Economic News

Household Debt in the U.S. Dips For the First Time in Six Years

Those looking for a silver lining to the current pandemic may have found one in a new report. According to the Federal Reserve Bank of New York, total household debt — which includes both housing and non-housing debt — came in at $14.27 trillion for the second quarter of the year. Importantly, that’s down 0.2% (equating to $34 billion) from the previous quarter, marking the first time since 2014 that the figure has decreased. It’s also the largest decline since 2013.

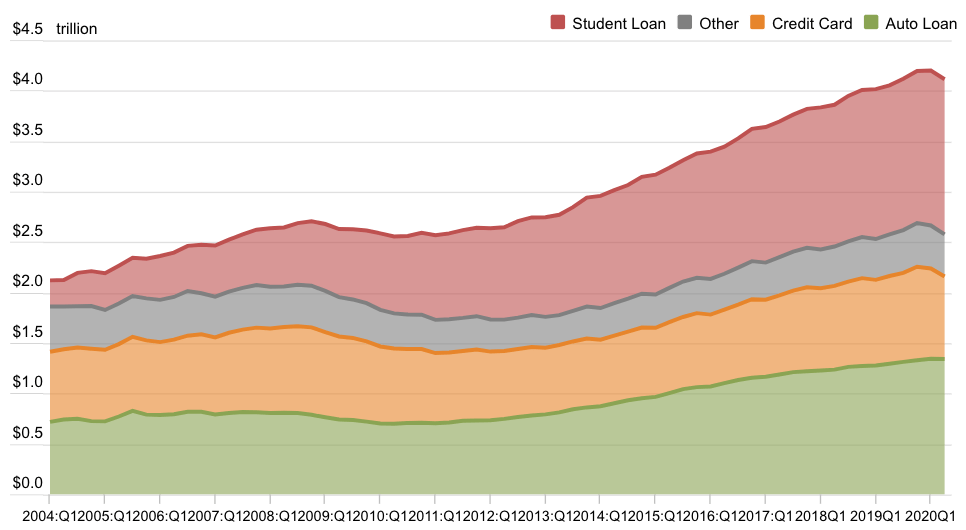

Despite the overall drop, housing debt actually rose from $10.10 trillion in the first quarter to $10.15 trillion in Q2. However, non-housing debt’s decline from $4.20 trillion to $4.12 trillion more than made up for it. That was thanks in part to the sharp drop in outstanding credit card balances. In fact, the $76 billion decline in credit card balances observed in Q2 amounts to the steepest drop seen since the New York Fed began tracking household debt in 1999. Overall, credit card balances now sit at $820 billion, which is down $51 billion for the year so far.

While one might expect that the financial challenges that have come with the coronavirus pandemic would send credit card usage higher, in actuality, it seems that the lockdowns led to lowered consumer spending overall. Additionally, it’s possible that the stimulus checks that were mailed to many Americans during the second quarter may have been applied to paying down credit card debt. Of course, with Congress still debating the next round of stimulus and programs, it’s unclear whether such trends will continue.

Commenting on the impacts COVID-19 had not only on this quarter’s report but also on the finances of the American people, New York Fed Administrator of the Center for Microeconomic Data Joelle Scally said in a statement, “Protections afforded to American consumers through the CARES Act have prevented large-scale delinquency from appearing on credit reports and damaging future credit access. However, these temporary relief measures may also mask the very real financial challenges that Americans may be experiencing as a result of the COVID-19 pandemic and the subsequent economic slowdown.” To Scally’s point, today’s Bureau of Labor Statistics report showed a monthly gain of just 1.8 million jobs, suggesting that the U.S.’s economic recovery is stalling.

Elsewhere, it seems that mortgage refinancing was popular during the quarter. The latest report shows mortgage originations (which includes refinancing) reached $846 billion — the largest volume in seven years. Also notable is that 0.5% of current mortgages became delinquent during the quarter, although that report notes that many borrowers enrolled in forbearance programs.

As encouraging as this report may seem on the surface, it’s hard to think of it as much more than an anomaly given the unique and complicated circumstances brought about by COVID-19. What will be more interesting is what the third quarter figures will show. On that front, given everything that’s going on right now, it’s really anyone’s guess as to what’s ahead.