Product Reviews

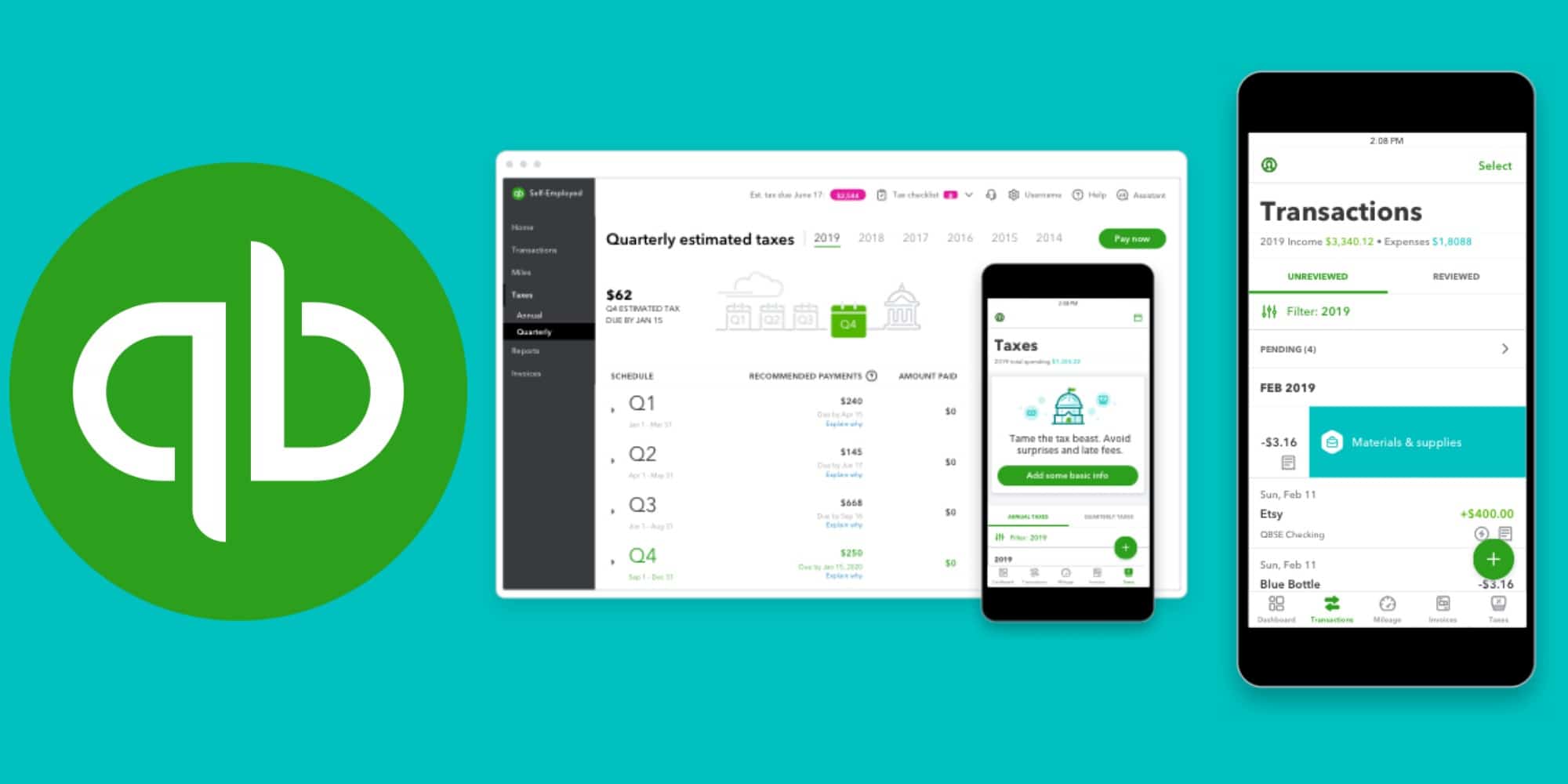

Quickbooks Self-Employed Review (2022)

A few years ago when my dad did my taxes, it was kind of a mess. Sure, scanning my 1099s, W-2s, and other forms to send to him in Arizona was simple enough, but when it came time to talk deductions, I was ill-prepared. While I did make efforts to find old emails or dig up receipts from throughout the year, it was clear that I could be a lot better organized with the whole thing and potentially save more as a result.

