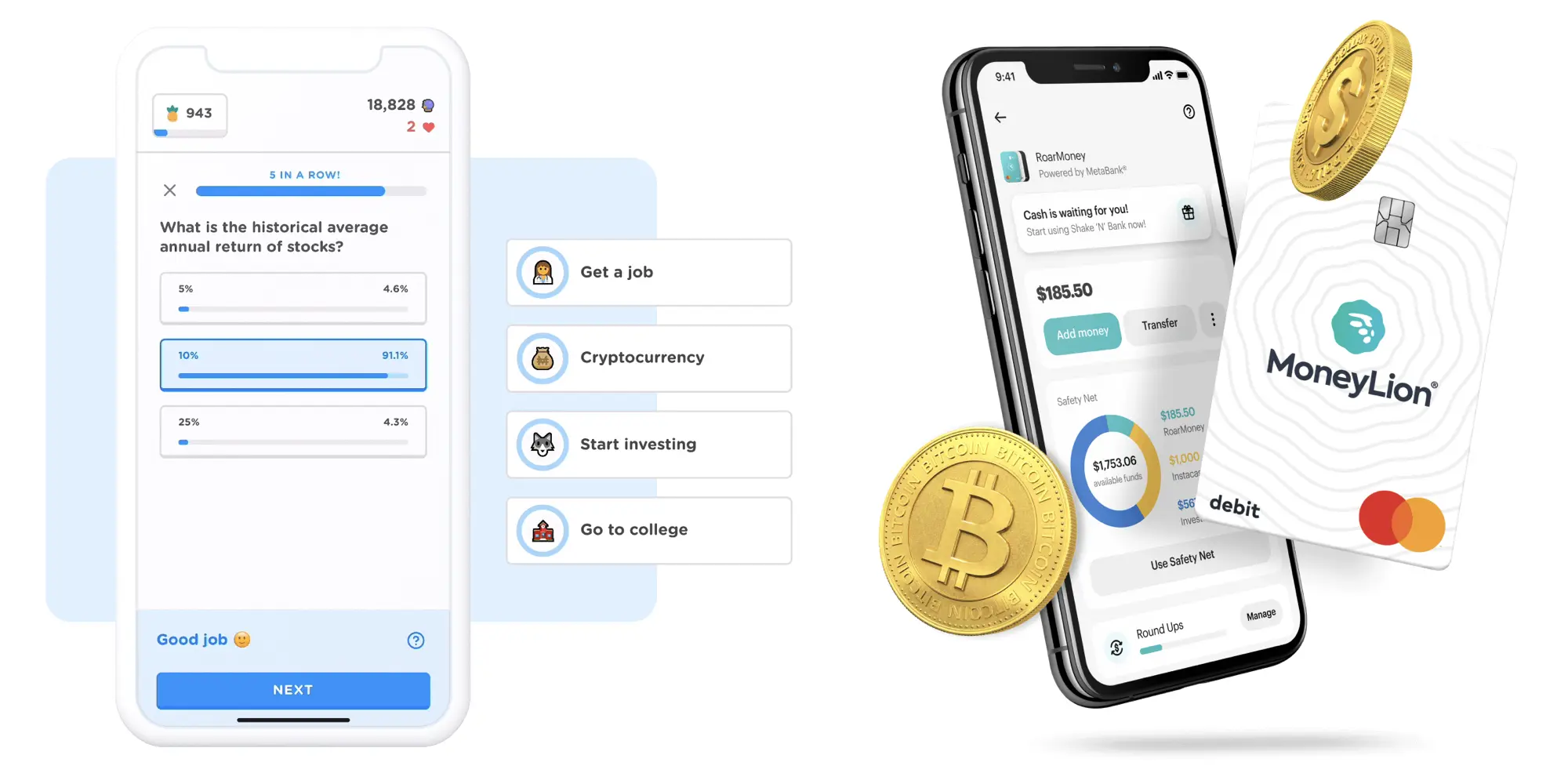

This week, Zogo and MoneyLion announced a new partnership. With this integration, MoneyLion users will be able to access Zogo money lesson modules via the app’s “Today Feed” tab. Some of the topics that will be covered in these lessons include investing, saving, budgeting, credit scores, loans, and entrepreneurship.

Launched in 2018, Zogo is a platform aimed at helping Gen Z and beyond learn about personal finance in a fun and engaging way. Not only can users explore different topics via digestible lessons and quizzes but can also earn rewards for reaching certain milestones. Currently, the company partners with more than 200 financial institutions (double the number announced in June 2021) while also maintaining its own educational app.

As for MoneyLion, in addition to being a neobank app, the service also strives to deliver “hyper-personalized money-related and money-adjacent content.” Among the products it offers are its RoarMoney account, a credit-building service, an investment account, crypto trading, and other features. According to the company, more than three million customers utilize the platform.

Announcing the partnership, MoneyLion Chief Product Officer Tim Hong said, “At MoneyLion, we think about our customers each day and want to provide them with the tools and know-how to become money savvy in a way that’s approachable and fun. Together with Zogo and through MoneyLion’s data science and machine learning capabilities, each customer will receive a unique lineup of content and information, and the tools necessary to help them achieve their money goals, and at the same time, have the confidence to improve their financial health with a hyper-personalized in-app feed.”

Zogo CEO Bolun Li also noted, “Partnering with a premier [neobank] such as MoneyLion is a pivotal step toward Zogo’s goal to bolster investor education for consumers’ prosperous financial futures. This is one of our biggest leaps in the FinTech space, driving us closer to our overall mission of reinventing financial education than ever before.”

Although Zogo has previously worked with the likes of American Express, this latest partnership with MoneyLion is still significant. Additionally, this deal is not only a win for both startups but also could well be beneficial to MoneyLion’s growing den of users who will now have easier access to Zogo’s materials. On that note, with the latter company rapidly adding institutions to its roster, the app seems poised to become the Duolingo of personal finance in short order.