Personal Finance News

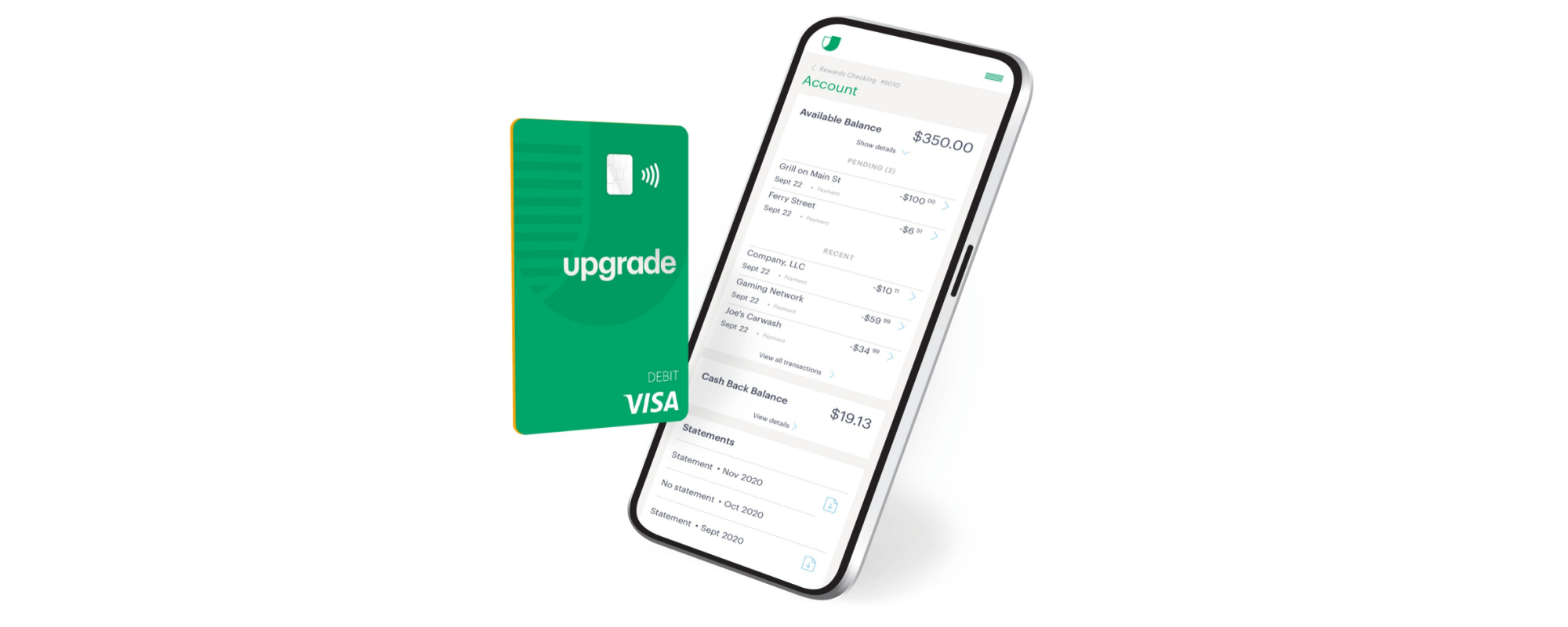

Upgrade Introduces Rewards Checking Account

Recent years have brought a flurry of FinTech and so-called neobanks, presenting some attractive alternatives to consumers seeking more for their money. Unfortunately, with interest rates falling tremendously in the past year, the APYs that many of these accounts once offered have been decimated, leaving startups to find other means of luring customers. In that vein, Upgrade (in partnership with Cross River Bank) has announced a new Rewards Checking account featuring some impressive cashback perks.

The main feature of Upgrade’s Rewards Checking is its debit card. Account holders can earn 2% cashback when they use their card on “everyday expenses” including purchases at convenience stores, drugstores, gas stations, and restaurants, or by making recurring payments for utilities, phone, cable, and select monthly subscriptions. All other purchases will earn 1% cashback. Upgrade does note that the 2% cashback category is limited to $500 in rewards per calendar year, which means that this enhanced cashback rate can be maxed out with $25,000 in spending across eligible categories.

In terms of fees, Upgrade says it has no account fees, monthly fees, transfer fees, or overdraft fees. Furthermore, another stated benefit is reimbursed ATM fees. However, this perk is limited to customers who maintain an average daily balance of at least $2,500 for the month or who have a direct payroll deposit of at least $1,000 during the month. Finally, Rewards Checking customers may receive rates as much as 20% lower on Upgrade loans.

Announcing the Rewards Checking feature, Upgrade co-founder and CEO Renaud Laplanche stated, “We asked our customers what would cause them to switch their primary checking account. The overwhelming answer was attractive rewards on debit card purchases.” Laplanche went on to add, “While credit cards often provide decent rewards, it has been nearly impossible for consumers to earn a broad 2% cash back on debit charges.” Elsewhere, Cross River founder, CEO, and chairman Gilles Gade said of partnering with the FinTech, “Upgrade’s no-fee Rewards Checking account combines everything mainstream consumers expect from a modern checking account with no fees, generous rewards and access to affordable credit. Cross River is proud to enable such a consumer-friendly product.”

While Upgrade’s Rewards Checking is far from the only interesting option currently available from a FinTech or neobank, it does have some unique elements. Namely, the 2% cashback on debit card purchases in select categories is a potentially lucrative perk — especially given its wide range and relatively high cap. For that reason, those who want to earn cashback rewards but aren’t fans of credit cards may want to take a closer look at this new account and see if Upgrade can live up to its name.