Shortly after getting through that, I decided to sign-up for Quickbooks Self-Employed (or QBSE, for the sake of this article) to see if that could help make tax time a bit easier the next go-round. Now, three years later and getting ready to work on my latest return, I can tell you that it certainly did make a difference. With that, here’s a quick look at Quickbooks Self-Employed and how it has helped me to save money the past few years.

- Allows users to track expenses, mileage, and more

- Create transaction rules for easy categorizing

- Tax bundle with TurboTax filing credit available

- Occasional duplicate transaction data is possible

- Monthly price continues to rise

- Paying quarterly taxes via Quickbooks required Tax Bundle

What is Quickbooks Self-Employed?

Even if you don’t recognize the name offhand, there’s a good chance you’ve at least heard of an Intuit product. The company is behind the TurboTax software you’ve likely seen on Costco displays each spring as well as their Quickbooks suite meant to aid small businesses with accounting. In that same vein, Quickbooks Self-Employed is a pared-down version of Quickbooks Online specifically aimed at sole proprietors like myself.

Getting Started With Quickbooks — The Main Features

Tracking Transactions

To me, the most useful element of QBSE is the ability to keep track of all your transactions. This is accomplished by first linking your bank accounts and credit cards to Quickbooks. Doing so will then allow you to go through all of your transactions — incoming and outgoing — and label them as “personal” or “business.” Furthermore, if it is business, you can select more specific categories that will come in handy when figuring out your tax deductions. You can also split transaction amounts between personal and/or as many business categories as you want and in whatever manner you choose.

You can either use the website or the app to go through your transactions. In fact, doing so on mobile provided an almost Tinder-like experience as you can swipe right to mark a purchase as “personal” and left for “business.” In either medium you can also set up rules so that future (and even existing) transactions of that nature will automatically be categorized for you.

Another helpful element is the ability to attach digital copies of receipts to any transaction. This is achieved by simply taking a picture of said receipt or forwarding confirmation emails to Quickbooks from a linked email account. Honestly this was a feature that I haven’t made much use of just yet but it’s one I probably should start taking advantage of moving forward.

I will offer one word of warning, however, and that is that you may want to double check all of your business transactions even if they’re already categorized manually or via a rule. That’s because there have been a handful of instances where I’ve spotted duplicate transactions displaying in my expenses. Obviously this could throw off your deduction calculations so it’s important to exclude those rogue clones. Luckily that part is easy enough to take care of — but I do wish this didn’t happen in the first place.

You can see for yourself how easy Quickbooks is to use in my video reviews below:

Totaling Mileage

While I don’t have a job that requires a lot of driving (my typical commute is the 20 feet from my bed to the next room where my home office is), Quickbooks Self-Employed opened my eyes to how lucrative tracking your business mileage can be. In case you don’t know, the current rate is $0.585 per mile driven for business. That means that my road trip to Tulsa to cover an event for another website earned me more than $200 in deductions.

If you do drive a lot, the QBSE app also offers an auto-tracking option. Although I haven’t used this feature to a great extent, I have experimented with it a few times and it does seem pretty helpful — and it definitely comes in handy for people like me who forget to check their odometer until it’s too late.

Of course you can always add your miles manually along with a description of what the travel was for, including start and endpoints.

On that note, one slight annoyance I’ve found with QBSE’s mileage entry is that you don’t seem to be able to duplicate a trip easily. This came into play when I was logging several days of drives to the FinCon Expo and would have loved to simply copy the trip and change the date.

