Credit Card News

What’s Going On With the Uber Credit Card?

A few years back, I got my first new credit card in probably a decade. Since that momentous occasion, I’ve received numerous credit card offers in the mail and have proceeded to throw them in the trash each and every time. I didn’t get any such mailing regarding the Uber Visa card when it launched in November 2017 but I did see it plastered all over the Internet. While, like most, I was quick to roll my eyes at the concept, looking at the perks the card was offering got me to quickly change my tune. Not only did I end up applying for the card the day it became available but also proceeded to talk up the card for a couple of years both on this blog and in real life.

Unfortunately, in 2019, Barclaycard and Uber made some major changes to my favorite credit card, necessitating a revisit to my original review. So what’s changed with the card that made me so salty about it — and how do I feel about it in 2021? Let’s take a look at the revamped Uber Visa card.

The Uber Credit Card in 2021

In October of 2019, Barclay and Uber announced a revamped Uber Visa card — now officially named the Uber Credit Card. Within a few months’ time, all current customers had been converted to the new product, including their earned rewards moving from regular cash to Uber Cash.

Sometime in 2020, Barclays suspended applications for the Uber Credit Card. As a result, while existing cardholders can continue to use the card and earn rewards under the 2019 updated model, it’s not currently possible for new customers to obtain the card. Furthermore, it’s unclear if or when Barclays will make the card available once again.

Below is my review of the Uber Credit Card product in its current form as an existing cardholder:

Uber Credit Card Rewards Categories

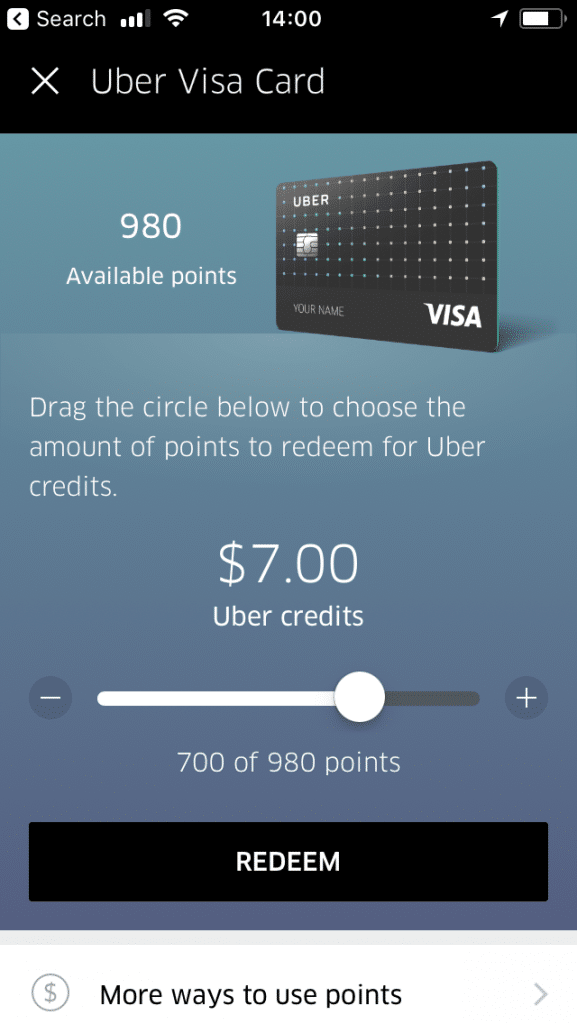

Uber Cash

First off, the biggest change to the Uber Credit Card — and the largest negative in my opinion — is that the card now only earns Uber Cash. Prior to late 2019, cardholders could use their points for statement credits, gift cards, cash transfers to bank accounts, or Uber credits. Instead, now you’re stuck using your rewards for rides or Uber Eats and that’s it. The card will still operate on a point-based system in which 1 point is equivalent to one cent. As a result, you can simply add a decimal and read your point balance as a dollar amount to see what your rewards are worth.

5% on Uber purchase

Under the old card’s rewards model, Uber rides only earned 2% back while Uber Eats (just filed under “Dining”) earned 4%. Ironically the former was recently bested when Uber partnered with Apple Card to offer 3% cash back. Therefore it makes sense that the company would finally put more of an emphasis on their own products.

This new category applies to Uber rides, Uber Eats, and JUMP bike and scooter rentals.

3% on dining

Down from the previous 4% back, the Uber Credit Card now nets you three points for every dollar you spend. This includes fast food, takeout, and table service. While my wife and I don’t eat out that much (although one could argue that near-weekly is a lot), I was surprised by how lucrative this category proved to be for us. Plus, unlike my Discover It card that might offer 5% on dining for a single quarter, this category is year-round. So while the step down is disappointing, 3% is still pretty strong.

