FinTech News

SoFi to Launch IPO Investing Feature for Customers

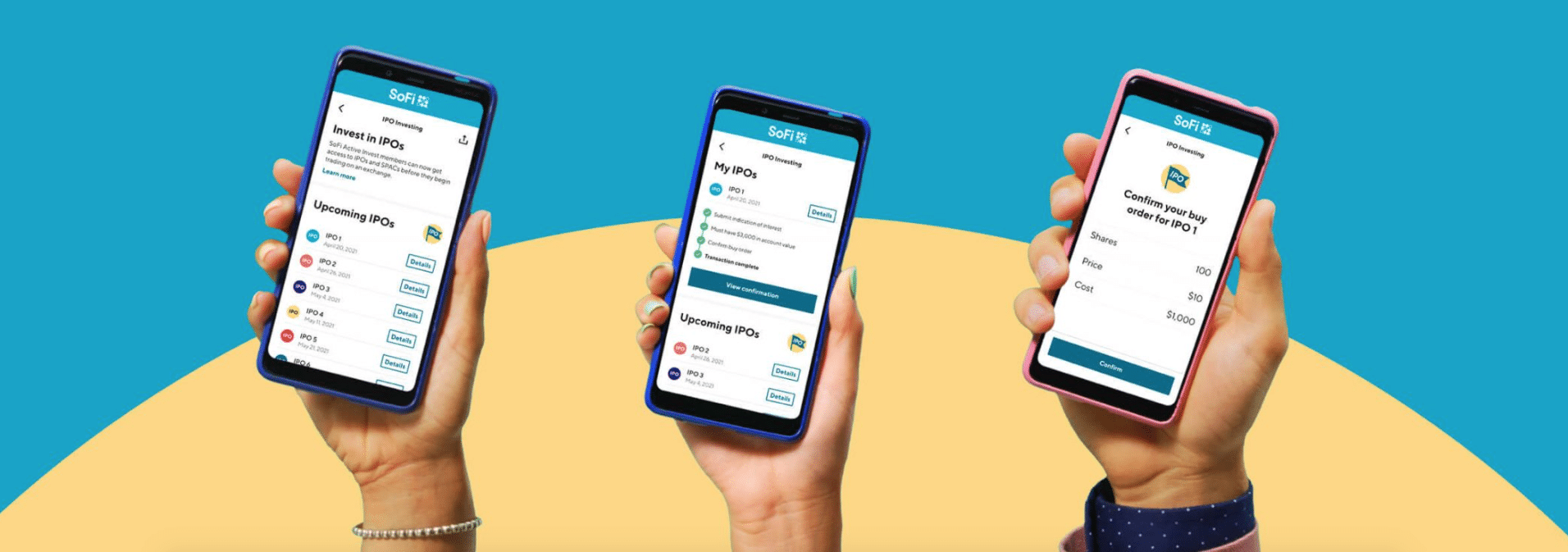

For many years, while everyday investors may have heard about upcoming initial public offerings (IPOs), buying shares at the original asking price was a right reserved for much larger investors. This reality has remained even as the popularity of retail investment apps has risen. Well, at long last, it seems this could be changing as SoFi recently announced that customers will be able to request shares/units for upcoming IPOs using their SoFi Invest platform.

In order to be eligible for IPO Investing and pricing, users must have a SoFi Active Investing account and have at least $3,000 across their SoFi Invest accounts (including their Automated Investing platform). However, SoFi notes that the allocation of shares/units will be determined using such factors as the size of a member’s order request, the customer’s total account value, and more. Customers will also only be able to participate in one IPO at a time. Meanwhile, the platform states that it may charge a $50 fee for shares purchased at IPO prices that are then sold within 120 days.

Additionally, SoFi says it will have an IPO Flipping Policy in place. Under this policy, those users who purchase IPO shares and sell them in less than 30 calendar days may be barred from participating in future IPOs. Currently, a single Flipping Policy violation will lead to a 180 day IPO participation suspension followed by a 365-day participation suspension on the second violation. Those who violate the policy three times will be permanently barred from SoFi IPO pricing.

Commenting on SoFi’s latest feature as well as what it means for the company and its customers, CEO Anthony Noto said in a statement, “Our mission at SoFi is to help people achieve financial independence to realize their ambitions. If you’re going to achieve your financial goals, having access to a broad range of diversified investment opportunities is imperative, and gaining access to primary offerings is another way to diversify your portfolio that has previously been restricted to a select few.” Noto added, “IPO Investing reflects our continued effort to make investing more accessible, by pioneering fractional shares, offering commission-free trading, creating unique SoFi-branded ETFs, and now, IPO investing.”

As Noto points out, IPO Investing is only the latest addition to SoFi’s growing platform. Currently, in terms of investing, the FinTech employs a roboadvisor, a commission-free trade platform, and supports buying and selling select cryptocurrencies. Elsewhere, SoFi also offers its SoFi Money hybrid cash management account and a recently-launched credit card in addition to the personal loan and student loan refinancing options that the company was built on.

If there’s a notable loser following SoFi’s announcement, it’s undoubtedly Robinhood. While that trading app continues to raise massive amounts of funds and is readying an IPO of its own, recent bad press has tainted the platform. Add to that the fact that SoFi is now beating them to a feature that seems right up their alley and it’s easy to imagine that the Robinhood team could soon be racing to play catch up. In the meantime, it will definitely be interesting to see how SoFi’s IPO Pricing platform impacts the continually-changing retail investment landscape.