Personal Finance News

Survey: Americans Lose Average of $1,819 to Financial Illiteracy

How does a deficit in financial education impact the wallets of Americans? A recent survey conducted by the National Financial Educators Council (NFEC) asked more than 3,000 consumers, “During the past year, about how much money do you think you lost because you lacked knowledge about personal finances?”

The majority (61.8%) reported losing between $0 and $499 due to their financial illiteracy. However, 15% said that they’d missed out on upwards of $10,000. Additionally, 7.2% reported losing between $500 and $999, 7.9% lost between $1,000 and $2,499, and another 7.9% said they lost between $2,500 and $9,999 last year.

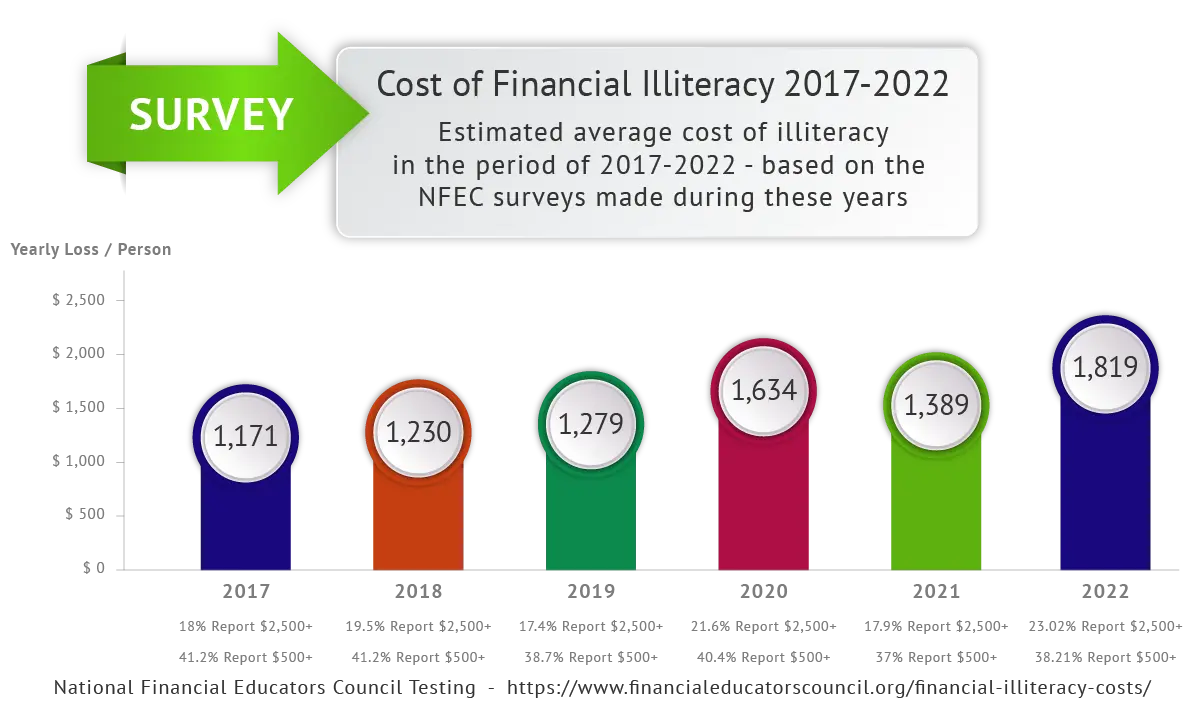

Using the data from the survey, the NFEC estimates that the average the consumers lost due to financial knowledge shortcomings was $1,819. This is up from 2021’s $1,389 average as well as the $1,634 average recorded in 2020. Similarly, the percentage of respondents reporting losses of more than $2,500 increased to 23% in 2022 compared to 17.9% the year prior. In total, NFEC pegs the total amount lost last year at $436 billion.

As for the financial mistakes that consumers reported making, the top response was paying credit card interest or fees. This was estimated to cost Americans $120 billion in 2022. Elsewhere, overdraft fees also made the list, totaling $17 million.

Commenting on the survey results, the NFEC’s CEO Vince Shorb said, “Financial illiteracy is an epidemic in the U.S., and it’s coming at a time when the economic climate is changing rapidly. That means financial education has never been more important than it is today.” Shorb added, “It’s essential that we help Americans get the personal finance knowledge they need to handle the real-life situations they’re going to face, both now and in the future.”

While 23 states require students to complete a personal finance course in high school in order to graduate, there have long been calls for greater emphasis on these topics as part of the public school curriculum. In the meantime, a growing number of FinTechs have unveiled educational materials meant to engage consumers of various ages and teach them more about budgeting, credit, and other topics. Most recently, the child and teen banking platform Greenlight unveiled its Level Up game feature.

Although it’s difficult to quantify how much money consumers lose due to a lack of knowledge on financial topics, there’s no question that greater personal finance education is needed. While adding such material to school curriculum may help prepare the next generation, adults who are already feeling the real world impacts are in need of education as well. Unfortunately, finding a solution to that problem may prove more difficult. That said, employers may consider offering financial literacy courses to their employees. Hopefully, with FinTechs and other outlets doing their best to make important information available to as many people as possible, these losses will start to decline in future surveys.