3% on hotels and airfare

As I’ve mentioned in the past, my wife and I really enjoy traveling and have been working to ensure we get to do more of it in the future. For that reason, while I’ve ultimately declined past offers, I have been tempted to try a branded credit card with the likes of Delta or Hilton. Alas these options never seemed to make much sense to me. On the contrary, the three points per dollar that this Uber Credit Card offers when booking flights or hotels compliments such wanderlust nicely (even if those points are ultimately redeemed in Uber credits). There’s also another bonus this card holds for travel enthusiasts, but we’ll discuss that more in a moment.

1% on everything else

Although the above categories cover a good amount of spending ground, there are plenty of purchases that don’t fall under any of these umbrellas. As a catch-all, the Uber Credit Card offers one point per dollar for pretty much everything else you buy. Considering this is what my Discover card mostly offers (aside from those rotating 5% categories), this really rounds out the rewards lineup relatively nicely.

Also worth noting is that the previous version of the card had a 2% back on online purchases category that has sadly been discontinued.

Other Uber Credit Card Perks and Benefits

No annual fee

Perhaps the Uber card’s greatest strength upon its release was that it was a free card. Thankfully this aspect has not changed. As someone who, until recently, didn’t have any annual fee cards, this is a big perk (and takes a bit of the sting out of the changes).

No foreign transaction fees

In my travels to Asia and now Europe, I’ve learned how annoying foreign transaction fees can be. Our main Visa tacks on 3% to anything we buy that’s not in U.S. dollars, while the Discover card has limited acceptance in some countries. So that’s why I was ecstatic about the thought of having a foreign transaction fee-free Visa card, which is what the Uber card delivers. Honestly this has been a game-changer for me and has saved me money on many adventures.

As a side note, I’ve also had good luck using my Uber Visa for foreign transactions made online. Previously I’ve run into issues trying to use a card to book hotel rooms in another country but had no such issues with this particular card. I may not be alone either as a travel agent friend of mine said that Barclaycards do tend to work better for such purchases than cards from some other issuers. It’s hard to say for sure but I’ve been pleased regardless.

Mobile phone insurance

One of the more interesting features is the inclusion of mobile phone insurance. You’ll need to ensure that you pay your cellular bill using your Uber card in order to take advantage of this offer. If you do, you’ll be able to file a damage or theft claim on your device and get up to $600 after a $25 deductible. For those of you with true butterfingers, you’ll be happy to know you can file two of these claims (up to $1,000 total) in a 12 month period.

Thankfully this is one offer I have yet to make use of myself. Therefore I can’t really speak to how the process of making a claim works or if this feature means you can forgo the insurance your phone manufacturer or wireless provider is trying to sell you — although it should be noted that $600 may not cover the entire cost of your device given today’s prices. What I can say is that, for those who choose to pass up those protections, hopefully this mobile insurance feature is all it’s “cracked” up to be.

Discontinued streaming credit

If you’re an existing cardholder who came to this review looking for mention of the $50 streaming credit earned after you spent $5,000 on the card in a year, I have some bad news for you. Sadly this perk was also removed from the card as of October 2019. However current cardholders like myself will apparently still be able to claim this credit until your next account anniversary date, but then no more.

Initial spending bonus

Like many credit cards, the Uber Visa offered a special incentive to sign-up for their card. When you were approved for the card and spent $500 in your first three months, you’d receive a 10,000 point ($100) bonus. Although this might not be the largest initial spending bonus known to man, $500 is also a pretty reasonable threshold.

Of course, this is now moot as Barclays is not currently (as of June 2021, at least) accepting new applications for the Uber Credit Card.

Uber Credit Card Experience and Tips

Accessing via apps and site

As I mentioned, the Uber Credit Card card is actually issued by Barclaycard. Thus you’ll likely want to download their mobile app after getting approved for the card. The app itself is pretty easy to use, offering Touch ID login and Apple Watch integrations. It also has a peek feature that lets you view your balance and other basic info without logging in (although you will need to opt-in to this feature).

Something I really appreciate about the Barclaycard app is that you can tap your individual transactions and view how many points you received. This function has allowed me to spot some anomalies and plot some ways to optimize my rewards (more on that in a minute). Other helpful features include the ability to set up travel plans, view your FICO score, and of course make payments.

Another way to view your point balance is in Uber’s flagship app. By adding your Uber Credit Card as a payment type, a point value bar will appear below your name and rating.

Point accrual tips

For the most part, I’ve received all of the points that I should have based on my spending categories. However I have noticed a couple of oddities. First, while I’d expect my local donut shop to qualify as dining and, thus, net me three points per dollar, I’ve now visited twice and only received 1% back. I’m guessing that this has something to do with how this small shop’s Square account is set up, but another cafe I visited that also utilizes Square resulted in 4% back (it would now be 3%). Ultimately this retailer-specific issue probably isn’t worth my looking into further but I’ll be keeping an eye on it for sure (also, if there’s fault to be laid, it would be on the retailer and not Barclay).

