Economic News

Redfin Finds New Home Sales Up, Prices Down in Q3 2019

As the Fed continues to cut interest rates little by little, there’s been a renewed interest in what’s happening with the housing market of late. Luckily the real estate site Redfin has just released their home sales report for the third quarter of 2019.

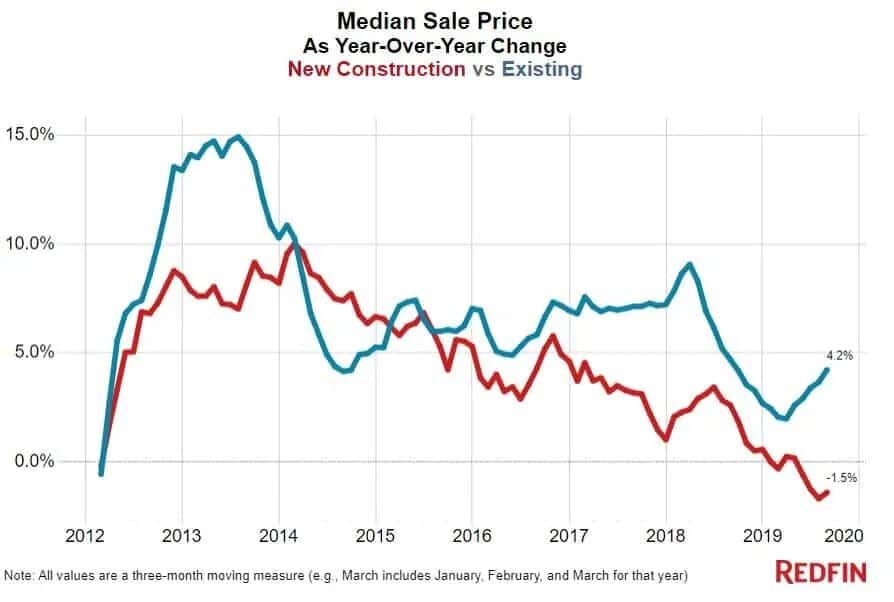

First up, Redfin’s data show new home sales increasing by 5.6% in the third quarter of the year. This also marks the second consecutive quarterly increase. Meanwhile prices for these new homes tumbled, dipping to a median of $370,300. Not only was this the third quarter in a row that prices have fallen but this particular drop was the largest seen since 2012. Similarly new home inventory also experienced the largest decrease in seven years, down 7.9% year over year. As for existing homes, they actually saw an increase in median price. For the third quarter prices rose 4.2% according to Redfin. Additionally, despite a 6.9% year over year dip in inventory, sales still managed to grow 2.1% in the quarter.

Offering some analysis of the Q3 results, Redfin chief economist Daryl Fairweather said, “Buyers are returning to the new-home market thanks to low mortgage rates and relatively low prices. And builders, also taking advantage of low interest rates to fund projects, are paying attention to preferences for affordability, which has led to more sales.” Fairweather went on to note, “Residential construction was a bright spot in the economy in the third quarter, a sign that builders are working to fill an inventory gap. As we head into the new year, I expect more new-home listings to hit the market, which should help sustain the relatively high level of sales.”

Looking specifically at different housing markets, Raleigh, North Carolina has shown a major appetite for new homes. Of all houses sold during the quarter, 27% were new builds. As a result Raleigh topped the list of metros in this regard, they were followed by New Orleans and Austin where new-builds accounted for 23.6% and 21.8% of homes sold respectively. Incidentally Redfin agent Allen Wyde has seen this preference first hand as a Raleigh agent. He explained the reasons behind the trend, noting, “While buyers in Raleigh have always been interested in new homes, construction nearly ground to a halt after the Great Recession as builders were scared of being left with newly built homes they wouldn’t be able to sell. In the last two years, builders have loosened the reins and started constructing homes without a buyer in mind. And they’re selling.”

With the Federal Reserve expected to pause interest rate cuts for now, it will be interesting to see how the housing market reacts not only in Q4 2019 but into 2020. On that note it seems that developers are already betting on an increase in buyers as residential construction building permits increased 9.7% year over year in the third quarter, making for the largest increase since 2017. In other words, while a housing recession might still be on the horizon, it’s certainly not here yet.