Instead I had to manually enter everything — including the addresses — over and over. I will say this process was slightly better on the app where QBSE would pull data from Google Maps to help autofill the addresses but it still wasn’t as easy as I believe it could be. The moral of the story is, if you’re going to be claiming a lot of business mileage, make sure to try the auto-tracking feature.

Invoices

Another useful feature for freelancing is Quickbooks’ invoicing section. Not only does QBSE offer the ability to generate and track invoices but you can also sign up to make those invoices payable online. If you do sign up for that option, bank transfer transactions are free, although credit card payments will cost you 2.9% plus $.25. That might not exactly be ideal but it’s also not terrible.

Also in the Invoice section is a beta feature: Time. Here, you’ll be able to track your time on various projects. By entering your hourly rate, Quickbooks will then display how much you should invoice for the project. Plus, you can mark projects as “paid” so you don’t miss out. To me, this feature is a great addition — and you don’t even need to be using Quickbooks invoicing to take advantage. While I suspect that many freelancers already have a time tracking service they like, if you don’t, it might be worth giving this one a try.

Tax Estimates and More

Now onto the reason I bought the software in the first place. In addition to the extremely useful transaction classifications and mileage tracking that come into play around tax time, Quickbooks Self-Employed also helps you estimate your quarterly taxes. To do that, you’ll want to set up your tax profile, keep up to date on categorizing your transactions, and be sure to include your business income. Of course it should be noted that QBSE only offers federal quarterly tax estimates so, if your state collects income tax and also requires estimated quarterly payments, you’ll still need to calculate those on your own. Meanwhile, for those of you who are unsure if you need to be paying quarterly taxes, this is an insightful article on that very topic that I recommend.

This is also where another minor annoyance with the basic QBSE comes in. Although you can generate some helpful tax reports including a spreadsheet of your different expenses and deductions, I was unable to find a way to export that data in a format that my father could plug into TurboTax. Additionally, there is a way to invite your accountant to access your books but, at this time, I’m unsure if that means that they’d be able to export the TurboTax file or not.

I actually tested out the Tax Bundle upgrade over the past couple of tax seasons and had a fairly positive experience with it. As promised it did transfer my data over from QBSE, which made things easier.

Naturally I still ended up having to make adjustments after sending my data over due to errors on my part but it was helpful nonetheless. And while I was a bit concerned I would need to make some additional payment before finally filing, I was relieved to find that both my state and federal returns were truly included in my plan. Sadly, that plan has increased by $8 a month since when I first signed up (now going for $25 a month) — but we’ll get to that later.

Even if you don’t opt for the bundle, the reports that you are able to export from Quickbooks make it fairly easy to plug in your deduction numbers. However I will say that, when I previously used other tax prep tools, some of my numbers didn’t seem to properly line up with my report. Thus I had to pay extra attention. Still, it did make things much simpler than they would have been otherwise.

To me, the ability to keep track of deductions and turn that into actual tax return inputs is where the software really paid for itself. Instead of fumbling for receipts or trying to brainstorm other items I was entitled to write off, I was able to easily provide all of my deduction data, which added up to be quite a substantial amount. Better yet I remember that, after my first round of taxes following my QBSE subscription, my dad even told me how impressed he was with my organization. Even in my 30s, that still feels nice.

Labs

In the few years that I’ve been using Quickbooks Self-Employed, the service has largely stayed the same. That said Intuit has been experimenting with new features via their Labs. You can access it by clicking the gear icon on the desktop site and then selecting “Labs” under “About You.” Once there, you can view the latest integration and innovations available for you to opt into.

One particularly cool feature related to transactions is Quickbooks’ integration with Amazon. Instead of your purchases merely being labeled as “Amazon” like they normally would, linking your Amazon account to QBSE will allow you to see what items were included in each shipment.