Alternatives to the Uber Credit Card

For those who may have been intrigued by the original Uber Visa and are now looking for a different option, I have a couple of suggestions:

Capital One SavorOne

When my wife and I were looking to fill the hole the all-but-loss of the Uber Visa left in our card line up, we ended up landing on this one. First, the SavorOne card offers 3% on dining just as the new Uber Credit Card does. Of course the difference here is that the Savor One still offers actual cash back and not Uber credits. Additionally, this 3% tier also extends to the broad category of “entertainment.” In my case, this notably includes purchases at “amusement parks” — perfect for the Disney Parks. Finally, the card also features 3% back at grocery stores, 3% back on select streaming services, and 1% everywhere else.

Another reason why we saw the SavorOne as a suitable replacement for the Uber Credit Card is that it too carries no annual fee and doesn’t charge any foreign transaction fees. Moreover the sign-up bonus actually bests Uber’s — giving you $200 cash back after you spend $500 on the card in your first 90 days.

By the way, if you want to regain the former 4% glory of the Uber Visa, there’s also the similarly-named Capital One Savor card. This option bumps both the dining, entertainment, and streaming categories up to 4% instead of 3% in addition to the 3% on groceries and 1% on everything else. The catch here is that the regular Savor card carries a $95 annual fee, although it is waived for the first year. The sign-up bonus also isn’t quite as exciting: $300 after $3,000 spent in your first three months.

Obviously, one thing missing here is a travel category. Therefore you may want to mix the Savor/SavorOne with another card that includes a multiplier for that.

American Express Gold Card

Before I get into why I think the Amex Gold may be a good pick for those enticed by the original Uber card, let me first warn that this card does carry an annual fee of $250. Now let me tell you why I think the Gold is worth it anyway.

First, in terms of point accrual, the card earns 4x Membership Rewards points at restaurants — similar to what the Uber card used to offer. Additionally, it also earns 4x points at U.S. supermarkets. Plus, cardholders can earn 3x points on flights they book directly through the airline or via Amex Travel.

Then come the credits that help offset that annual fee. Most applicable here, the Amex Gold now earns $10 a month in Uber Cash, which can be used for rides or Uber Eats orders. However, be aware that these credits expire at the end of the month that they’re received in. On top of that, there’s also a $10 per month dining statement credit that’s triggered by purchases on Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, Boxed, and participating Shake Shack locations.

Final Thoughts on the New Uber Credit Card

Before I get to my final thoughts, I wanted to share this quote from my original review: “When the Uber Visa card was first announced, I actually wondered if it would just be a temporary gimmick that would scale back its perks a few months into its run. To its credit, that has certainly not been the case — the card remains as great as advertised all this time later.” Well, while I may have been off on the timing, my overall statement now seems prophetic.

As I mentioned, I had been a raving fan of the Uber Visa since its release. Then, after the changes, I was pretty livid and said the card would be all but dead to me. Now, some year-and-a-half later, I’ve found myself falling somewhere in the middle.

What was great about the original iteration of the card is that it seemed to prioritize the needs of its target market over brand-specific loyalty. Then, the card transitioned to be the Uber store card that many assumed it would be upon release (before reading details, of course). Surely there’s nothing wrong with creating a card strictly for Uber enthusiasts but the bait and switch is what made the whole episode so disappointing.

Despite wanting to write-off the Uber Credit Card entirely, I’ve since made a specific spot for it in my line-up. See, between my American Express Platinum Card and Gold Card, I earn $25 in Uber/Uber Eats credits per month. Interestingly, however, the app doesn’t force me to pay with either of these cards if my order balance tops the amount I have in credits. Because of this, I can put the remainder on my Uber card and earn 5% back. Then, I tap these funds to further add to my Uber credits collection and start the cycle over again. Is it ideal? No. Would I have signed up for the card just to do this? Nope again. But, hey, it works.

The other use case I’ve found involves travel. Although the Platinum does most of the heavy lifting, given its 5x points on flights (booked directly through the airline or via Amex Travel) and 5x points on hotel booking made through Amex Travel, there are times when it makes sense to book outside of these restrictions. In those cases, earning 3% Uber Cash seems more attractive to me than earning 1% back from another option.

Of course, this tempered response arrives only after the damage has already been done. Apparently I wasn’t the only one disappointed by the 2019 Uber Credit Card updates as the card is not currently available to new applicants. Thus, it doesn’t really matter how I feel — but I’m happy to share my thoughts anyway.

Overall, for frequent Uber users, there was still definitely a lot to like about the Uber Credit Card from Barclaycard. Ironically, while I didn’t use the service all that much when the product change occurred, the perks of other credit cards have pushed me toward using Uber (or at least Uber Eats) more now. With that, I’ll be continuing to hold onto my Uber Credit Card until Barclays decides to kill it entirely.