FinTech News

Robinhood Announces Cash Card, Replaces Cash Management Offering

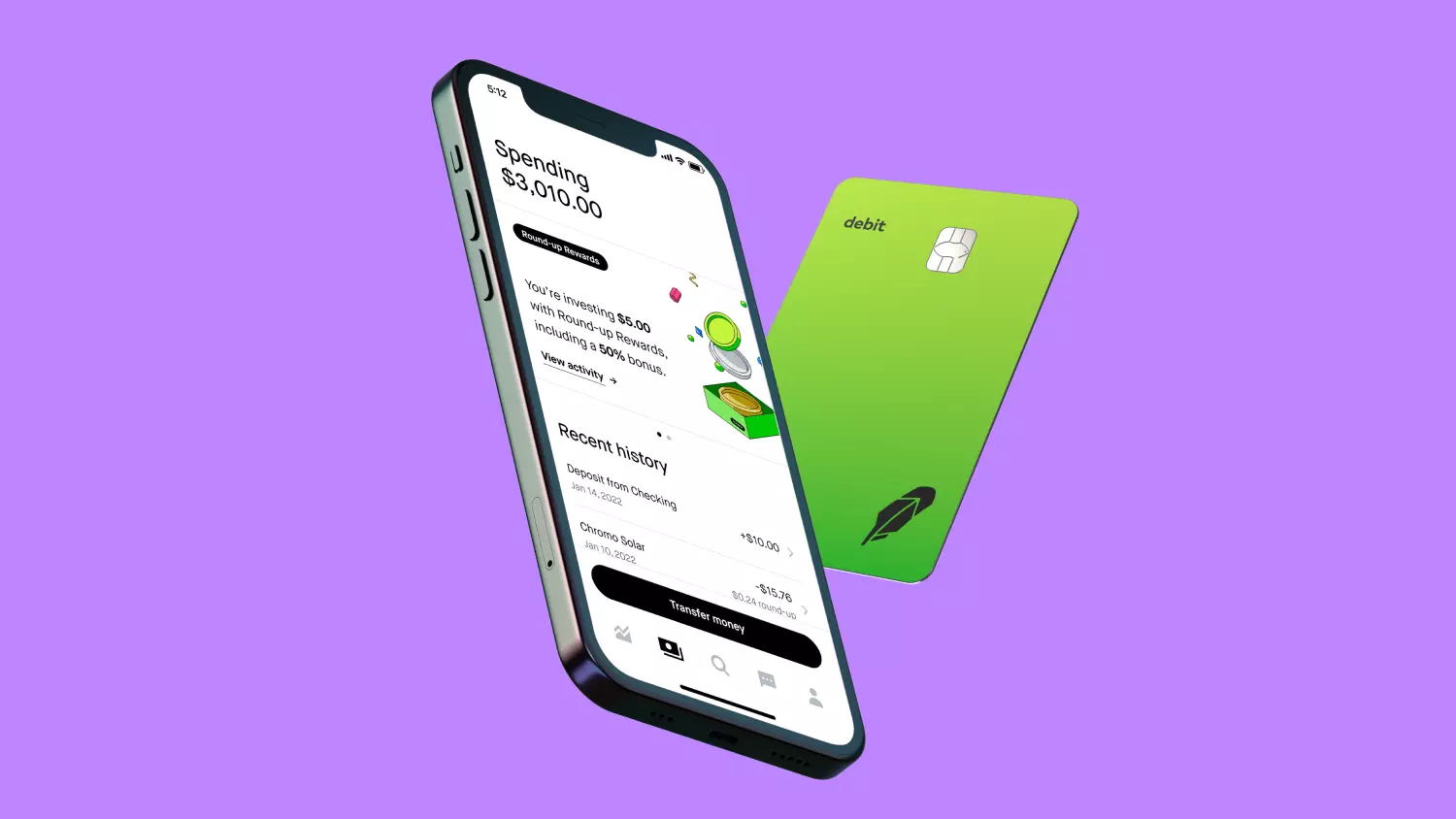

More than two years after Robinhood officially launched its Cash Management account, the popular investment app is set to replace it with a new offering. Today, the company announced the impending debut of the Robinhood Cash Card. With the new card, users will be able to earn rewards and automatically grow their investment portfolio while making everyday debit purchases.

According to a blog post on the company’s site, the Robinhood Cash Card will allow customers to automatically round-up purchases to the nearest dollar and have the spare change invested in the asset of their choice (stock slices, crypto, etc.). Then, each week, Robinhood Money will give users a bonus of between 10% and 100% of their accrued round-up funds as a bonus. However, this benefit is capped at $10.

Elsewhere, Robinhood plans to introduce an Instant Savings feature that will “help customers beat inflation by giving them savings when they shop at some of their favorite spots like H&M, Chevron and Chipotle.” Like with other FinTechs apps, customers will be able to receive their direct deposit payroll funds up to two days early. Direct deposit users will also have the option to automatically invest a portion of their paychecks on the platform. Notably, the Cash Card will have no monthly fees, subscription fee, in-network ATM fees, overdraft fees, or account minimums. The Robinhood Cash Card will be issued by Sutton Bank.

With the Cash Card set to replace the current Cash Management account, Robinhood says it’s now retired sign-ups for the previous product. Current Cash Management customers are invited to join the waitlist for the Cash Card. Moreover, Robinhood says that “a percentage” of existing Cash Management users will gain access to the new card as early as this week.

In their FAQ, Robinhood does highlight a few differences between the Cash Management account and Cash Card that existing users may be interested in. For one, the Cash Card spending account will not earn interest. However, the FAQ seems to imply that while the Cash Management account name will be going away, brokerage customers may still earn interest on funds via the sweeps program.

For new customers, another notable difference is that, unlike the Cash Management account, customers are not required to have a brokerage account in order to open a Cash Card (although the round-ups feature may not be available to these users). Meanwhile, Robinhood advertises that Cash Card customers will have access to more than 90,000 fee-free ATMS, which would suggest that the offering will still operate on both the Allpoint and MoneyPass ATM networks.

Overall, the incoming Robinhood Cash Card has some interesting features, although there are still some questions to be answered. Of course, with the new account set to start rolling out in a matter of days, those queries should soon be cleared up. In the meantime, those interested in the Robinhood Cash Card can join the public waitlist on the card’s dedicated site.