Small Business News

Two-Thirds of Small Businesses Report Being in Good Health

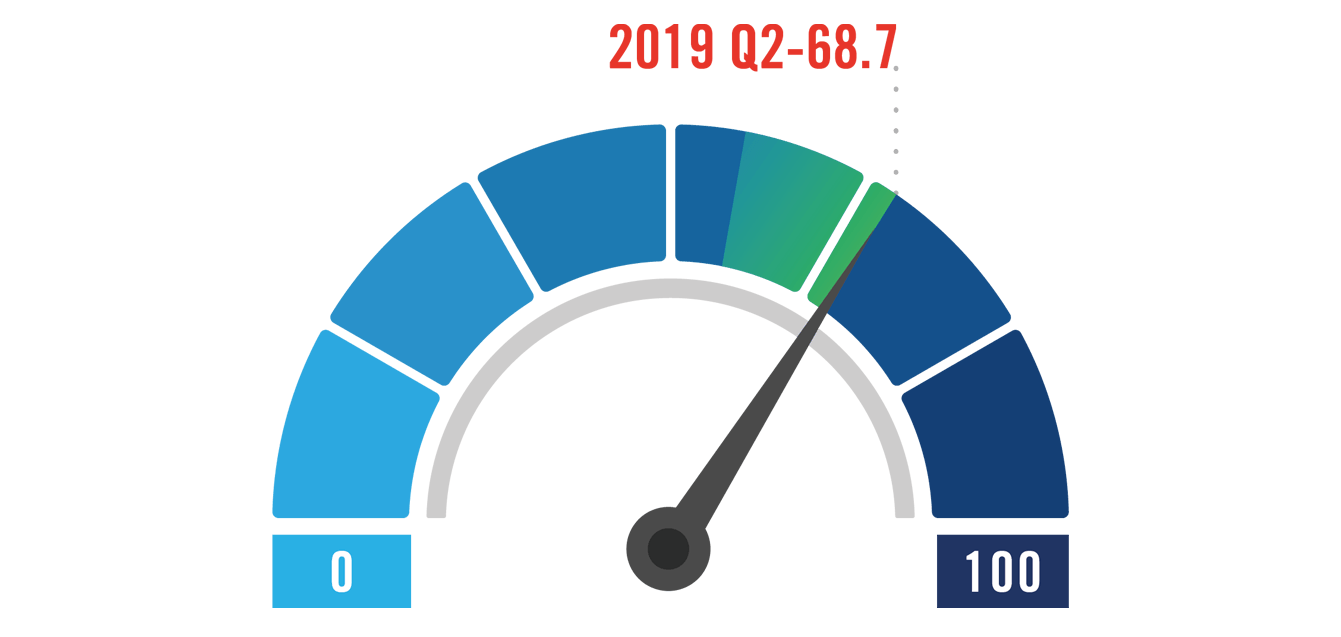

It seems now is still a great time to be a small business owner. In fact, after a dip during the first quarter of the year, the MetLife and U.S. Chamber of Commerce Small Business Index rose more than three points for Q2 2019. Moreover a majority of entrepreneurs surveyed expressed positive sentiments about the health of their businesses and the overall economy.

According to the latest report, 65% of small business owners described their businesses as being in good health. That figure rose to 71% among businesses aged 11 to 20 years old, while those older and younger were slightly lower (64% and 62% respectively). Notably those reporting a healthy diagnosis rose most sharply among manufacturers while fewer owners in the retail space were feeling optimistic last quarter. Nevertheless, overall, more than one-quarter of those surveyed said they plan to increase investments in their businesses over the next year.

From business health to the health of the economy at large, 59% said the United States economy was doing well. That’s an increase of six points from the first quarter of the year. Meanwhile 51% said the same of their local economies — down slightly from 53% in Q1.

Speaking to this quarter’s results, The Darling Company owner Lexi Montgomery told the U.S. Chamber of Commerce, “It’s an excellent time to be in business. Tech is rapidly expanding, and there are lots of contract opportunities for those who don’t want traditional 9-to-5 jobs. Plus, because people have a lot of freedom to make decisions, and subliminal marketing has become quite advanced — people are spending a lot more money. The market is good for everyone, especially business owners and first-world consumers.” Similarly, DIGR president and chief architect Eric Axelrod said, “The overall strength of the economy is a big driver of perception. Small manufacturers are especially optimistic because consumer spending is on the rise. The shift to ecommerce and away from wholesale toward direct-to-consumer is helping most of them in the short term as brick-and-mortar sales continue to move to online sales.”

The responses recorded by MetLife and U.S. Chamber of Commerce’s Small Business Index seem to reflect similar polls conducted by the National Federation of Independent Business and others, which each show small business optimism holding at historic highs. Despite continued declines in some sectors such as retail, the 16 point optimism increase seen in manufacturing goes to show that even long-suffering verticals can’t be counted out. With the expected Federal Reserve rate cut waiting in the wings — potentially lowering the cost of small business borrowing and expansion — it will be interesting to see if the third-quarter results bring similar increases to small business sentiment.