Economic News

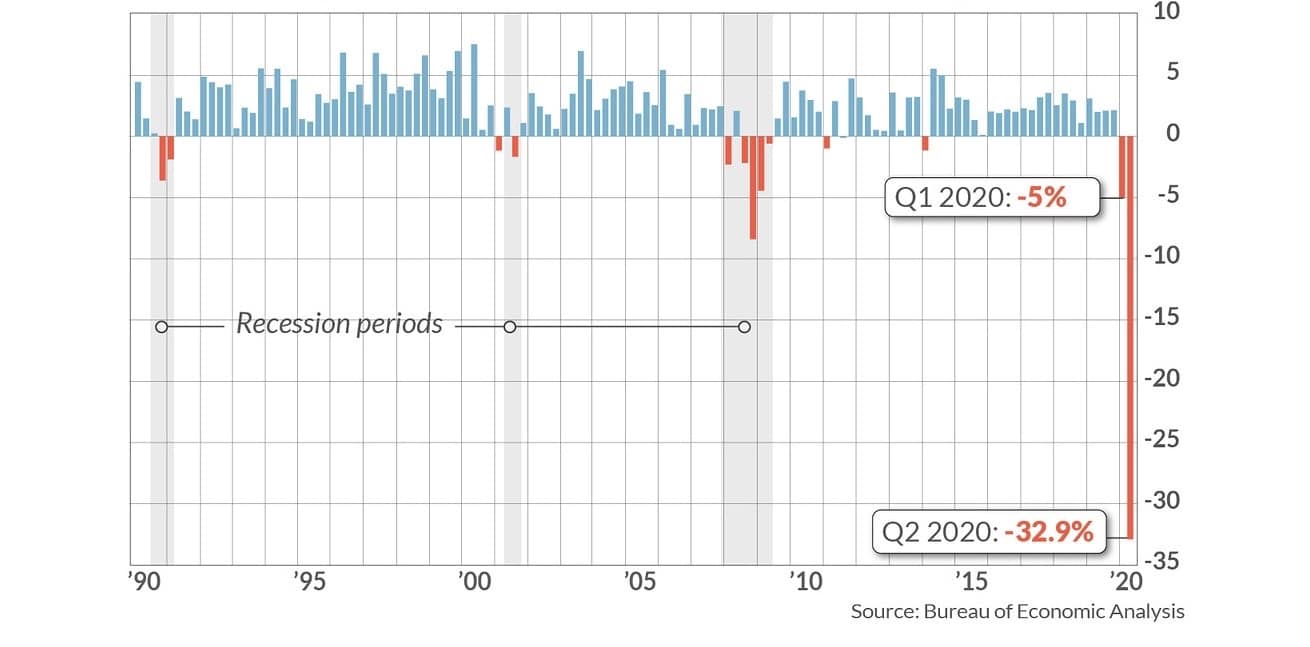

United States Economy Contracts 32.9% in Q2

As Congress continues to debate potential next steps for financial relief amid the coronavirus pandemic, new figures are showing the economic impacts of the disease. This morning, the Bureau of Economic Analysis reported that the United States’ gross domestic product declined by 32.9% during the second quarter of 2020. That marks the worst recorded quarterly GDP drop, nearly quadrupling Q4 2008’s 8.4% drop that held the previous title. The decline also follows a first quarter that contracted 5%. While drastic, the plunge was far from unexpected given the impacts of the COVID-19 pandemic that led to lockdowns and closures lasting most of the quarter in some areas.

The contraction also confirms what we already knew: the U.S. is in a recession. With two consecutive down quarters, the longest expansion is U.S. history has official come to an end after 11 years. Moreover, as CNN Business notes, more than five years of GDP growth have been erased during the first half of this year.

It should be noted that, as we’ve seen with unemployment, it’s possible that we could see a significant rebound in the third quarter as business continue to reopen — with some economists currently expecting an expansion of 18%. However it seems highly unlikely that a full recovery will happen as quickly as once hoped. In fact, with increasing cases in some areas leading to reopening rollbacks, it’s unclear when things will turn around. As Navy Federal Credit Union corporate economist Robert Frick explained to MarketWatch, “The virus is the boss. The longer this goes on, the deeper the damage.”

Meanwhile, as noted, Congress has yet to agree on the details for another round of economic stimulus, with Democrats and Republican lawmakers disagreeing on what types of programs to include as well as what the total bill should be. For example, one debate revolves around federal unemployement benefits that had granted workers an extra $600 a week in support. With some businesses reopening, members of the GOP are looking to cut this figure citing concerns that it disincentives workers from returning to their jobs. Also on the table are possible revivals of the Paycheck Protection Program for small businesses as well as second mailing of checks for as much as $1,200.

Despite being widely expected, the size of the economy’s second quarter decline is alarming nonetheless. Making matters worse is that the newly-minted recession is largely unlike others that U.S. has faced. Therefore, the nation could be in for quite a rocky ride as the pandemic continues to play out.