Small Business News

Goldman Sachs Survey Shows COVID-19’s Impact on Small Businesses

Even as some areas of United States are looking for ways to begin reopening businesses amid the coronavirus pandemic, many American small businesses are still struggling and are uncertain of what’s ahead. Now the situation has been quantified in a new survey from Goldman Sachs that highlights some of the issues that small businesses are currently facing.

The survey spoke with 1,790 small business owners that are part of Goldman Sachs’ “10,000 Small Businesses” program. This group included owners in 47 states as well as four U.S. territories. Also notable is that the survey was conducted between April 20th and 21st, which is between when the first round of Paycheck Protection Program (PPP) funds ran out and when the second round arrived.

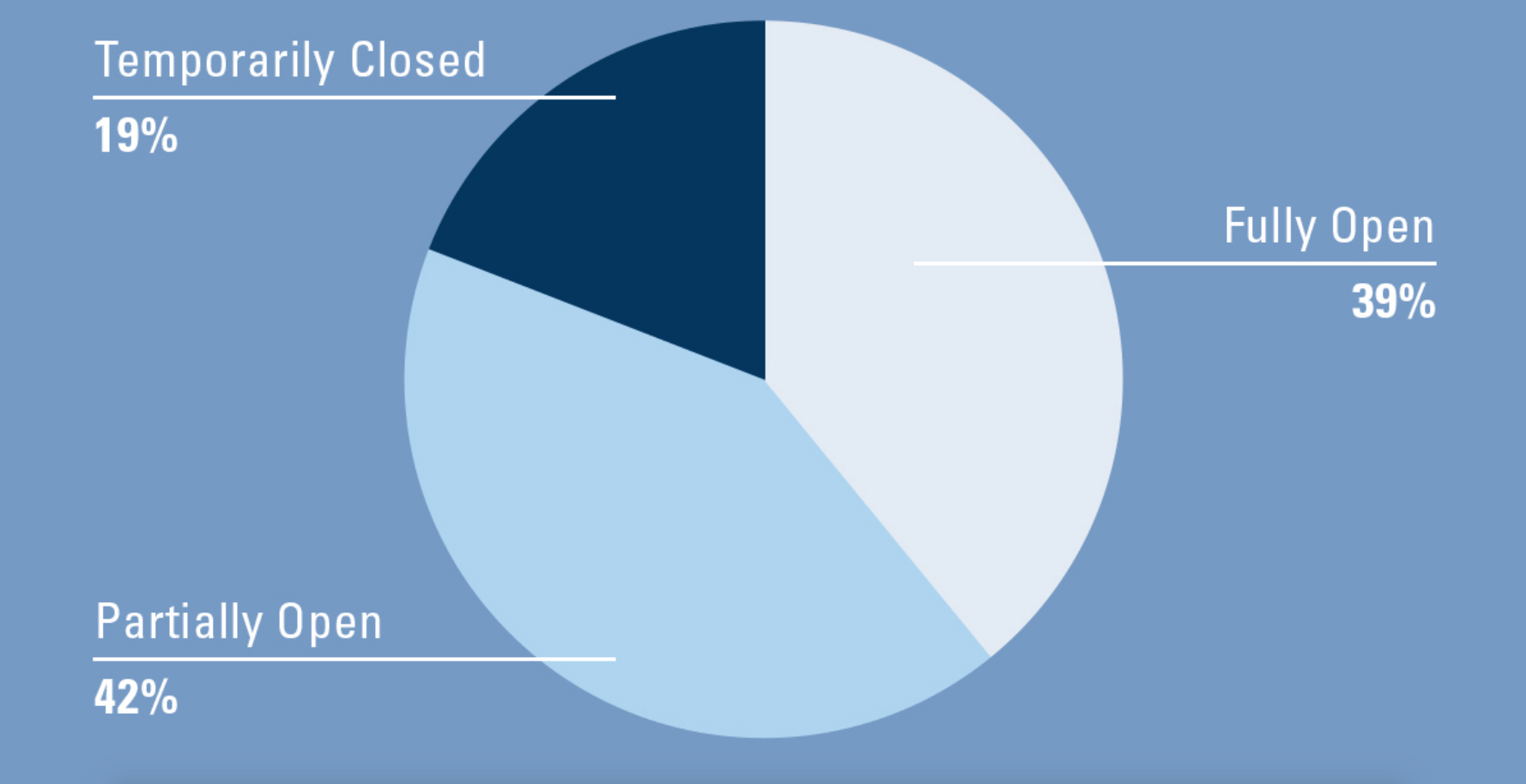

Speaking of PPP, at the time of the survey, 71% of respondents had filed applications but were waiting on funds. More encouraging is the fact that 68% of those approved expect that they’ll be able to retain 75% to 100% of their payroll. Additionally 81% of those surveyed said their businesses were still operating in some capacity, with 39% fully open and 42% at least partially open.

Unfortunately, even among businesses that are still operating, many are having to cut their workforce. In fact Goldman found that respondents’ had a median of 11 employees prior to the COVID-19 outbreak compared to a median of 6 today. Overall businesses surveyed report they’ve had to cut their workforces by 37%.

As for owners’ finances, unsurprisingly 85% of respondents say their personal finances have been hurt by the current crisis. Even more concerning, 64% predict that their current funds will run dry in less than three months. Interestingly 42% also say they’ve spoken with their business landlords or mortgage holders seeking rent relief (the results of those requests was not shared in Goldman’s report).

Of course, even after this pandemic subsides and businesses begin to reopen, there will still be some long-lasting ramifications. On that note, a whopping 93% of business owners say this crisis will continue to impact the way they operate going forward. Simiarly 68% suggest they will permanently adjust their business models accordingly. Meanwhile 69% fear that larger players will have a greater advantage over small business as the result of this crisis.

While the second round of funding — and tighter regulations meant to curb money going to unintended recipients — for PPP may be a good start in helping U.S. small businesses survive, it’s clear that it will take more for them to begin healing. For one, more than three-quarters of businesses surveyed say that the Small Business Administration should extend the current PPP deadline of June 30th, with 53% stating the extension should be for three months or more. Additionally the majority of respondents also advise that the application process should be easier and that funds should be distributed more quickly once approvals are made. Obviously these changes aren’t easy in the face of emergency but hopefully something can be done to help these struggling businesses and the millions of people they employ.