From there you can also label individual items in your order as “business” or “personal” without having to calculate the split yourself. As someone who frequently mixes business with pleasure when it comes to Amazon purchases, this feature had been extremely useful. I used the past tense “had” in that last sentence as, more recently, I’ve been having issues with this feature. Although it shows that I’m connected to Amazon, I still get an error — and trying to connect again leads to a cycle of captchas.

Luckily, if you run into this same problem, there is at least an Amazon Import option where you can export two reports from the site and then upload them to QSBE so that it can show what each order consisted of. Obviously this isn’t as convenient or cool but, hey, at least it works.

Looking at Labs lately, some of the other items featured include custom color-coded tags, the ability to import mileage trips from Google, integration with Coinbase, and more. Another useful option I’ve found in Labs allows you to assign a “purpose” to a given account. What’s great about this is that you can note an account as “Mostly business” so that transactions from that account will be automatically filed as such (of course you can always override this in the event you do come across a “Personal” purchase).

If there’s anything I don’t really like about Labs it’s simply how hidden it is and that it seems to have stagnated some. Considering how convenient some of these tools are, you’d think Intuit would want to make them more prominent or just fully integrate them since it’s been a while that they’ve been in “Labs.” In any case, if you’re looking to add some additional capabilities to your Quickbooks experience, it’s definitely worth checking this section — and here’s hoping they roll out additional functions soon.

Quickbooks Self-Employed Cost

Here at Dyer News we really believe in the benefits of Quickbooks so we reached out and were able to secure a deal for our readers. You can get Quickbooks Self-Employed for 50% off for 3 months!

In the time that I’ve been a customer, Quickbooks has increased its prices. Currently, the basic Self-Employed plan retails for $15 a month, but they do sometimes offer sales. For example, at the time of this publication, they are offering the first 6 months for 40% off (you can find Self-Employed by clicking the “For Freelancers” tab). Meanwhile, they also now have two Tax Bundle options. The first — which includes one state and one federal tax return filing via TurboTax — goes for $25 (sometimes $12 a month for a trial period) while the Live Tax Bundle option adds CPA support, including a final review of your returns. This latter plan is normally $35 a month but discounts to $17 during your trial. Incidentally you can actually write off your subscription as a business expense, which to be honest feels awesomely meta.

Final Review on Quickbooks Self-Employed

Having now gone through the whole tax process solo a couple of times, I can honestly say I wouldn’t have been nearly as successful had I not invested in Quickbooks Self-Employed — it’s not a commercial, it’s just true. While I can’t say for sure how much I saved as a direct result of the software, I can tell you anecdotally that there were plenty of business transactions I came across I wouldn’t have given a second thought to had the software not brought them to my attention.

Additionally, I’ve now learned just how helpful it is to have all of your business expense data in one place along with invoice tracking. In that aspect, while I mostly use it to help with my taxes, this could also be an important tool for freelancers looking to keep better track of their finances overall. Therefore, while the recent price hikes may be disappointing and there are still a few bugs you may need to squash from time to time (namely duplicate transactions), I personally remain a Quickbook Self-Employed subscriber and have no plans to change that now.

Quickbooks Self Employed is a paid monthly service. The base plan starts at $15 a month and you can bundle it with Turbotax for $25/month or Turbotax Live for $35/month.

Quickbooks Self-Employed (QBSE) is designed for independent contractors while QuickBooks online (QBO) is best for small businesses. They both have a number of similar core features. If you file a Schedule C along with your personal taxes then QBSE is the better solution. If you file as a business entity, usually form 1120, then QBO is a better solution.

The basic QuickBooks Self Employed service costs $15 a month. You can also add Turbotax or Turbotax Live to your subscription for an additional $10 or $20/month respectively. By using the special offer from DyerNews you can get any of the three services for 40% for the first six months.

Per FTC guidelines, this website may be compensated by companies mentioned through advertising, affiliate programs or otherwise. (Note: advertising relationships do not have any influence on editorial content. Advertising compensation allows Fioney to provide quality content for free. All editorial opinions are those of the individual author and/or Fioney.)